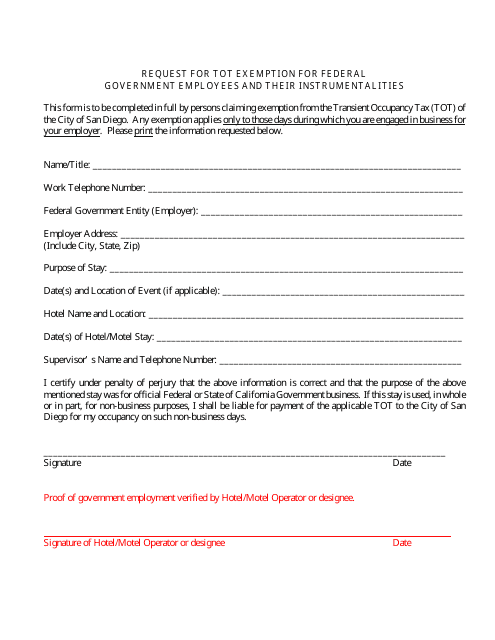

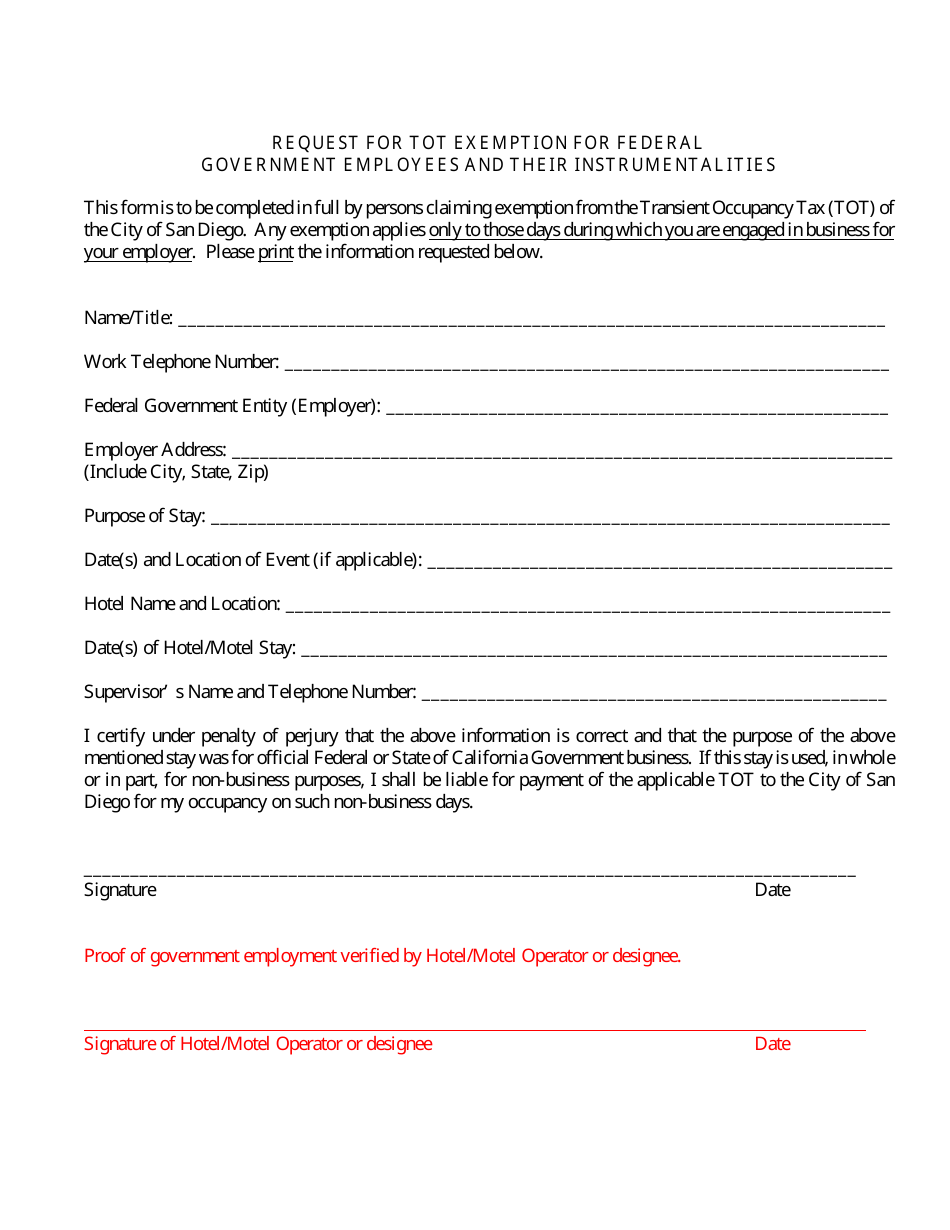

Request for Tot Exemption for Federal Government Employees and Their Instrumentalities - City of San Diego, California

Request for Tot Exemption for Federal Government Employees and Their Instrumentalities is a legal document that was released by the Office of the City Treasurer - City of San Diego, California - a government authority operating within California. The form may be used strictly within City of San Diego.

FAQ

Q: What is a Tot Exemption?

A: A Tot Exemption is a property tax exemption for equipment and improvements used by federal government employees and their instrumentalities.

Q: Who is eligible for a Tot Exemption in the City of San Diego, California?

A: Federal government employees and their instrumentalities are eligible for a Tot Exemption.

Q: What does the Tot Exemption cover?

A: The Tot Exemption covers property tax exemptions for equipment and improvements used by federal government employees and their instrumentalities.

Q: How can I apply for a Tot Exemption in the City of San Diego?

A: You can apply for a Tot Exemption by submitting a request to the City of San Diego's Assessor's Office.

Q: Is the Tot Exemption specific to federal government employees in San Diego?

A: Yes, the Tot Exemption is specific to federal government employees in the City of San Diego, California.

Q: Are there any fees associated with the Tot Exemption application?

A: No, there are no fees associated with the Tot Exemption application for federal government employees and their instrumentalities in San Diego.

Form Details:

- The latest edition currently provided by the Office of the City Treasurer - City of San Diego, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Office of the City Treasurer - City of San Diego, California.