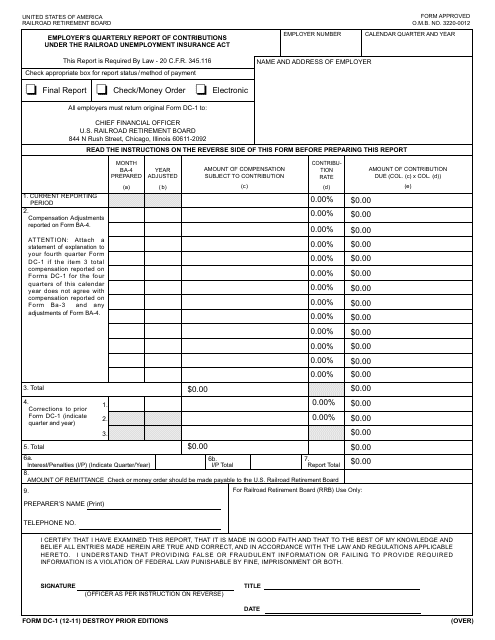

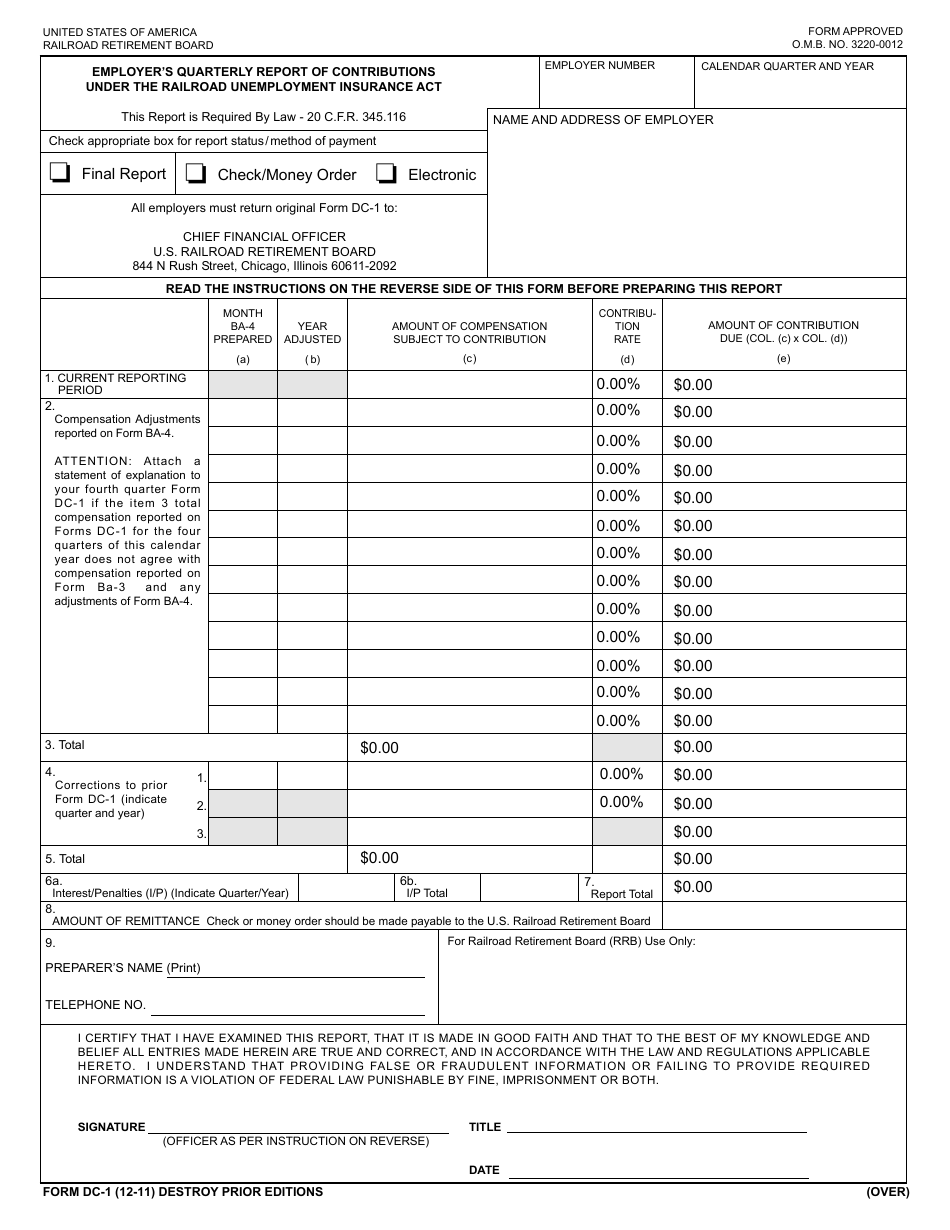

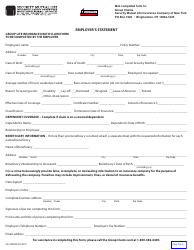

Form DC-1 Employer's Quarterly Report of Contributions Under the Railroad Unemployment Insurance Act

What Is Form DC-1?

This is a legal form that was released by the U.S. Railroad Retirement Board on December 1, 2011 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DC-1?

A: Form DC-1 is the Employer's Quarterly Report of Contributions under the Railroad Unemployment Insurance Act.

Q: Who is required to file Form DC-1?

A: Railroad employers are required to file Form DC-1.

Q: What is the purpose of Form DC-1?

A: Form DC-1 is used to report contributions made by railroad employers under the Railroad Unemployment Insurance Act.

Q: When is Form DC-1 due?

A: Form DC-1 is due quarterly, and the due dates are generally the last day of the month following the end of each calendar quarter.

Q: How can Form DC-1 be filed?

A: Form DC-1 can be filed electronically or by mail.

Q: Are there any penalties for not filing Form DC-1?

A: Yes, there can be penalties for failing to file Form DC-1 or for filing a false or fraudulent report.

Form Details:

- Released on December 1, 2011;

- The latest available edition released by the U.S. Railroad Retirement Board;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DC-1 by clicking the link below or browse more documents and templates provided by the U.S. Railroad Retirement Board.