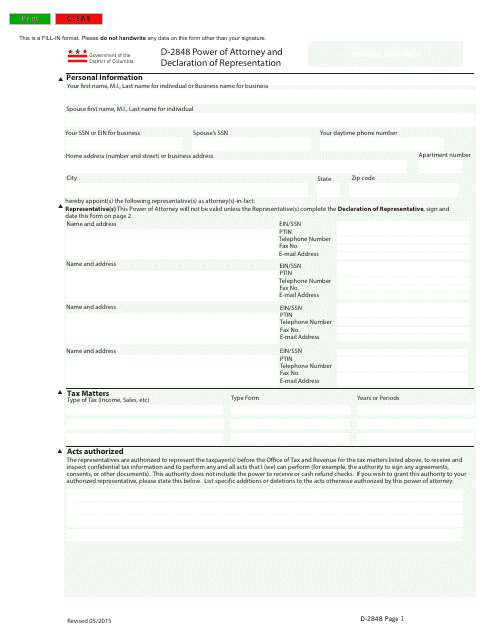

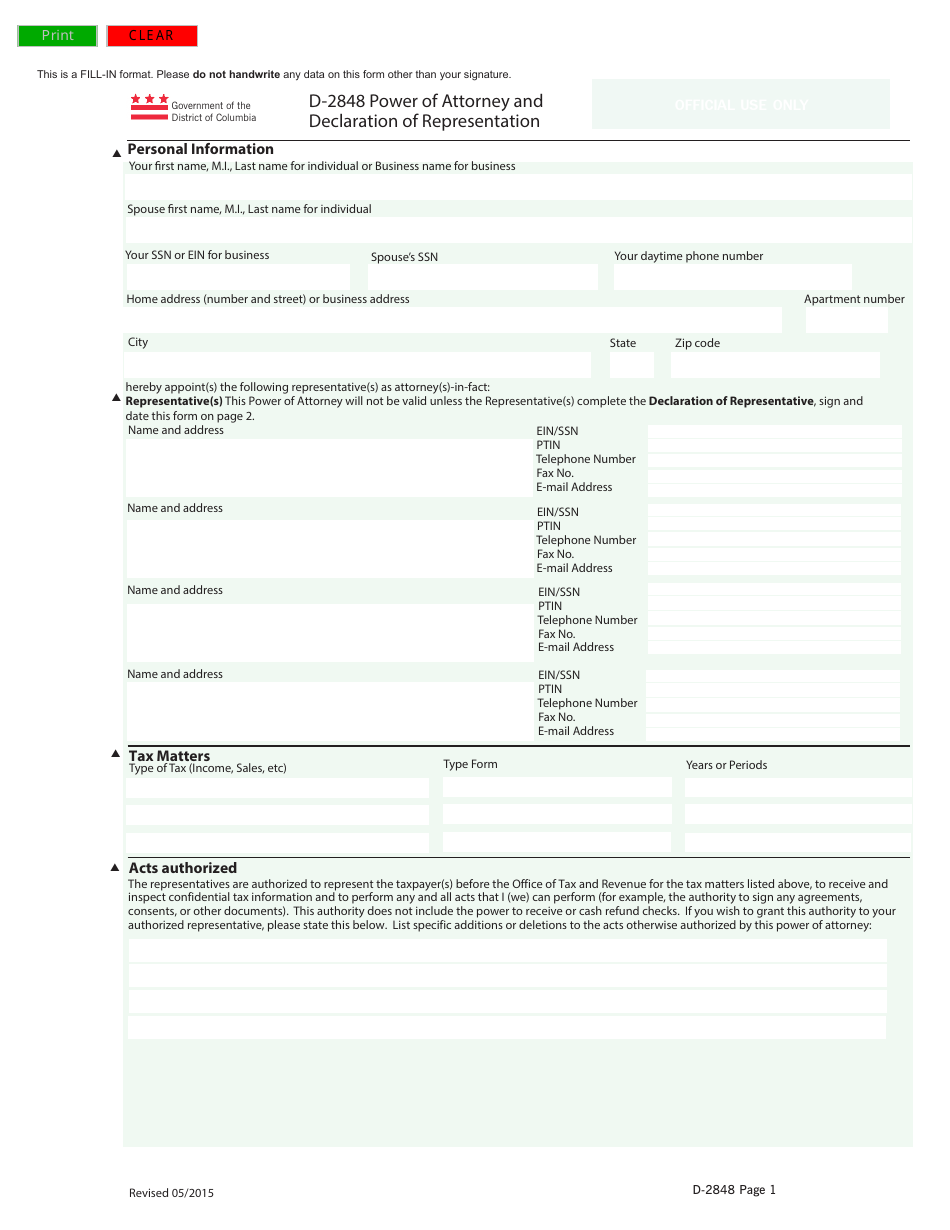

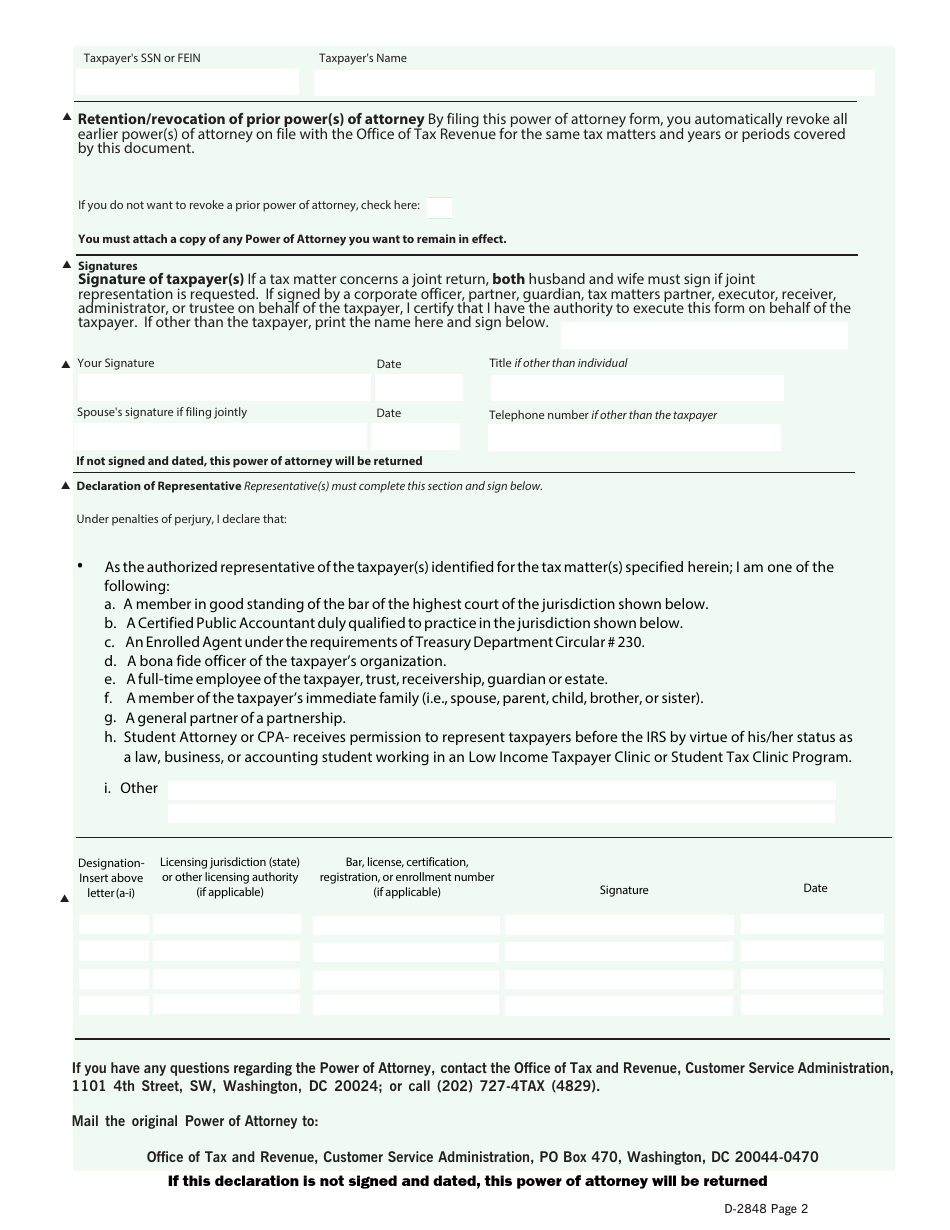

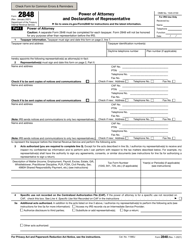

Form D-2848 Power of Attorney and Declaration of Representation - Washington, D.C.

What Is Form D-2848?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-2848?

A: Form D-2848 is a Power of Attorney and Declaration of Representation form.

Q: What is the purpose of Form D-2848?

A: The purpose of Form D-2848 is to authorize an individual to represent you before the Internal Revenue Service (IRS) for matters relating to your tax obligations.

Q: Who can use Form D-2848?

A: Any taxpayer who needs someone to act on their behalf for tax-related matters in Washington, D.C. can use Form D-2848.

Q: What information is required on Form D-2848?

A: Form D-2848 requires the taxpayer's personal information, information about the representative, and details of the tax matters for which representation is being authorized.

Q: How is Form D-2848 filed?

A: Form D-2848 should be sent to the address specified by the IRS in the instructions provided with the form.

Q: Is there a fee for filing Form D-2848?

A: No, there is no fee for filing Form D-2848.

Q: Can Form D-2848 be revoked?

A: Yes, the taxpayer can revoke the authorization by submitting a signed written statement to the IRS.

Q: Is Form D-2848 valid for all tax years?

A: No, Form D-2848 is only valid for the tax year indicated on the form.

Form Details:

- Released on May 1, 2015;

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-2848 by clicking the link below or browse more documents and templates provided by the Washington Dc Office of Tax and Revenue.