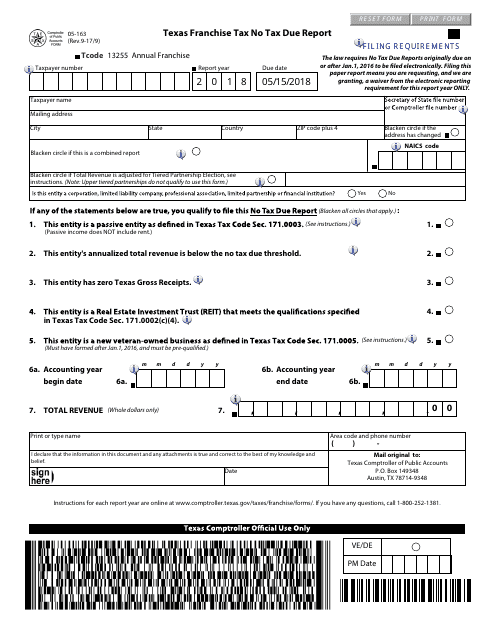

Form 05-163 Texas Franchise Tax No Tax Due Report - Texas

What Is Form 05-163?

Form 05-163, Texas Franchise Tax No Tax Due Report , is a legal document completed by a taxable entity that does not owe any taxes to the state of Texas for the reporting year. Most companies in Texas do not owe any franchise tax since most of them do not have an annualized total revenue of more than $1,130,000. However, you are still under obligation to complete and file Texas Form 05-163 electronically every year.

This form was released by the Texas Comptroller of Public Accounts . The latest version of the form was issued on September 1, 2017 , with all previous editions obsolete. A fillable 05-163 Form is available for download below.

Where to File Form 05-163?

If you are required to file Form 05-163 on or after January 1, 2016, you can only do it online via WebFile. File this report using the Texas Comptroller of Public Accounts. Using Texas Comptroller eSystems, you will be able to create a taxpayer account to file any tax returns and reports you need. Your No Tax Due Report is due on, or before May 15th every year.

Form 05-163 Instructions

Add the following details in Texas Franchise Tax Form 05-163:

-

State the taxpayer number - either the number assigned to the entity by the Comptroller's office or the federal employer identification number (FEIN);

-

Indicate the Secretary of State file number or Comptroller file number;

-

Write down the full name and mailing address of the taxpayer;

-

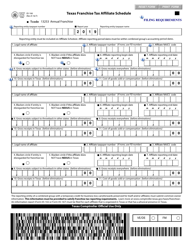

You are allowed to file a report on behalf of a combined group - blacken the appropriate circle if you do it. You may determine the eligibility of the combined group based on the total revenue as a whole. Additionally, you are required to fill outForm 05-166, Texas Franchise Tax Affiliate Schedule, to provide details on all members of the group;

-

Choose one or several statements that qualify your entity to file this report. Your entity must fall under one of the following categories:

- Entity is passive - at least 90% of its federal gross income is derived from or is related to financial investments and assets, dividends, and royalties;

- Entity's annualized total revenue is below the no tax due threshold - less than or equal to $1,130,000;

- Entity has zero Texas Gross Receipts;

- Entity is a Real Estate Investment Trust (REIT) that holds interests in limited partnerships or other taxable entities holding real estate, or only holds real estate it occupies for business purposes;

- Entity is a new veteran-owned business - formed or organized in Texas on or after January 1, 2016, and owned by an individual honorably discharged from the United States armed services;

-

Enter the accounting year start and end dates;

-

Indicate your total revenue. A REIT, new veteran-owned business, or passive entity may enter zero;

-

Write down your name and phone number. Certify all statements in the form are true and correct, sign the document, and write down the actual date.