This version of the form is not currently in use and is provided for reference only. Download this version of

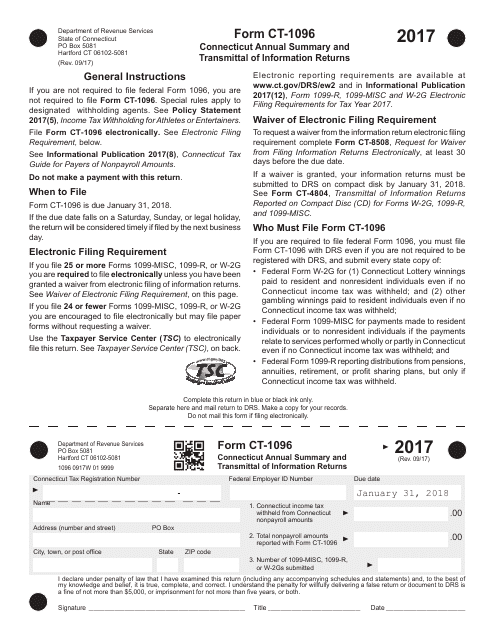

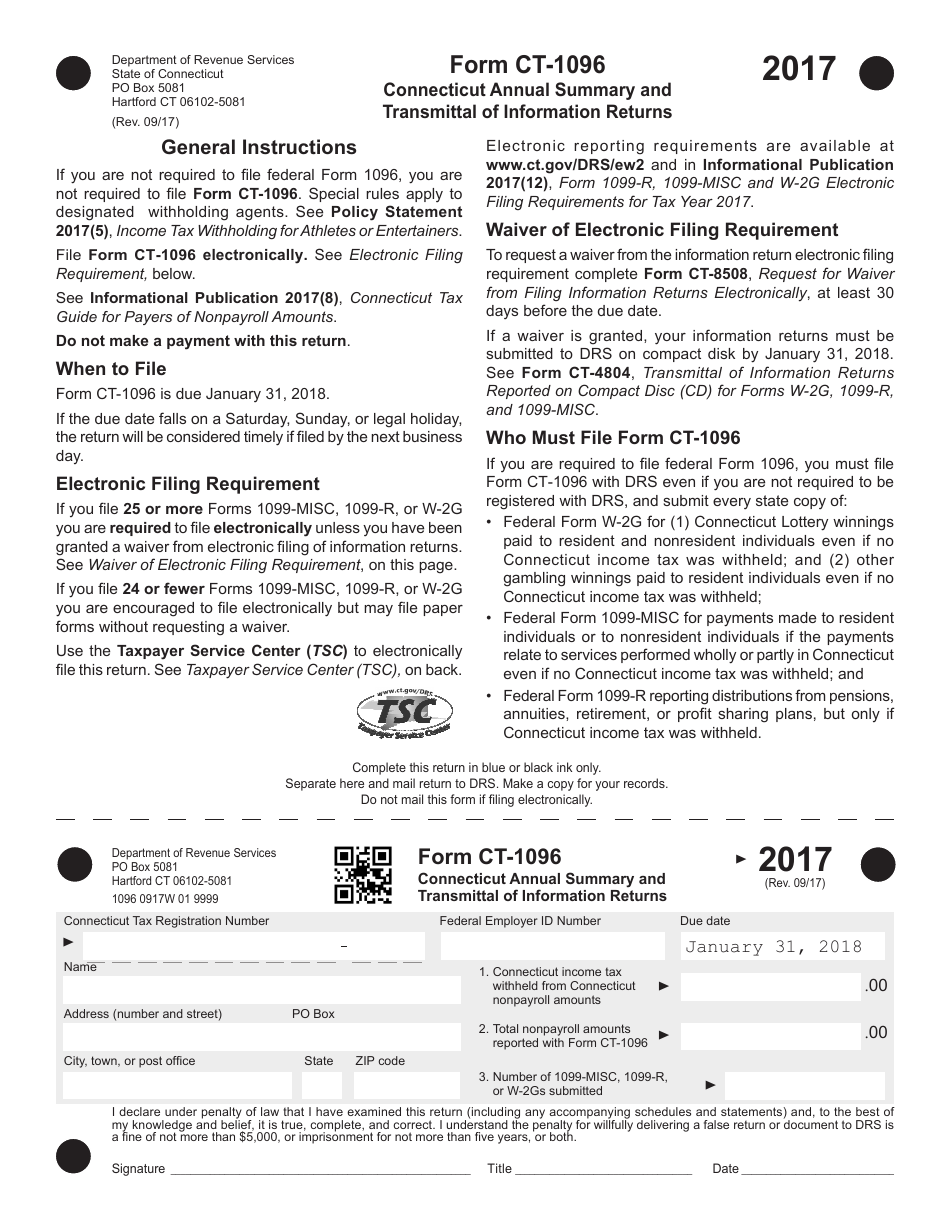

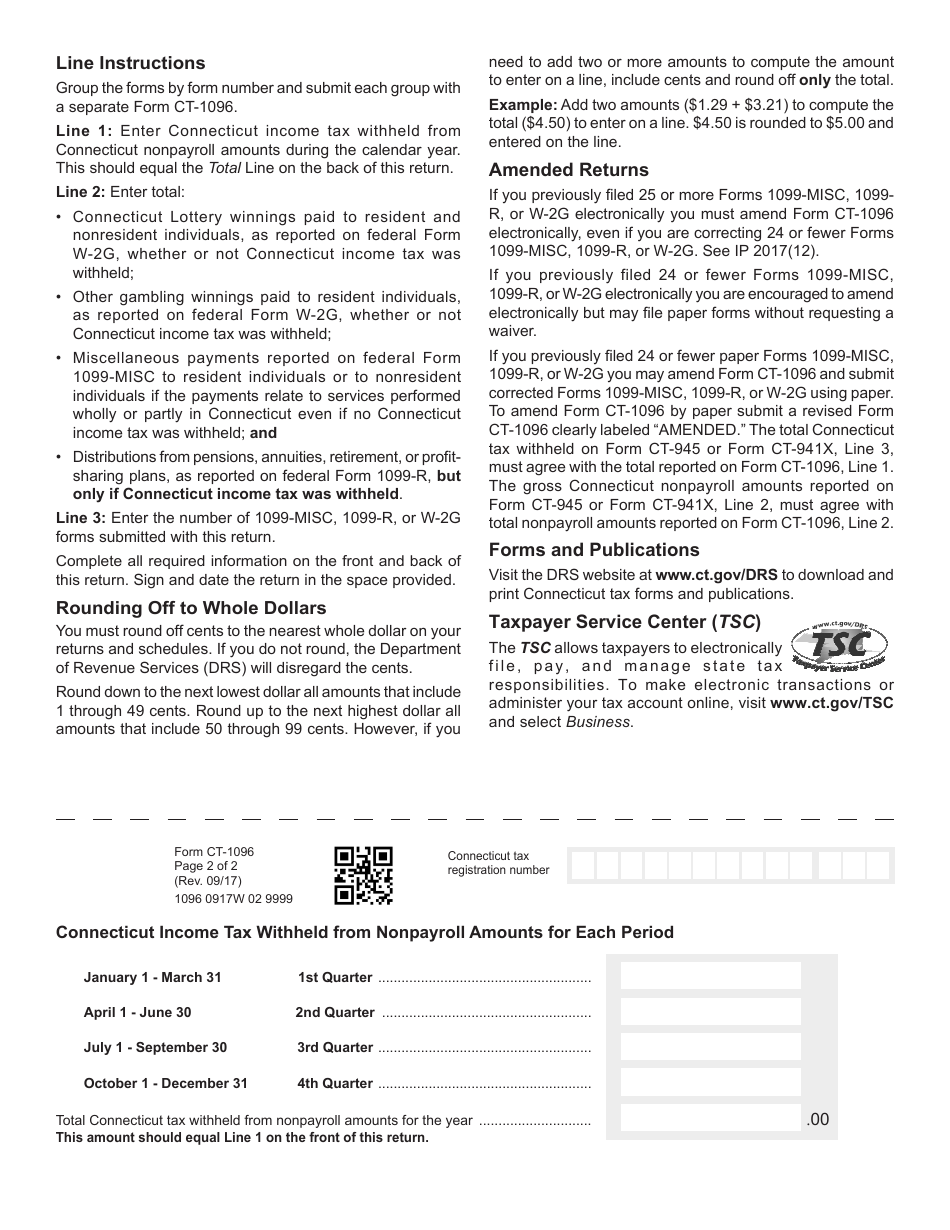

Form CT-1096

for the current year.

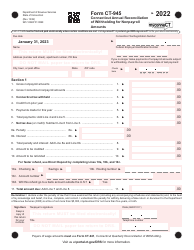

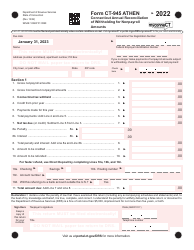

Form CT-1096 Connecticut Annual Summary and Transmittal of Information Returns - Connecticut

What Is Form CT-1096?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1096?

A: Form CT-1096 is the Connecticut Annual Summary and Transmittal of Information Returns.

Q: What is the purpose of Form CT-1096?

A: The purpose of Form CT-1096 is to summarize and transmit information returns (such as Forms W-2, 1099, and 1098) to the state of Connecticut.

Q: Who needs to file Form CT-1096?

A: Anyone who is required to file information returns with the state of Connecticut needs to file Form CT-1096.

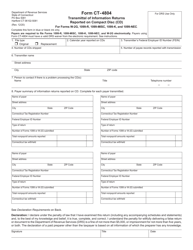

Q: What information is required on Form CT-1096?

A: Form CT-1096 requires information such as the payer's name, address, federal identification number, and total number of information returns being transmitted.

Q: When is Form CT-1096 due?

A: Form CT-1096 is due by January 31st following the end of the calendar year in which the information returns were required to be filed.

Q: Are there any penalties for late filing of Form CT-1096?

A: Yes, there are penalties for late filing of Form CT-1096. The penalty amount depends on the number of information returns being transmitted and the delay in filing.

Q: Is Form CT-1096 required for both paper and electronic filing?

A: No, if you choose to file electronically, you do not need to file a paper copy of Form CT-1096.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1096 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.