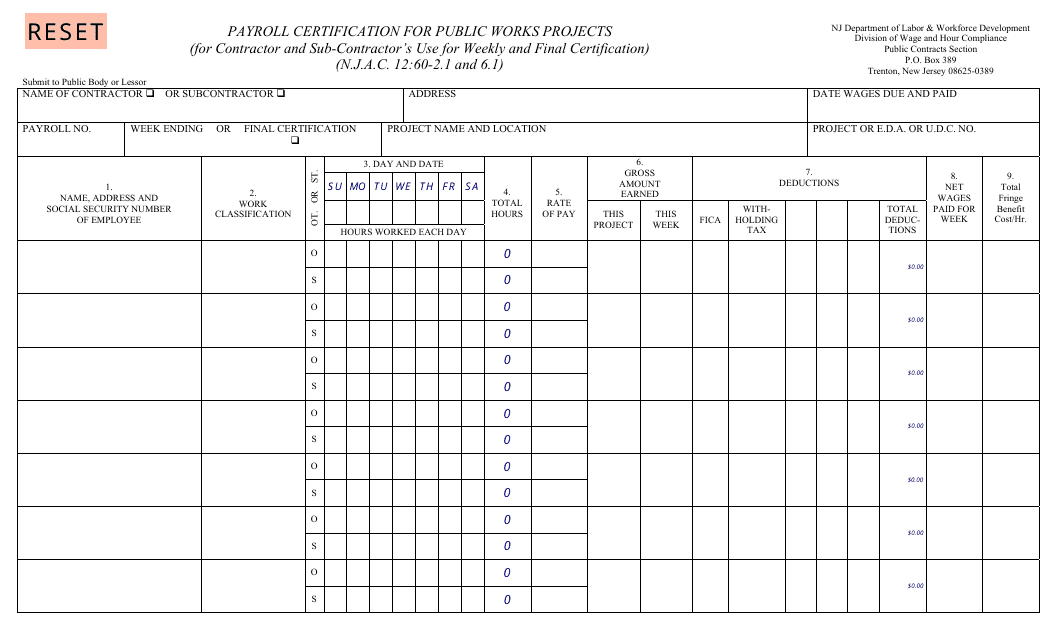

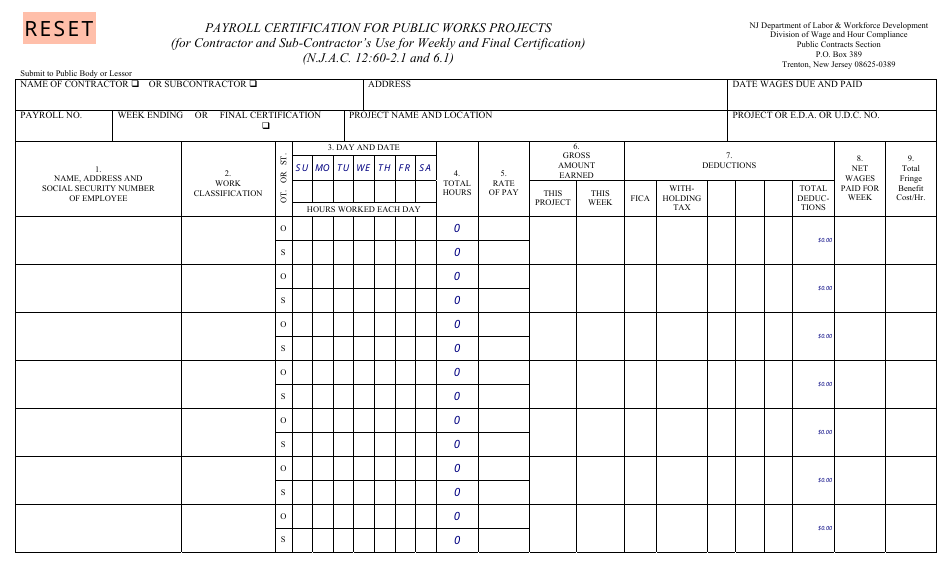

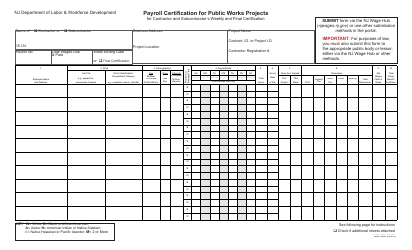

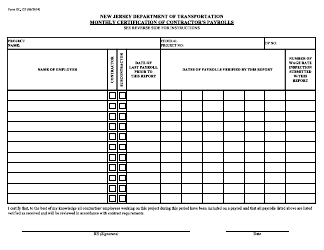

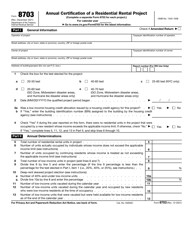

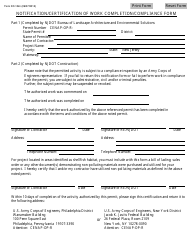

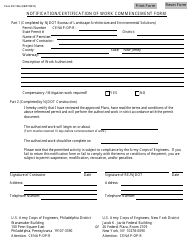

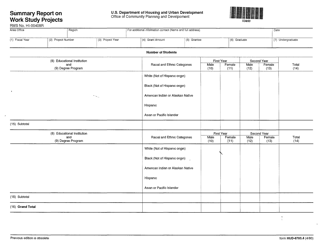

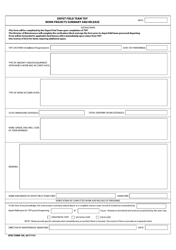

Payroll Certification for Public Works Projects - New Jersey

Payroll Certification for Public Works Projects is a legal document that was released by the New Jersey Department of Labor & Workforce Development - a government authority operating within New Jersey.

FAQ

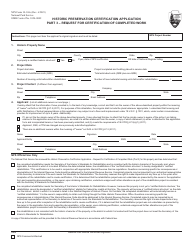

Q: What is payroll certification for public works projects in New Jersey?

A: Payroll certification is a requirement for contractors working on public works projects in New Jersey to ensure that workers are paid the prevailing wage rates.

Q: What is the prevailing wage?

A: The prevailing wage is the minimum wage rate that must be paid to workers on public works projects in New Jersey, determined by the New Jersey Department of Labor and Workforce Development.

Q: Who is required to submit payroll certifications?

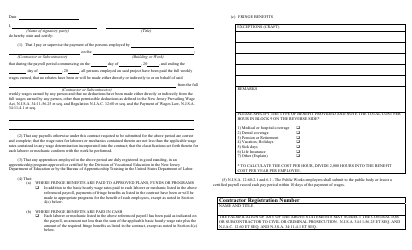

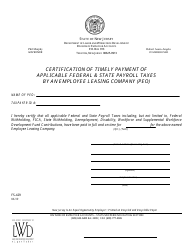

A: Contractors and subcontractors working on public works projects in New Jersey are required to submit payroll certifications to demonstrate that they are paying the prevailing wage.

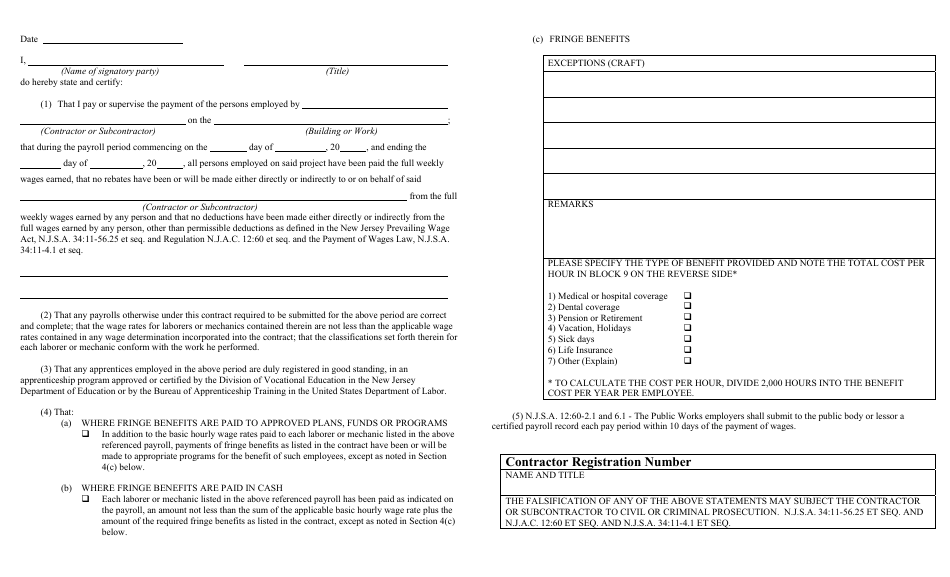

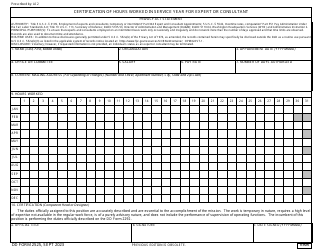

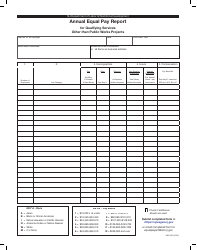

Q: What information is included in a payroll certification?

A: A payroll certification includes details such as the worker's name, hours worked, wage rate, deductions, and total wages paid.

Q: How often are payroll certifications submitted?

A: Payroll certifications are typically submitted on a weekly basis for each worker on the project.

Q: What happens if a contractor fails to submit payroll certifications?

A: Contractors who fail to submit payroll certifications or provide false information may face penalties, such as being disqualified from bidding on public works projects in the future.

Form Details:

- The latest edition currently provided by the New Jersey Department of Labor & Workforce Development;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of Labor & Workforce Development.