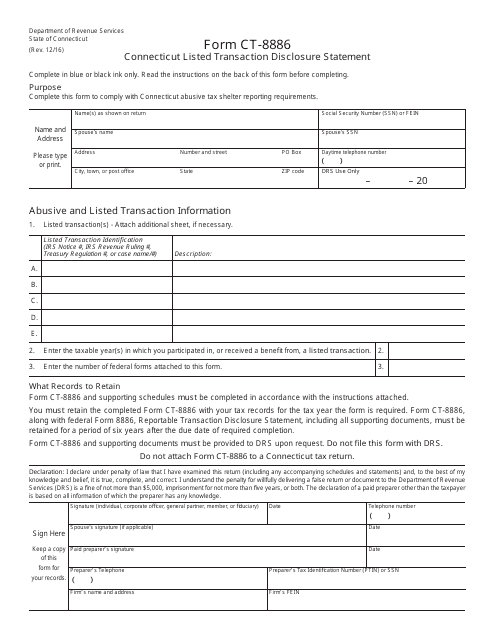

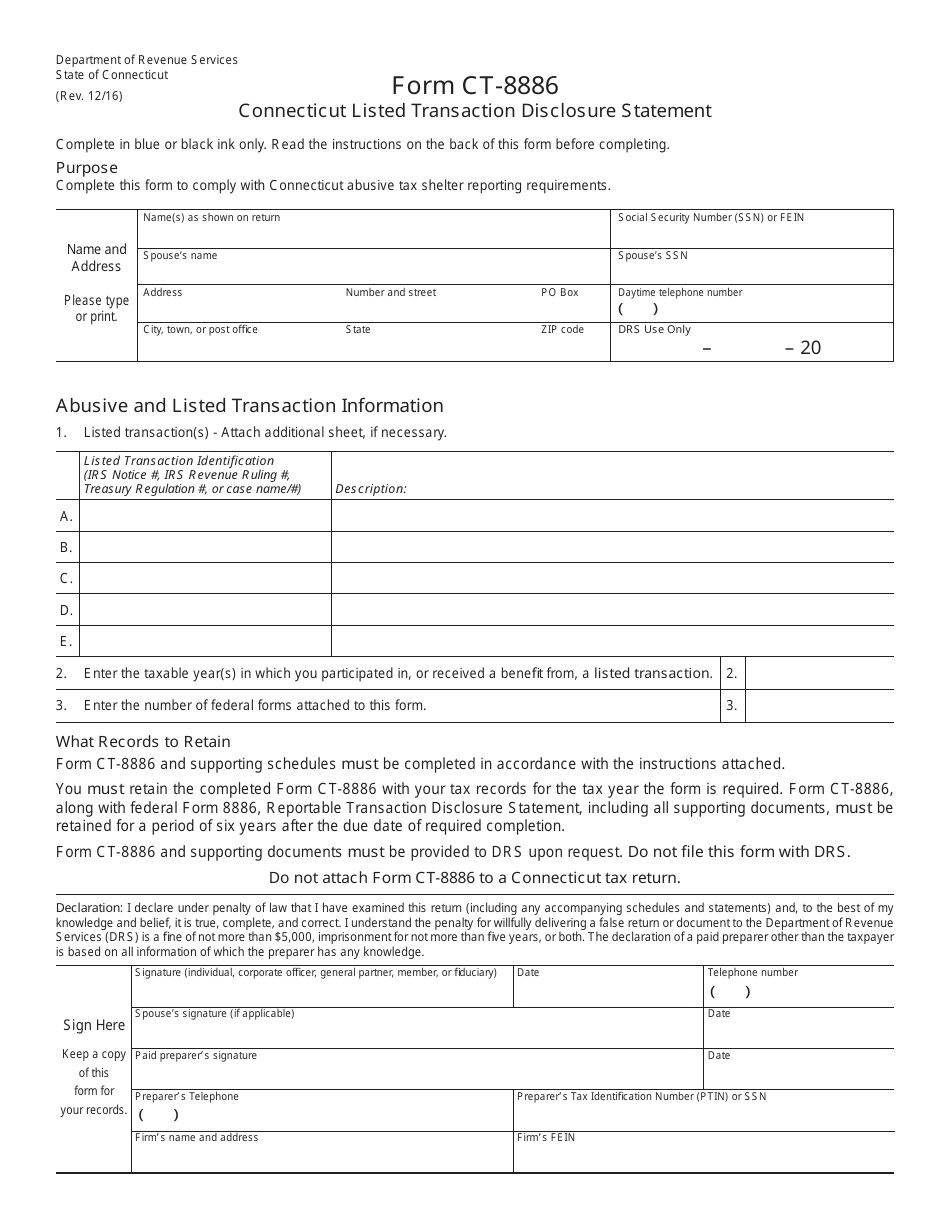

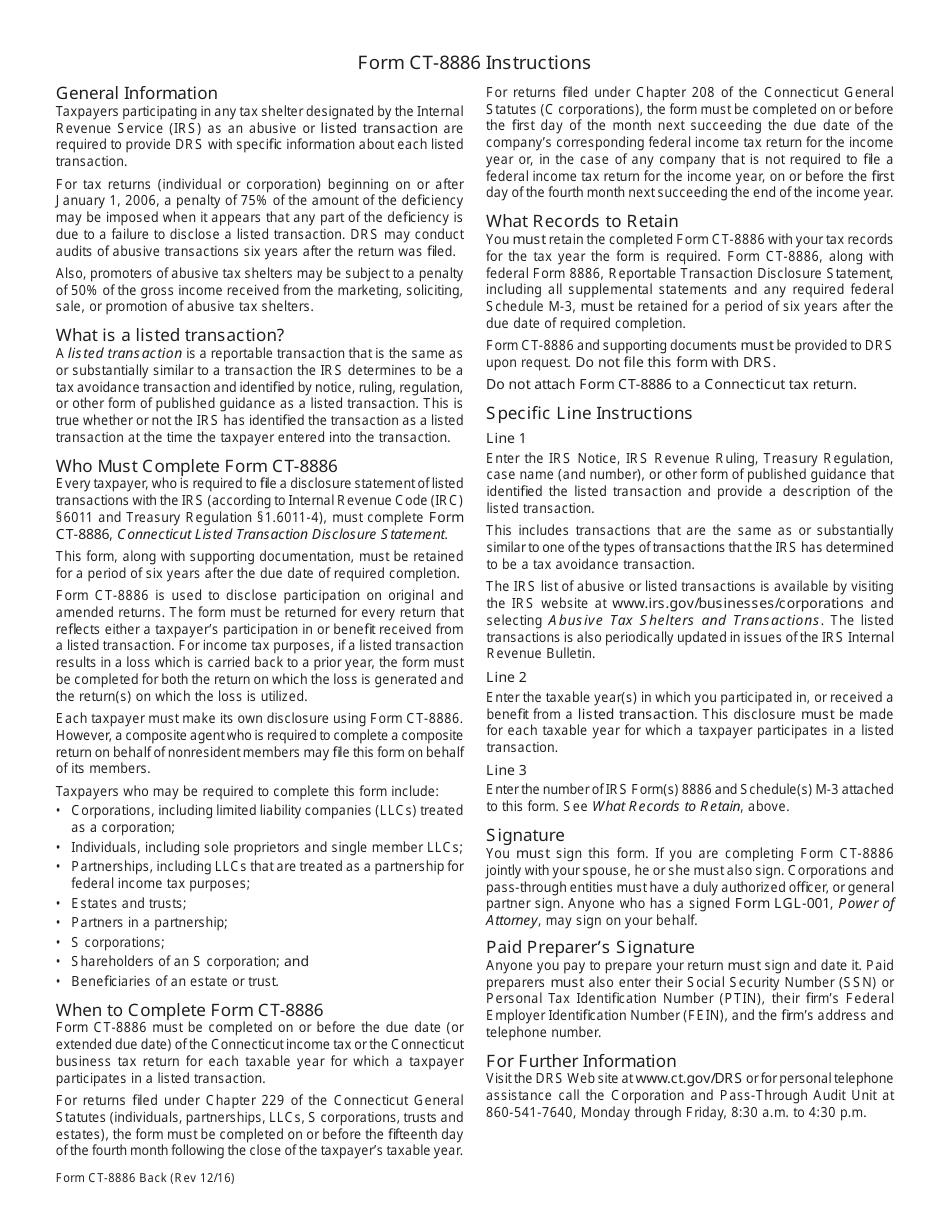

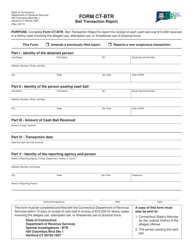

Form CT-8886 Connecticut Listed Transaction Disclosure Statement - Connecticut

What Is Form CT-8886?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-8886?

A: Form CT-8886 is the Connecticut Listed Transaction Disclosure Statement.

Q: What is the purpose of Form CT-8886?

A: The purpose of Form CT-8886 is to disclose certain listed transactions for Connecticut tax purposes.

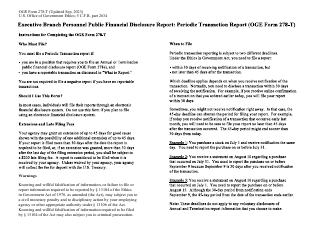

Q: Who needs to file Form CT-8886?

A: Taxpayers who have participated in certain listed transactions and have a Connecticut tax liability need to file Form CT-8886.

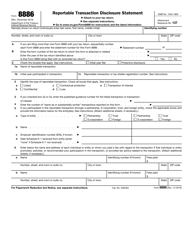

Q: What are listed transactions?

A: Listed transactions are transactions or arrangements that the IRS has determined to be tax avoidance transactions of interest.

Q: Is Form CT-8886 specific to Connecticut?

A: Yes, Form CT-8886 is specific to Connecticut and is used to disclose listed transactions for Connecticut tax purposes.

Q: When is Form CT-8886 due?

A: Form CT-8886 is generally due on or before the due date of the taxpayer's Connecticut income tax return.

Q: Are there any penalties for failing to file Form CT-8886?

A: Yes, there are penalties for failing to file Form CT-8886, including civil penalties and potential criminal prosecution.

Q: Can I e-file Form CT-8886?

A: No, Form CT-8886 cannot be e-filed and must be filed by mail or delivered in person.

Q: Can I file Form CT-8886 electronically?

A: No, Form CT-8886 cannot be filed electronically and must be submitted by mail or in person.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-8886 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.