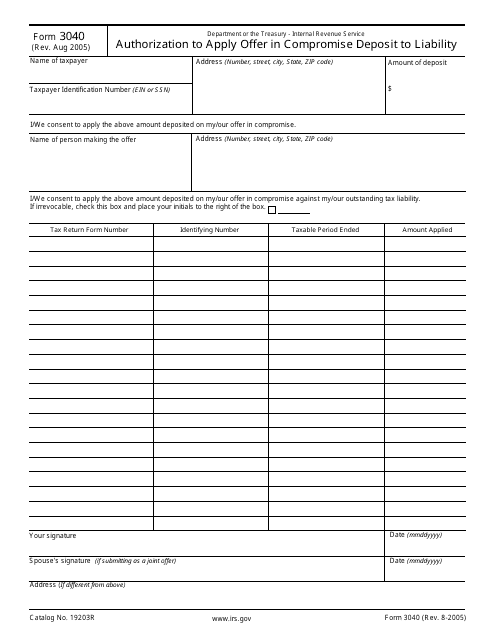

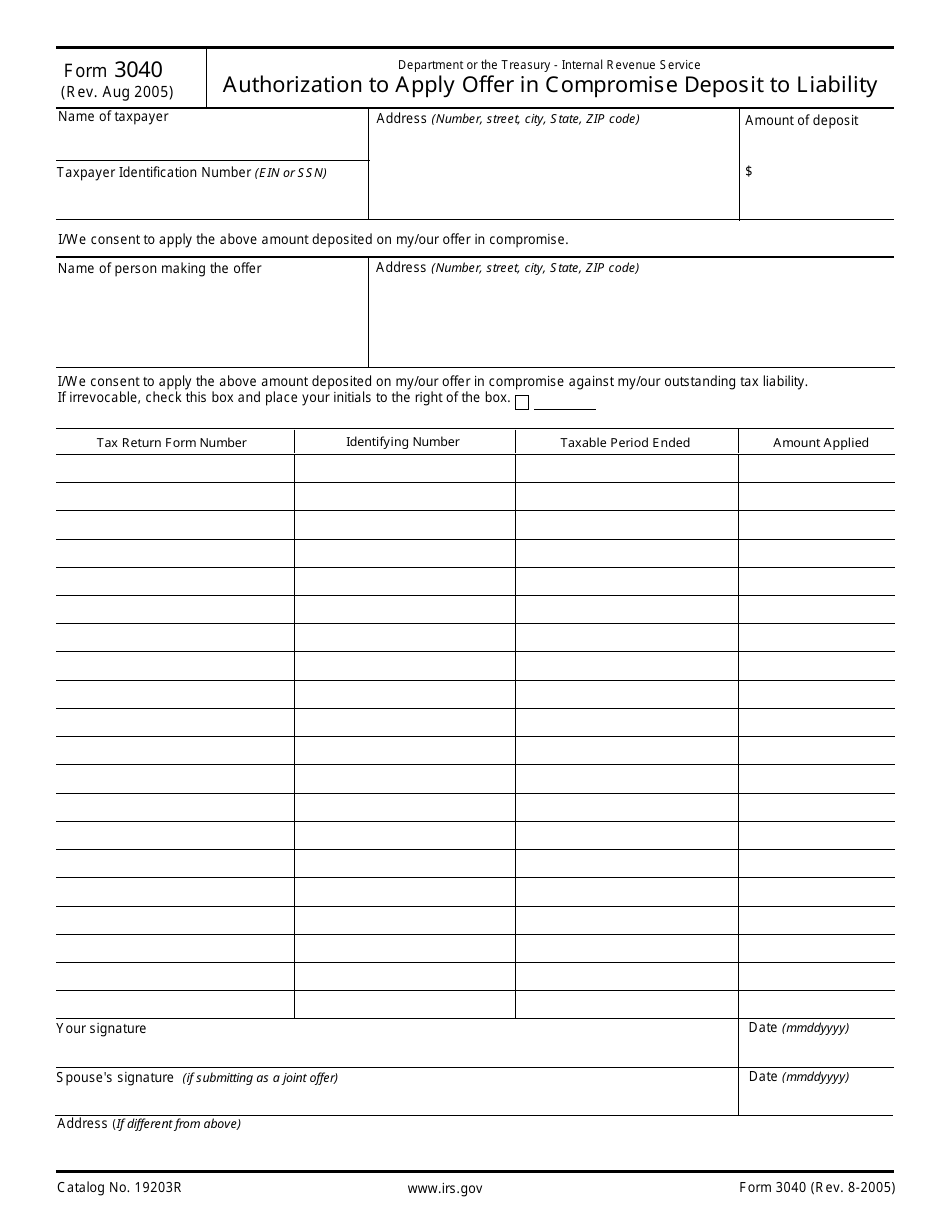

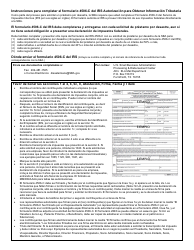

IRS Form 3040 Authorization to Apply Offer in Compromise Deposit to Liability

What Is IRS Form 3040?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on August 1, 2005. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 3040?

A: IRS Form 3040 is the Authorization to Apply Offer in Compromise Deposit to Liability form.

Q: What is an Offer in Compromise?

A: An Offer in Compromise is an agreement between a taxpayer and the IRS that settles the taxpayer's tax liabilities for less than the full amount owed.

Q: What is the purpose of IRS Form 3040?

A: The purpose of IRS Form 3040 is to authorize the IRS to apply the deposit made with an Offer in Compromise towards the taxpayer's tax liability.

Q: When should IRS Form 3040 be used?

A: IRS Form 3040 should be used when a taxpayer has made a deposit with an Offer in Compromise and wants to apply that deposit towards their tax liability.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 3040 through the link below or browse more documents in our library of IRS Forms.