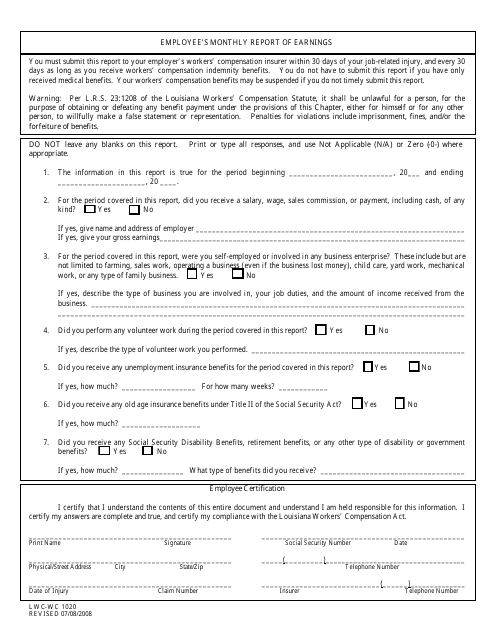

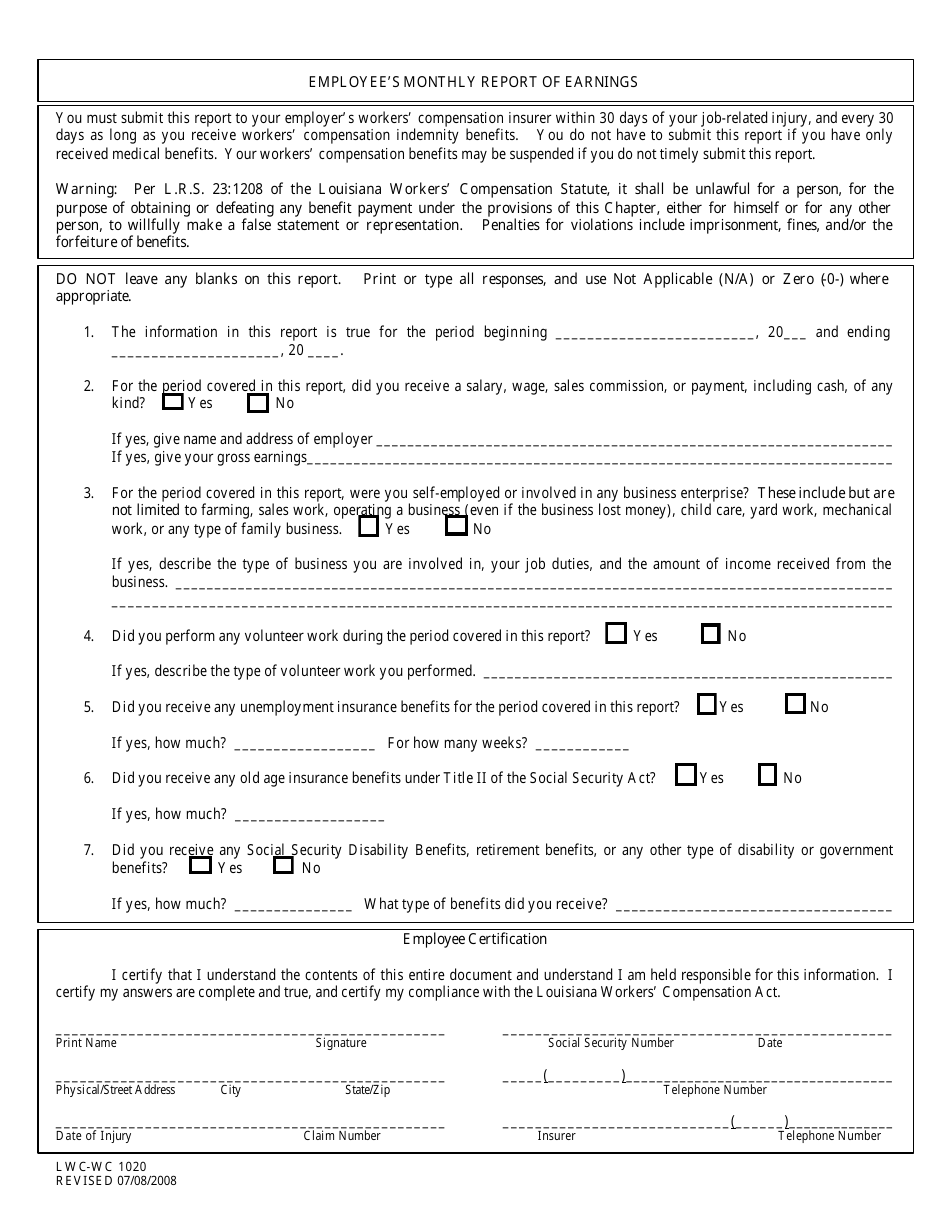

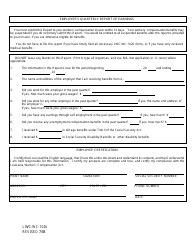

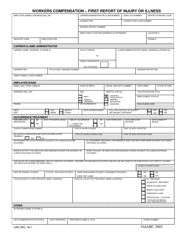

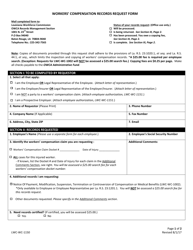

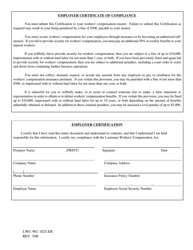

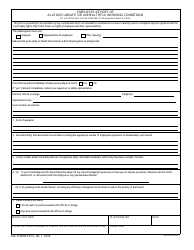

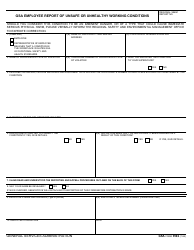

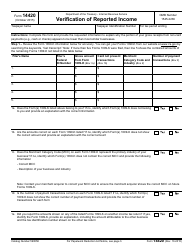

Form LWC-WC1020 Employee's Monthly Report of Earnings - Louisiana

What Is Form LWC-WC1020?

This is a legal form that was released by the Louisiana Workforce Commission - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LWC-WC1020?

A: Form LWC-WC1020 is the Employee's Monthly Report of Earnings specific to Louisiana.

Q: What is the purpose of Form LWC-WC1020?

A: The purpose of Form LWC-WC1020 is to report monthly earnings of an employee for workers' compensation purposes in Louisiana.

Q: Who needs to fill out Form LWC-WC1020?

A: Employees in Louisiana who have suffered a work-related injury and are receiving workers' compensation benefits need to fill out Form LWC-WC1020.

Q: What information is required on Form LWC-WC1020?

A: Form LWC-WC1020 requires information such as the employee's name, personal identification number, employer information, and details of monthly earnings.

Q: When should Form LWC-WC1020 be submitted?

A: Form LWC-WC1020 should be submitted on a monthly basis, typically within the first few days of each month, reporting the previous month's earnings.

Q: Are there any penalties for not submitting Form LWC-WC1020?

A: Failure to submit Form LWC-WC1020 as required may result in penalties or the suspension of workers' compensation benefits.

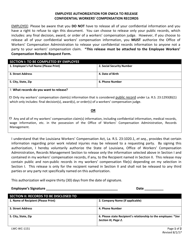

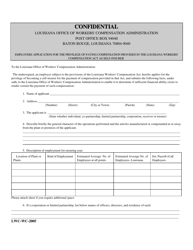

Q: Is Form LWC-WC1020 confidential?

A: Yes, the information provided on Form LWC-WC1020 is confidential and is used solely for workers' compensation purposes.

Q: Are there any fees associated with filing Form LWC-WC1020?

A: No, there are no fees associated with filing Form LWC-WC1020.

Form Details:

- Released on July 8, 2008;

- The latest edition provided by the Louisiana Workforce Commission;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LWC-WC1020 by clicking the link below or browse more documents and templates provided by the Louisiana Workforce Commission.