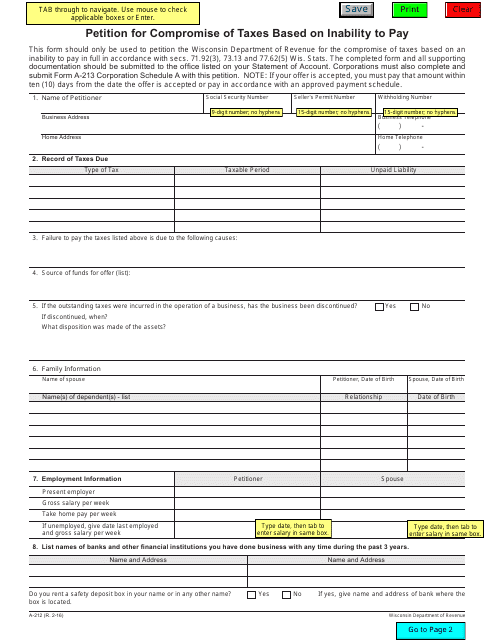

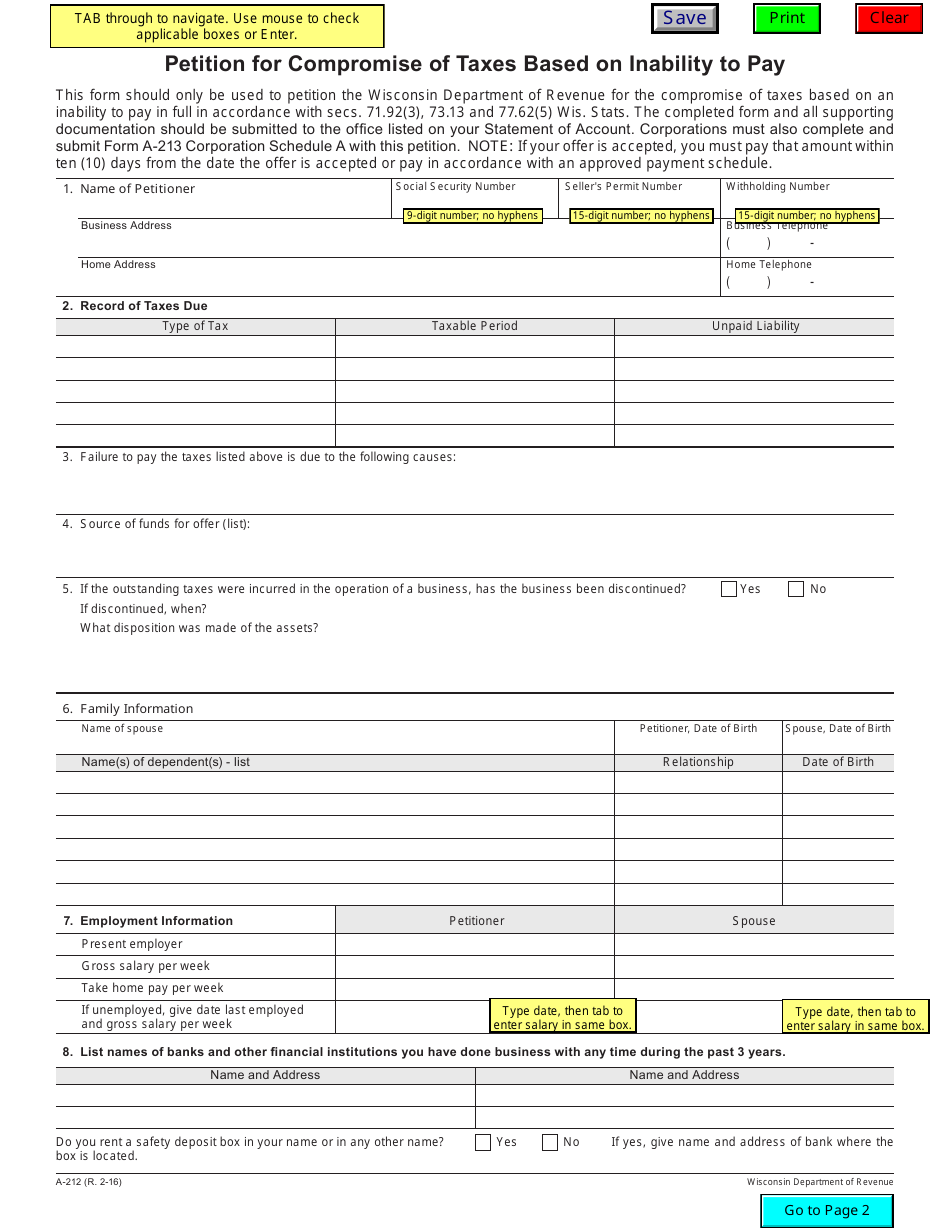

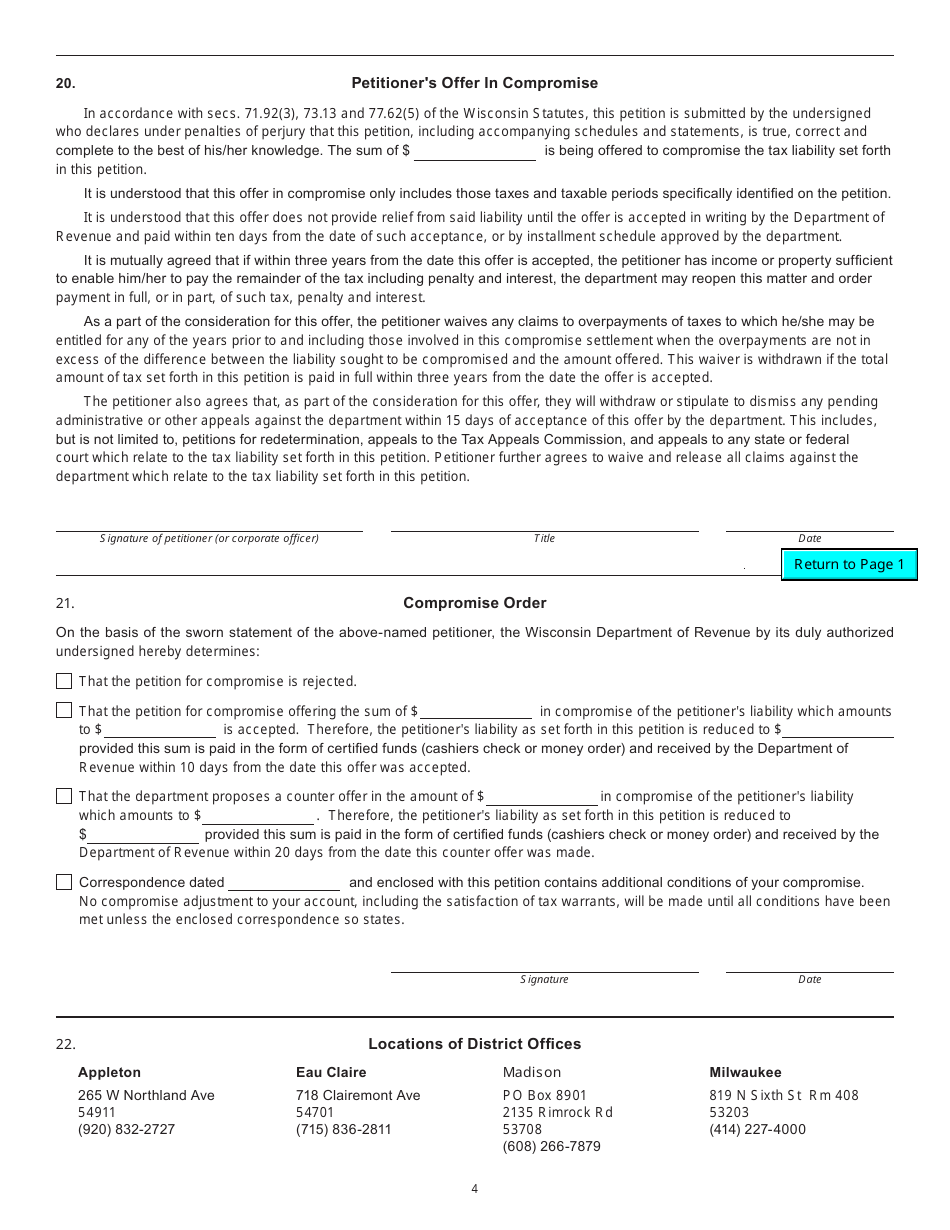

Form A-212 Petition for Compromise of Taxes Based on Inability to Pay - Wisconsin

What Is Form A-212?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-212?

A: Form A-212 is the Petition for Compromise of Taxes Based on Inability to Pay in Wisconsin.

Q: Who can use Form A-212?

A: Individuals and businesses in Wisconsin who are unable to pay their taxes in full can use Form A-212.

Q: What is the purpose of Form A-212?

A: The purpose of Form A-212 is to request a compromise of taxes based on the taxpayer's inability to pay in full.

Q: How do I fill out Form A-212?

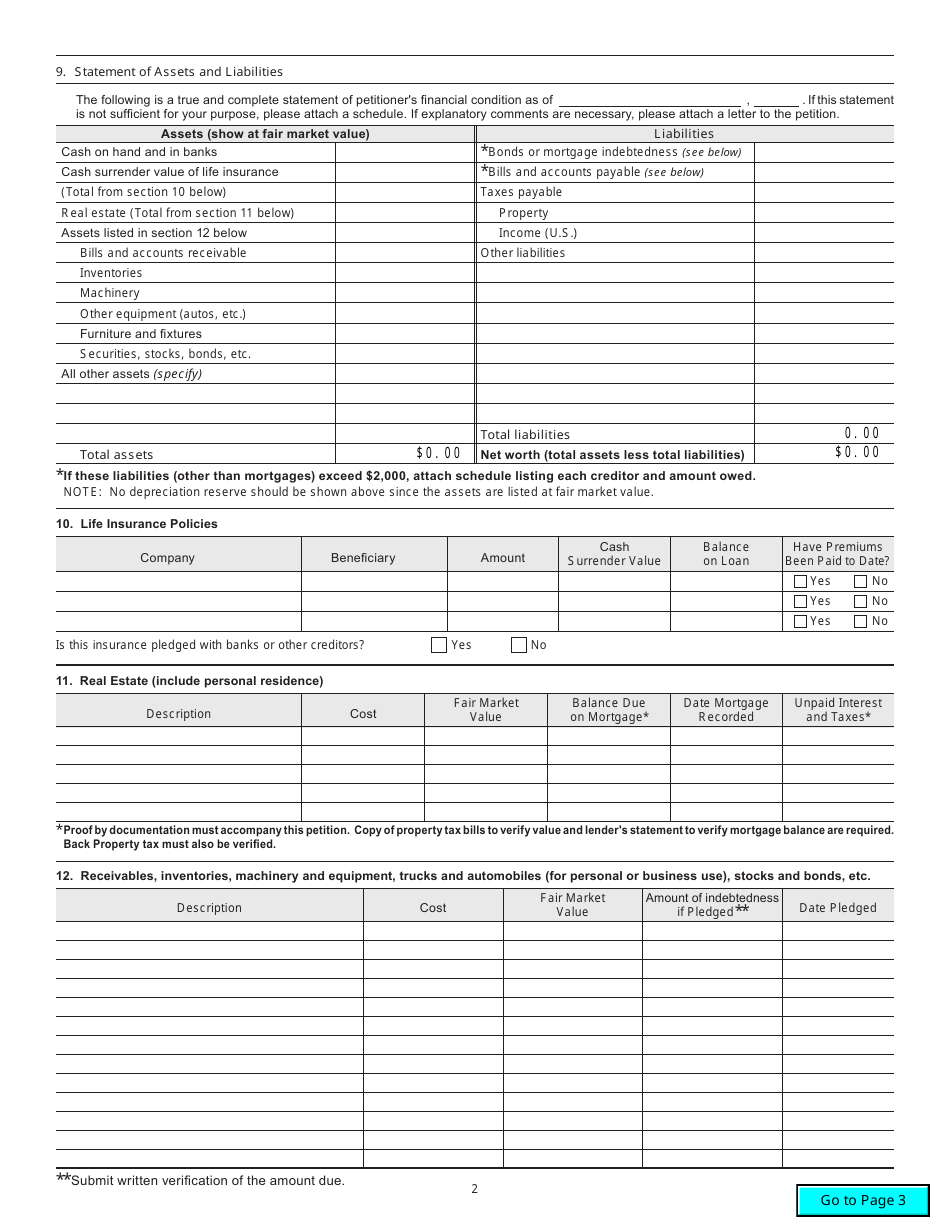

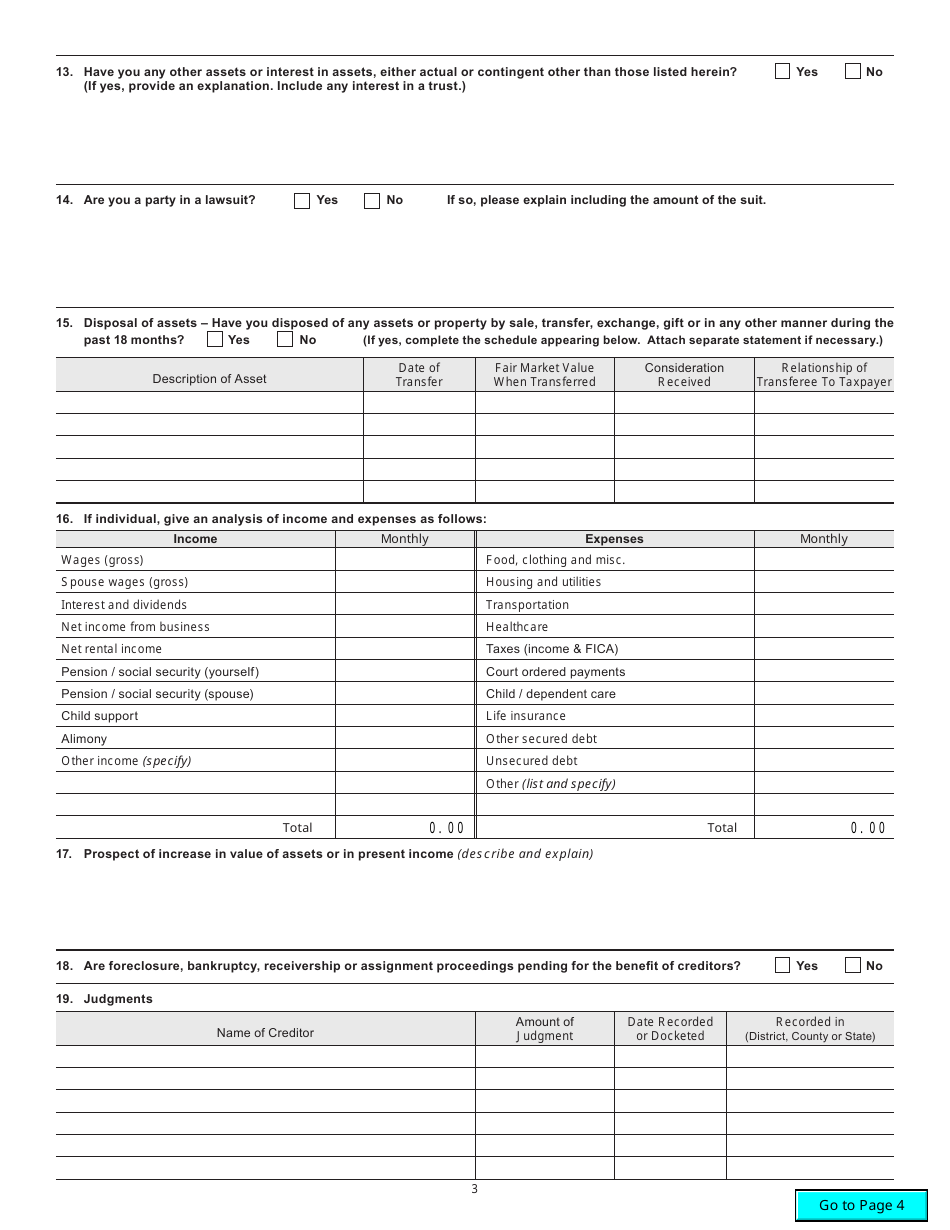

A: You must provide accurate information about your financial situation, income, expenses, and assets on Form A-212.

Q: Is there a fee to submit Form A-212?

A: Yes, there is a non-refundable fee of $20 to submit Form A-212.

Q: What happens after I submit Form A-212?

A: The Wisconsin Department of Revenue will review your petition and determine if a compromise is appropriate.

Q: What if my petition is approved?

A: If your petition is approved, you may be able to settle your tax debt for a reduced amount.

Q: What if my petition is denied?

A: If your petition is denied, you will still be responsible for paying your tax debt in full.

Q: Can I appeal if my petition is denied?

A: Yes, you have the right to appeal the denial of your petition within 30 days.

Form Details:

- Released on February 1, 2016;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-212 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.