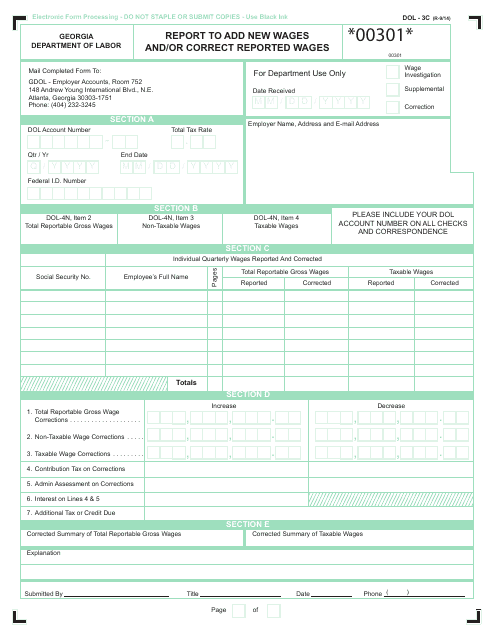

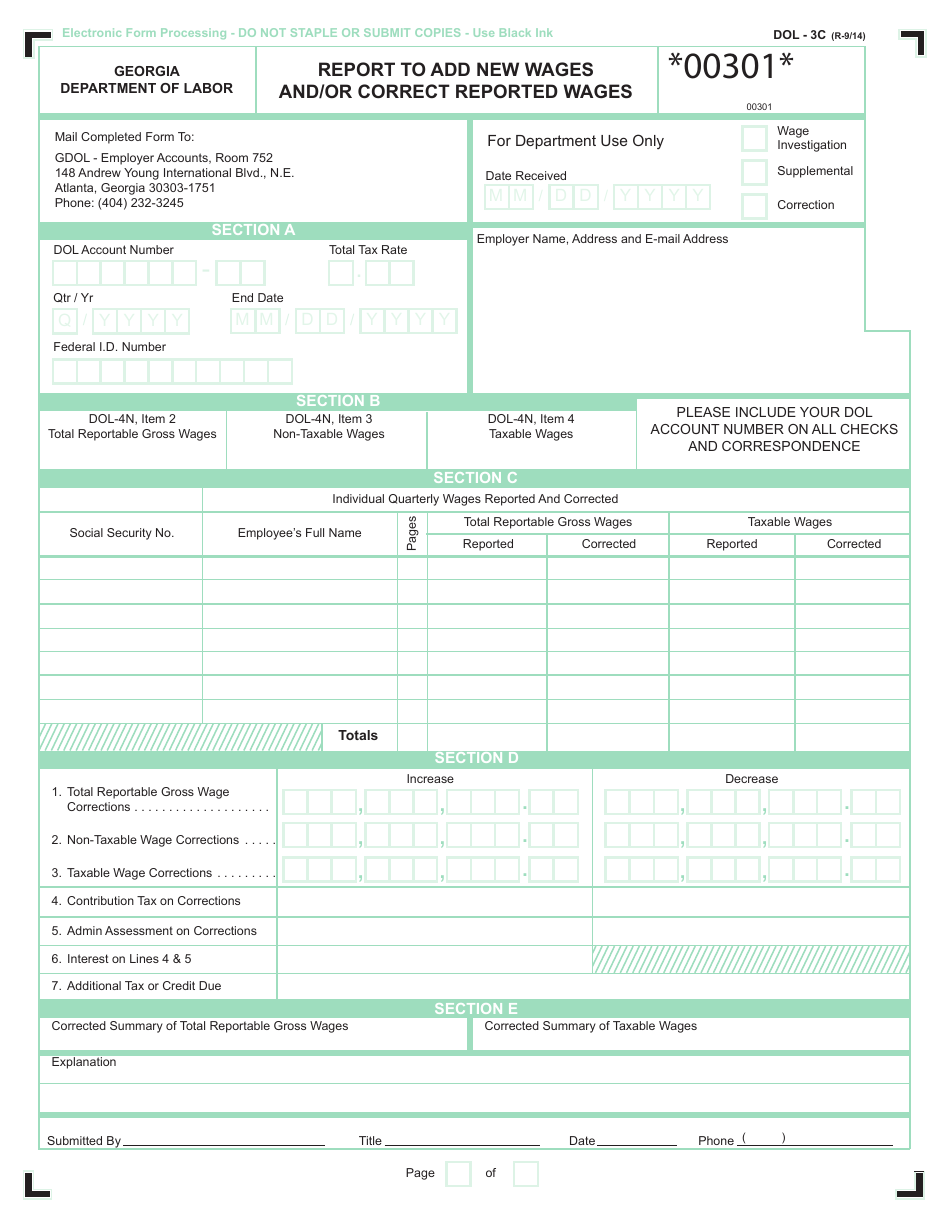

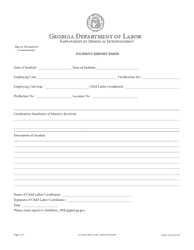

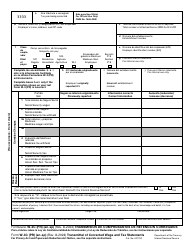

Form DOL-3C Report to Add New Wages and / or Correct Reported Wages - Georgia (United States)

What Is Form DOL-3C?

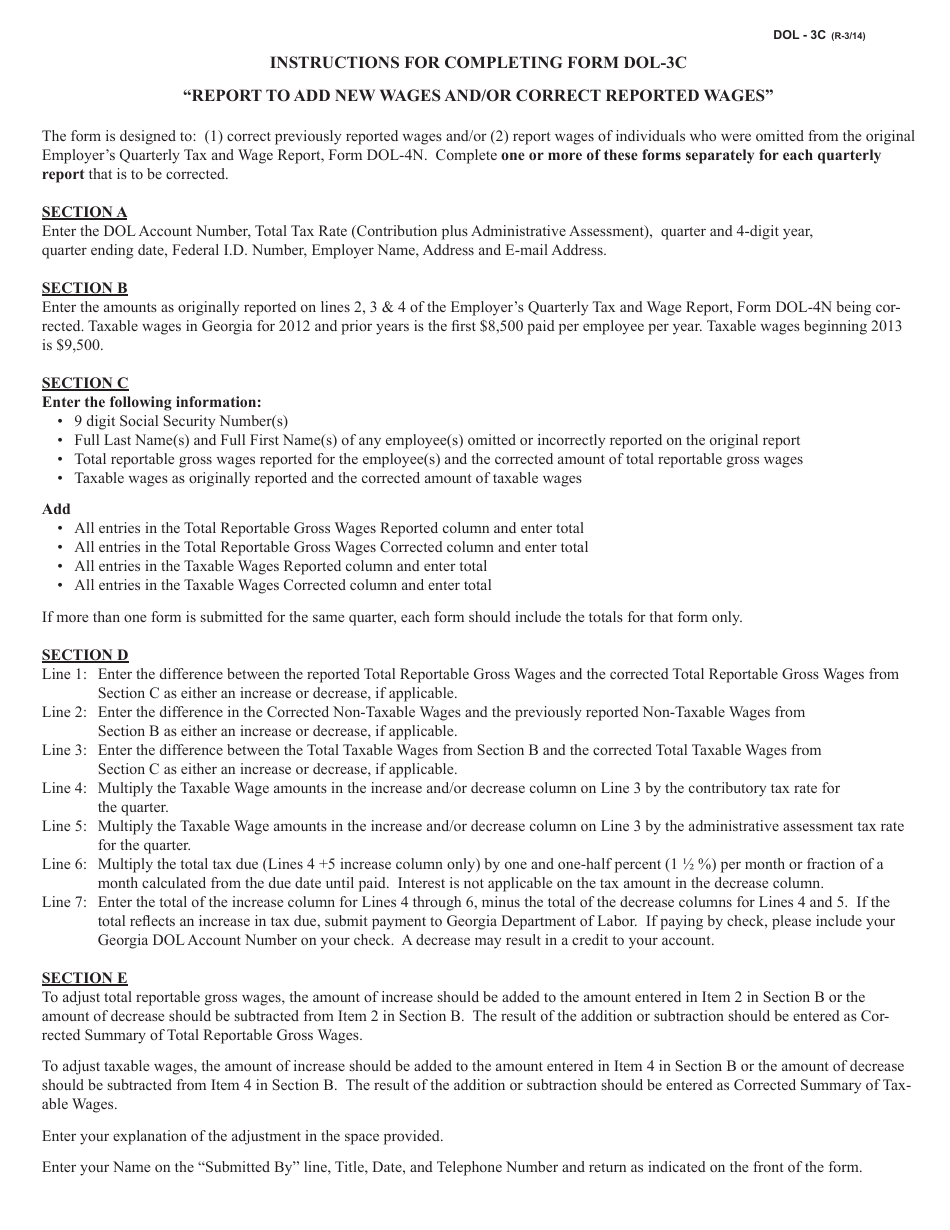

This is a legal form that was released by the Georgia Department of Labor - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

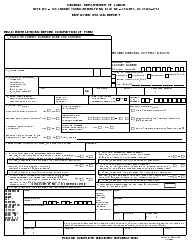

Q: What is the DOL-3C Report?

A: The DOL-3C Report is a form used in Georgia to add new wages and correct reported wages.

Q: Who uses the DOL-3C Report?

A: Employers in Georgia use the DOL-3C Report to add new wages and correct reported wages.

Q: When should I use the DOL-3C Report?

A: Use the DOL-3C Report when you need to add new wages or correct reported wages for your employees.

Q: Is the DOL-3C Report specific to Georgia?

A: Yes, the DOL-3C Report is specific to Georgia and is not used in other states.

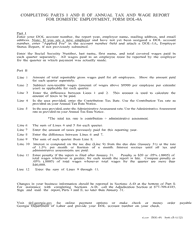

Q: What information do I need to complete the DOL-3C Report?

A: You will need information about the employee's wages, including the amount and the time period the wages were earned.

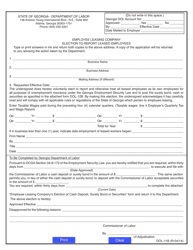

Q: Are there any deadlines for submitting the DOL-3C Report?

A: Yes, there are deadlines for submitting the DOL-3C Report. It is best to check with the Georgia Department of Labor for specific deadlines.

Q: Are there any fees associated with submitting the DOL-3C Report?

A: There are no fees associated with submitting the DOL-3C Report.

Q: What if I make an error on the DOL-3C Report?

A: If you make an error on the DOL-3C Report, you can submit a corrected report to fix the error.

Form Details:

- Released on September 1, 2014;

- The latest edition provided by the Georgia Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DOL-3C by clicking the link below or browse more documents and templates provided by the Georgia Department of Labor.