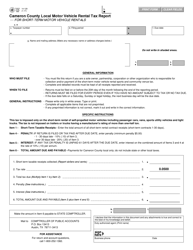

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 50-285

for the current year.

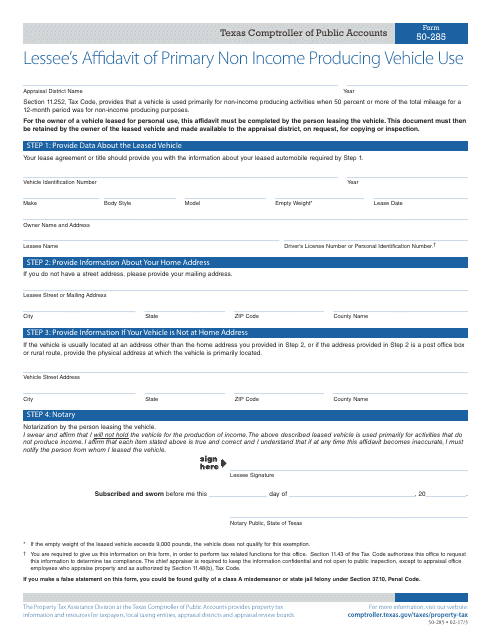

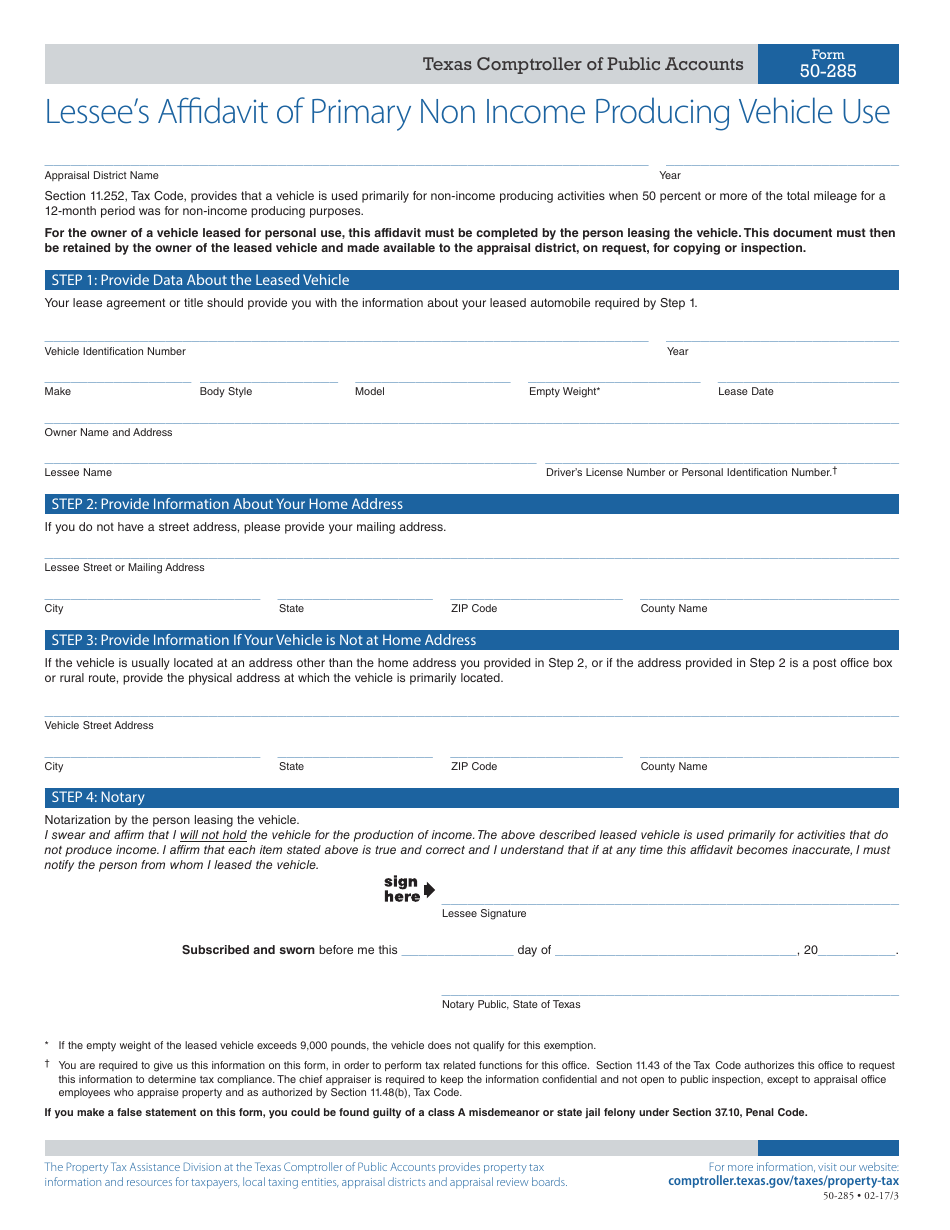

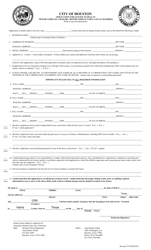

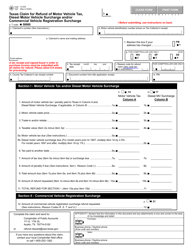

Form 50-285 Lessee's Affidavit of Primary Non Income Producing Vehicle Use - Texas

What Is Form 50-285?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 50-285?

A: Form 50-285 is the Lessee's Affidavit of Primary Non Income Producing Vehicle Use in Texas.

Q: Who needs to fill out form 50-285?

A: Lessees of vehicles in Texas who use the vehicle primarily for personal use and not for income-producing activities need to fill out form 50-285.

Q: What is the purpose of form 50-285?

A: The purpose of form 50-285 is to certify that the lessee is not using the leased vehicle for income-producing activities.

Q: Is there a fee for submitting form 50-285?

A: No, there is no fee for submitting form 50-285.

Q: What information is required on form 50-285?

A: Form 50-285 requires information about the lessee, the leased vehicle, and a declaration of non income-producing use.

Q: Can the information provided on form 50-285 be verified?

A: Yes, the information provided on form 50-285 may be subject to verification by the Texas Department of Motor Vehicles.

Q: What happens if the information on form 50-285 is found to be false?

A: If the information on form 50-285 is found to be false, the lessee may be subject to penalties and fines.

Q: Do I need to submit form 50-285 every year?

A: No, form 50-285 is only required to be submitted once unless there is a change in the use of the leased vehicle.

Q: Can I use form 50-285 for commercial vehicles?

A: No, form 50-285 is specifically for non income-producing use of vehicles and cannot be used for commercial vehicles.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-285 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.