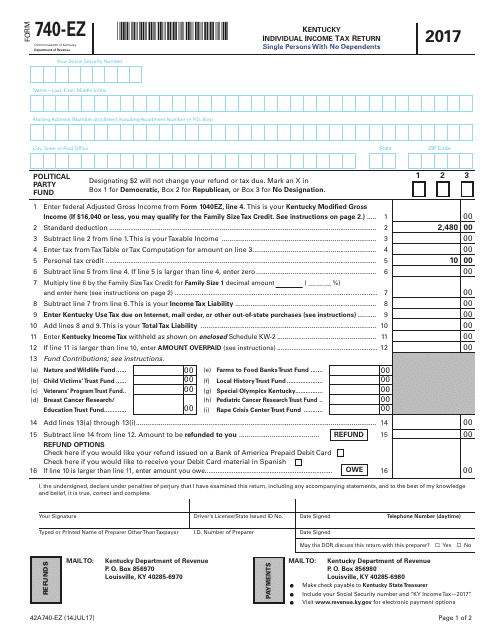

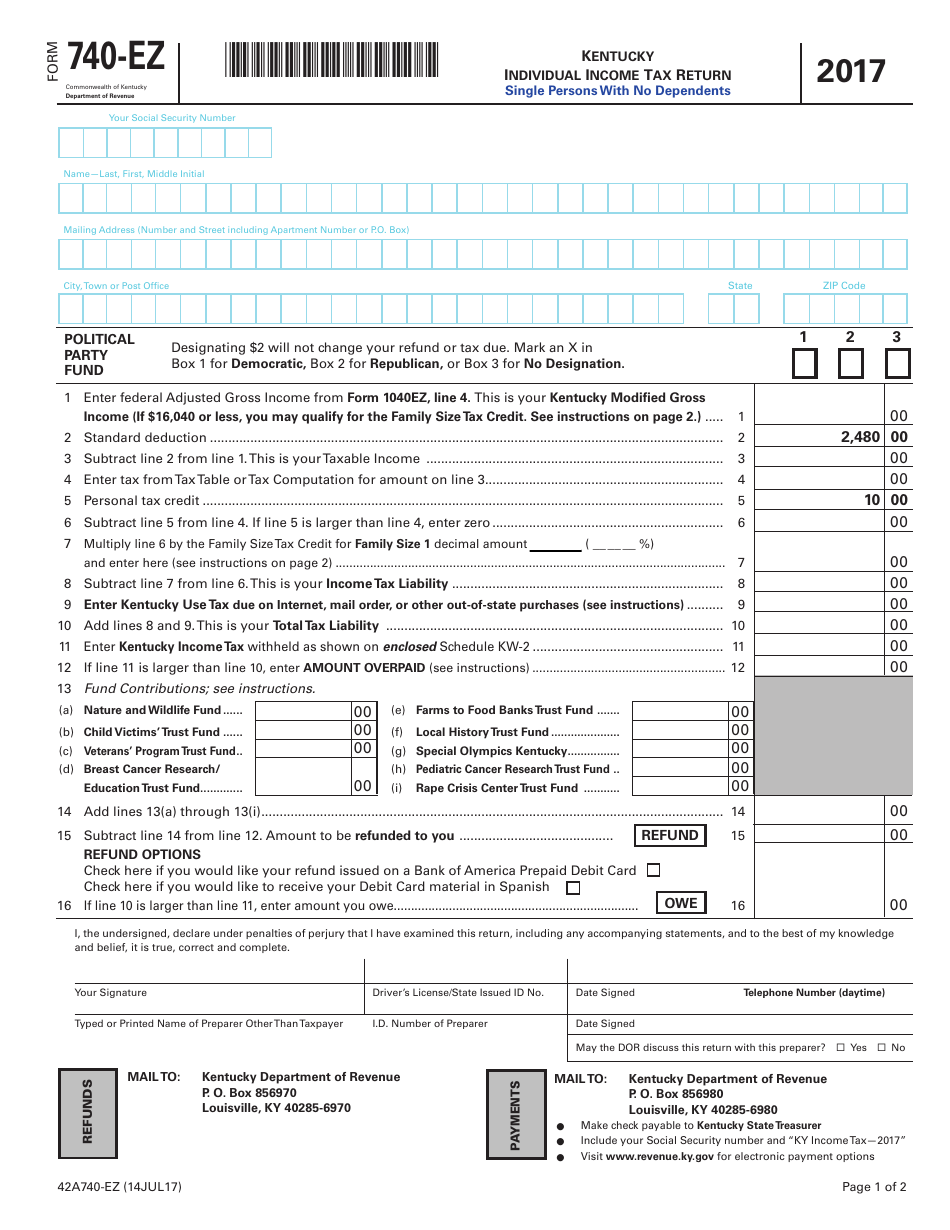

Form 740-EZ Kentucky Individual Income Tax Return - Kentucky

What Is Form 740-EZ?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 740-EZ?

A: Form 740-EZ is the Kentucky Individual Income Tax Return for residents of Kentucky.

Q: Who needs to file Form 740-EZ?

A: Residents of Kentucky who have income from Kentucky sources need to file Form 740-EZ.

Q: What is the purpose of Form 740-EZ?

A: Form 740-EZ is used to report and calculate the amount of income tax owed to the state of Kentucky.

Q: Is Form 740-EZ available for both single and married taxpayers?

A: Yes, Form 740-EZ is available for both single and married taxpayers.

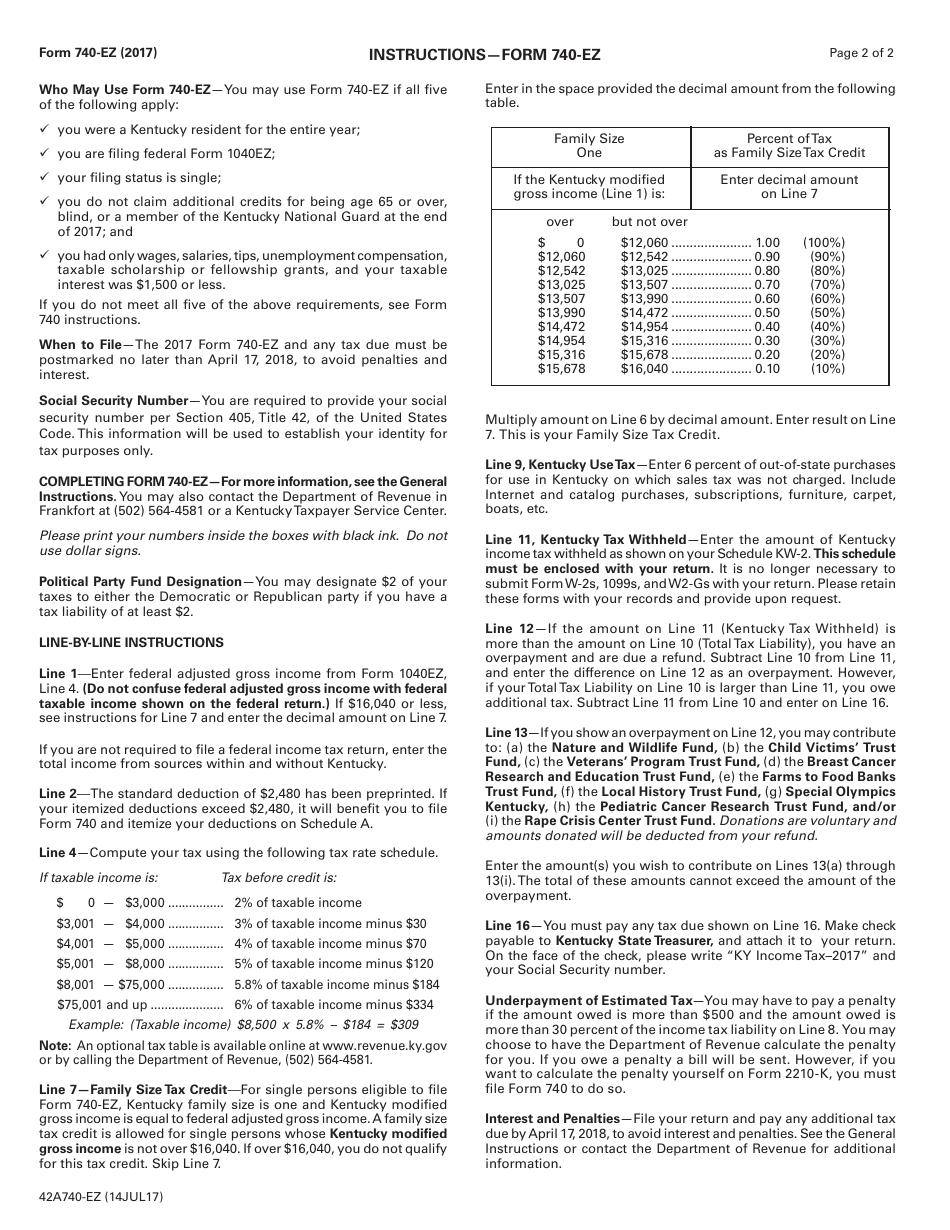

Q: How do I file Form 740-EZ?

A: Form 740-EZ can be filed electronically or by mail using the instructions provided by the Kentucky Department of Revenue.

Q: What if I have additional income or deductions that are not covered by Form 740-EZ?

A: If you have additional income or deductions that are not covered by Form 740-EZ, you may need to use the standard Form 740 instead.

Q: When is the deadline to file Form 740-EZ?

A: The deadline to file Form 740-EZ is the same as the federal income tax deadline, which is usually April 15th.

Q: Can I file Form 740-EZ if I am a part-year resident of Kentucky?

A: No, Form 740-EZ is only for full-year residents of Kentucky. Part-year residents should use the standard Form 740.

Q: What documents do I need to include with Form 740-EZ?

A: You may need to include copies of your federal income tax return and any supporting documents that are necessary to verify your income and deductions.

Form Details:

- Released on July 14, 2017;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 740-EZ by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.