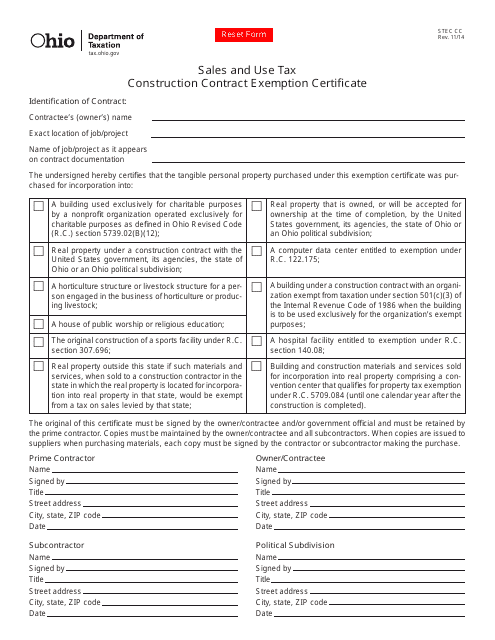

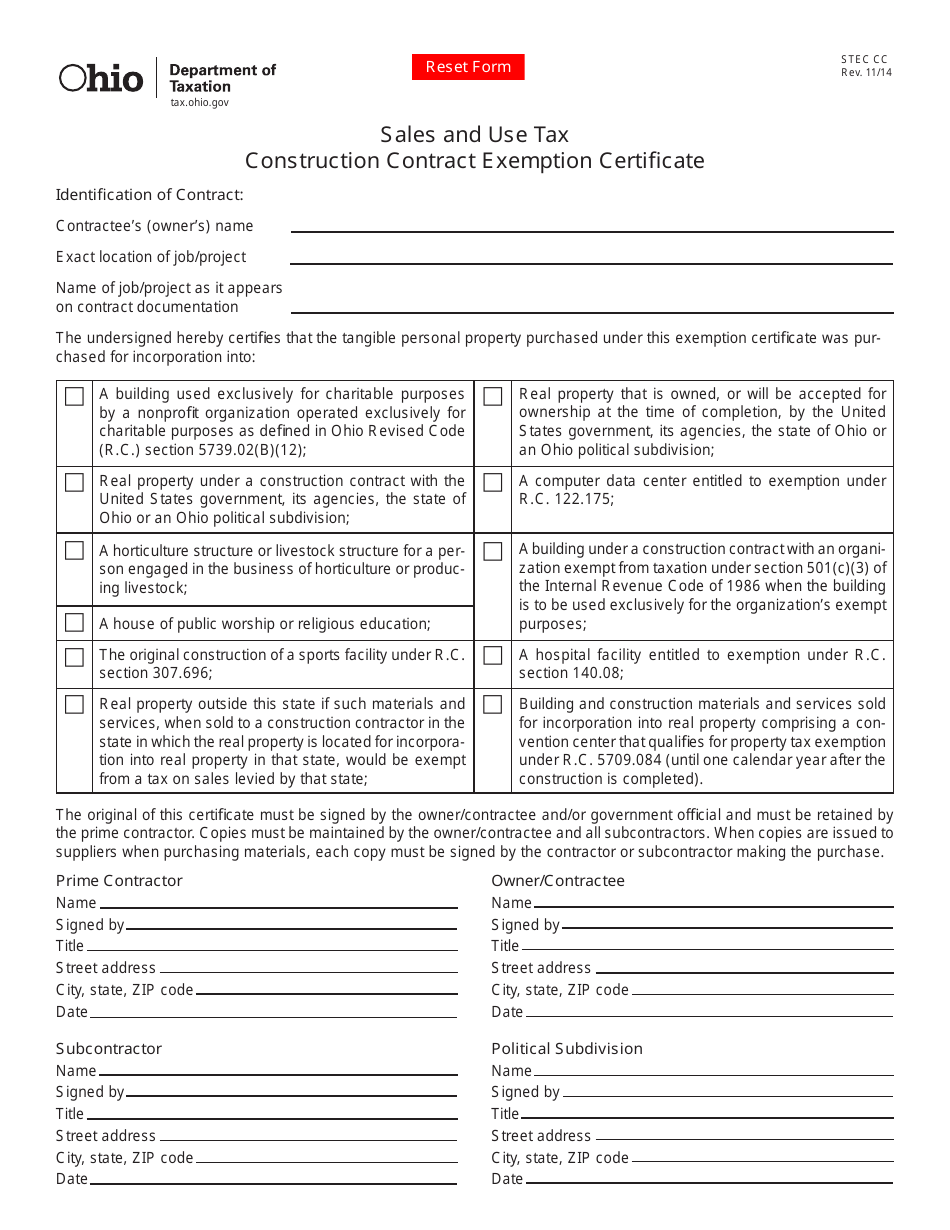

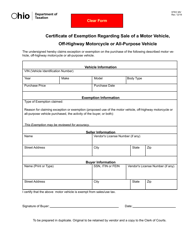

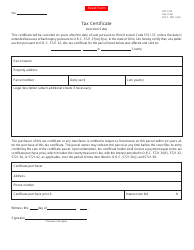

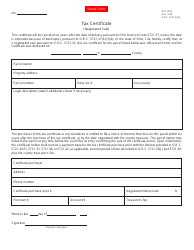

Form STEC CC Sales and Use Tax Construction Contract Exemption Certificate - Ohio

What Is Form STEC CC?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

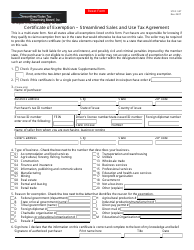

Q: What is the STEC CC Sales and Use Tax Construction Contract Exemption Certificate?

A: The STEC CC Sales and Use Tax Construction Contract Exemption Certificate is a form used in Ohio to claim an exemption from sales and use tax on construction contracts.

Q: Who can use the STEC CC Sales and Use Tax Construction Contract Exemption Certificate?

A: The STEC CC Sales and Use Tax Construction Contract Exemption Certificate can be used by contractors or subcontractors who are working on construction projects in Ohio.

Q: What is the purpose of the STEC CC Sales and Use Tax Construction Contract Exemption Certificate?

A: The purpose of the STEC CC Sales and Use Tax Construction Contract Exemption Certificate is to allow contractors and subcontractors to claim an exemption from paying sales and use tax on construction contracts.

Q: How do I fill out the STEC CC Sales and Use Tax Construction Contract Exemption Certificate?

A: You must provide your business information, the project details, and indicate the reason for the exemption on the STEC CC Sales and Use Tax Construction Contract Exemption Certificate.

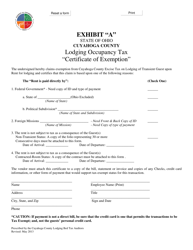

Q: Is the STEC CC Sales and Use Tax Construction Contract Exemption Certificate applicable in all counties of Ohio?

A: Yes, the STEC CC Sales and Use Tax Construction Contract Exemption Certificate is applicable in all counties of Ohio.

Q: Can I use the STEC CC Sales and Use Tax Construction Contract Exemption Certificate for all types of construction projects?

A: Yes, the STEC CC Sales and Use Tax Construction Contract Exemption Certificate can be used for all types of construction projects in Ohio.

Q: Do I need to submit the STEC CC Sales and Use Tax Construction Contract Exemption Certificate to the Ohio Department of Taxation?

A: No, you do not need to submit the STEC CC Sales and Use Tax Construction Contract Exemption Certificate to the Ohio Department of Taxation. However, you should keep a copy of the filled-out certificate for your records.

Q: Is the use of the STEC CC Sales and Use Tax Construction Contract Exemption Certificate mandatory?

A: No, the use of the STEC CC Sales and Use Tax Construction Contract Exemption Certificate is not mandatory. It is optional and can be used by contractors and subcontractors who qualify for the exemption.

Form Details:

- Released on November 1, 2014;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STEC CC by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.