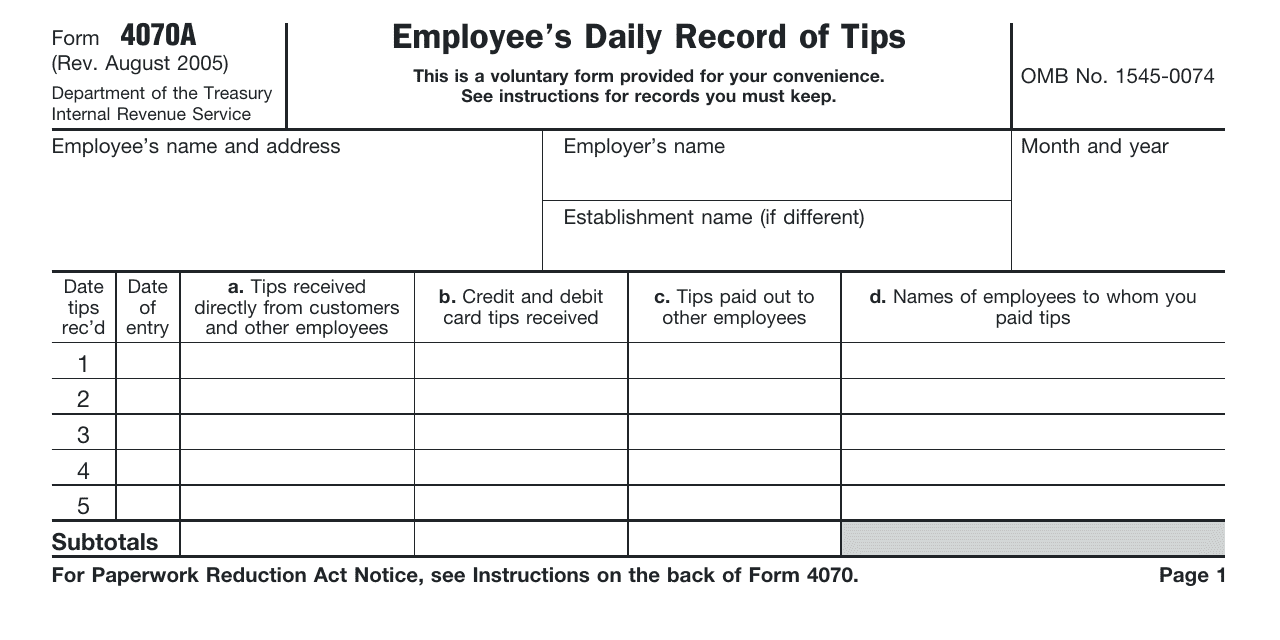

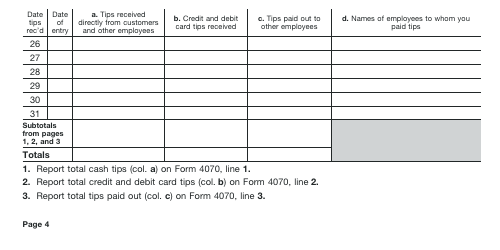

IRS Form 4070A Employee's Daily Record of Tips

What Is IRS Form 4070A?

IRS Form 4070A, Employee’s Daily Record of Tips , is a written list of tips earned by an employee who later prepares a formal report to inform their employer about the tips.

Alternate Names:

- Tax Form 4070A;

- IRS Tip Reporting Form.

While people that work in the service industry are permitted to use an alternative method to calculate their tips, it is advised to stick to a uniform log an employee can fill out daily - this way, step by step, you will not miss any tips due to forgetting them after a few days. No matter the arrangement you have in your establishment - it is possible the employees agree to share all the tips or every person gets to keep whatever they receive from customers during their interactions - this kind of instrument will let you stay on top of all the additional income you receive over the course of thirty days.

This document was issued by the Internal Revenue Service (IRS) on August 1, 2005 , rendering previous versions of the form outdated. You may download an IRS Form 4070A fillable edition below.

IRS Form 4070A should be used with IRS Form 4070, Employee's Report of Tips to Employer. This form is used to report tips received in a month or any other period of time, as it is required by the employer.

The IRS Tip Reporting Form does not require recording tips received in a form of an item of value, but these must be reported on IRS Form 1040, U.S. Individual Income Tax Return.

Check out the 4070 Series of forms to see more IRS documents in this series.

Form 4070A Instructions

Here is how you may fill out the IRS Tip Reporting Form:

-

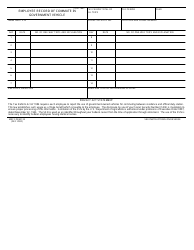

Write down your name and address. List the details of the employer - generally, the legal name is enough but you can also enter the name of the establishment if it is different. Specify the month and the year when the form is completed.

-

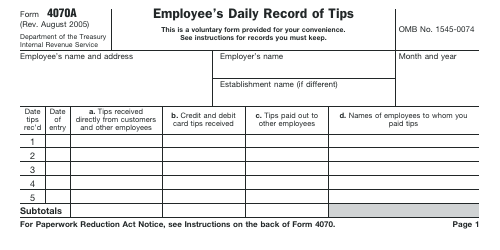

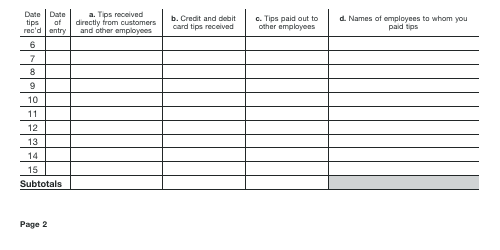

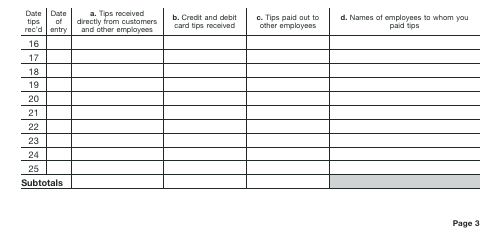

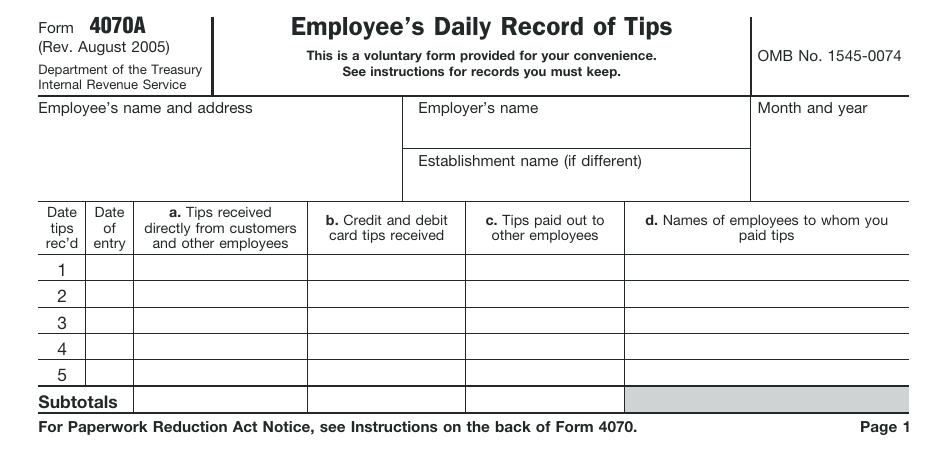

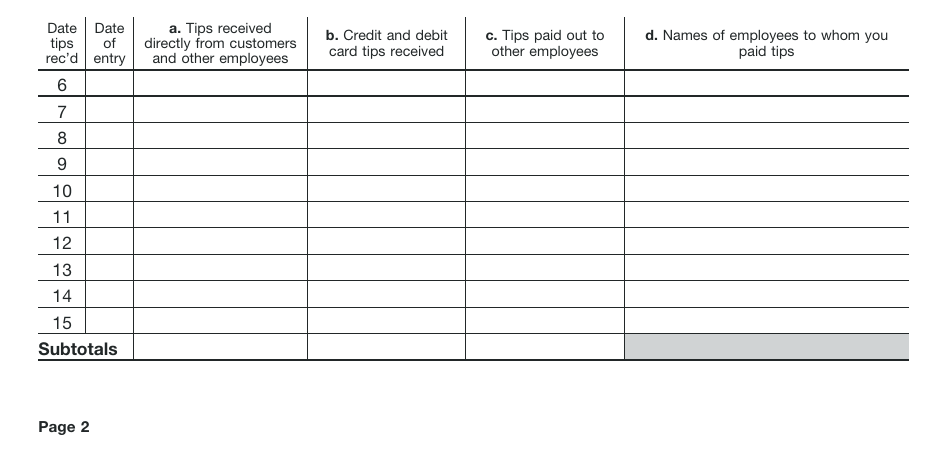

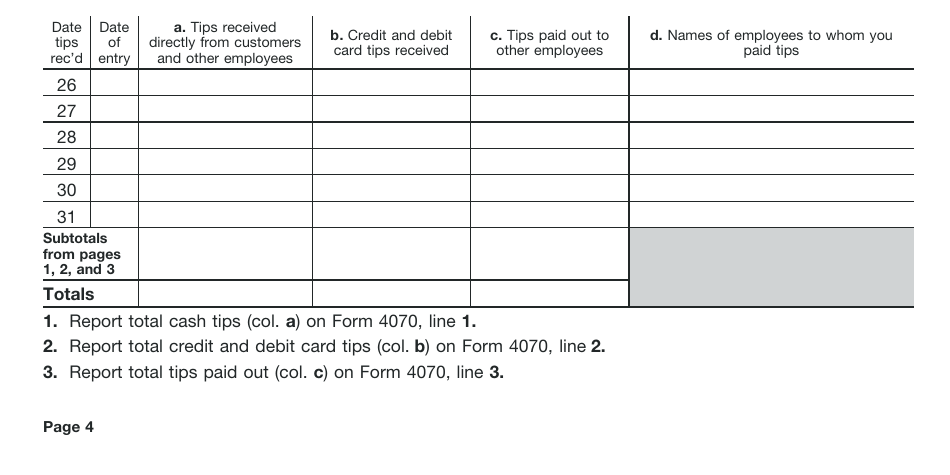

Indicate the day when you add new information to the form - the left column in the table already states the date which will allow you to create a comprehensive report without confusion no matter when you start your work and recordkeeping . You may skip certain lines since you will have days off as well as days when your organization does not conduct any operations and continue filling out the papers on the day you get tips.

-

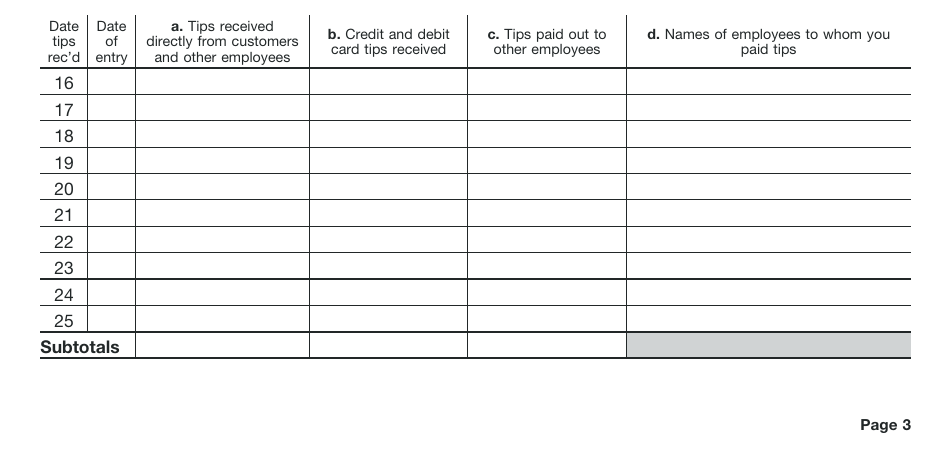

Point out the amount of tips you got directly from your clients and from the employees if your organization has established a tip-sharing system . List the amount of tips you received after credit and debit card transactions were successfully carried out. Record the amount of tips you had to pay to your coworkers. The document also allows you to identify those people if necessary and compute the subtotal results in case it will help you save time later or your employer requested this information specifically.

-

Once the month is over, proceed with calculations - you have to combine all the amounts listed on four pages of the form . There will be three separate fields to clarify the amount of tips from every category on the IRS Form 4070, Employee's Report of Tips to Employer - be ready to submit this information by the tenth day of the month that comes after the month outlined in writing.