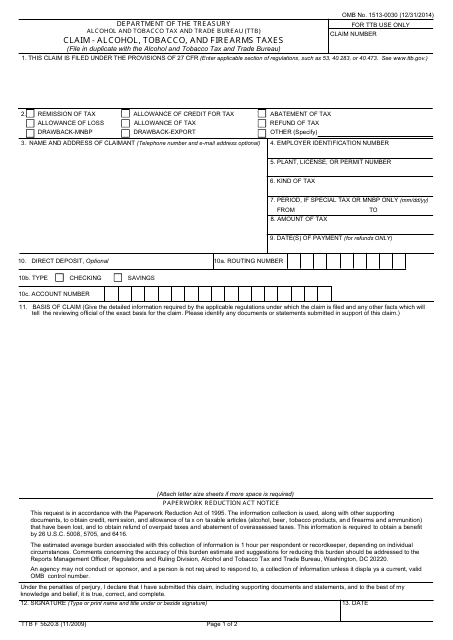

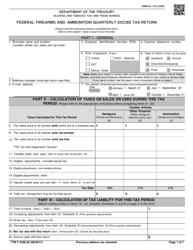

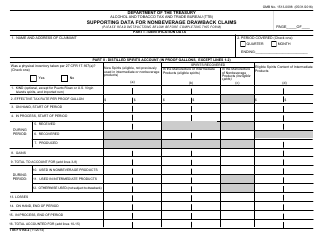

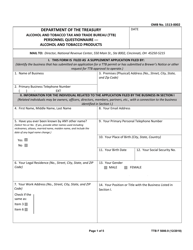

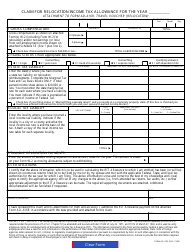

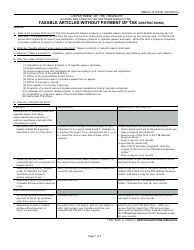

TTB Form 5620.8 Claim - Alcohol, Tobacco, and Firearms Taxes

What Is TTB Form 5620.8?

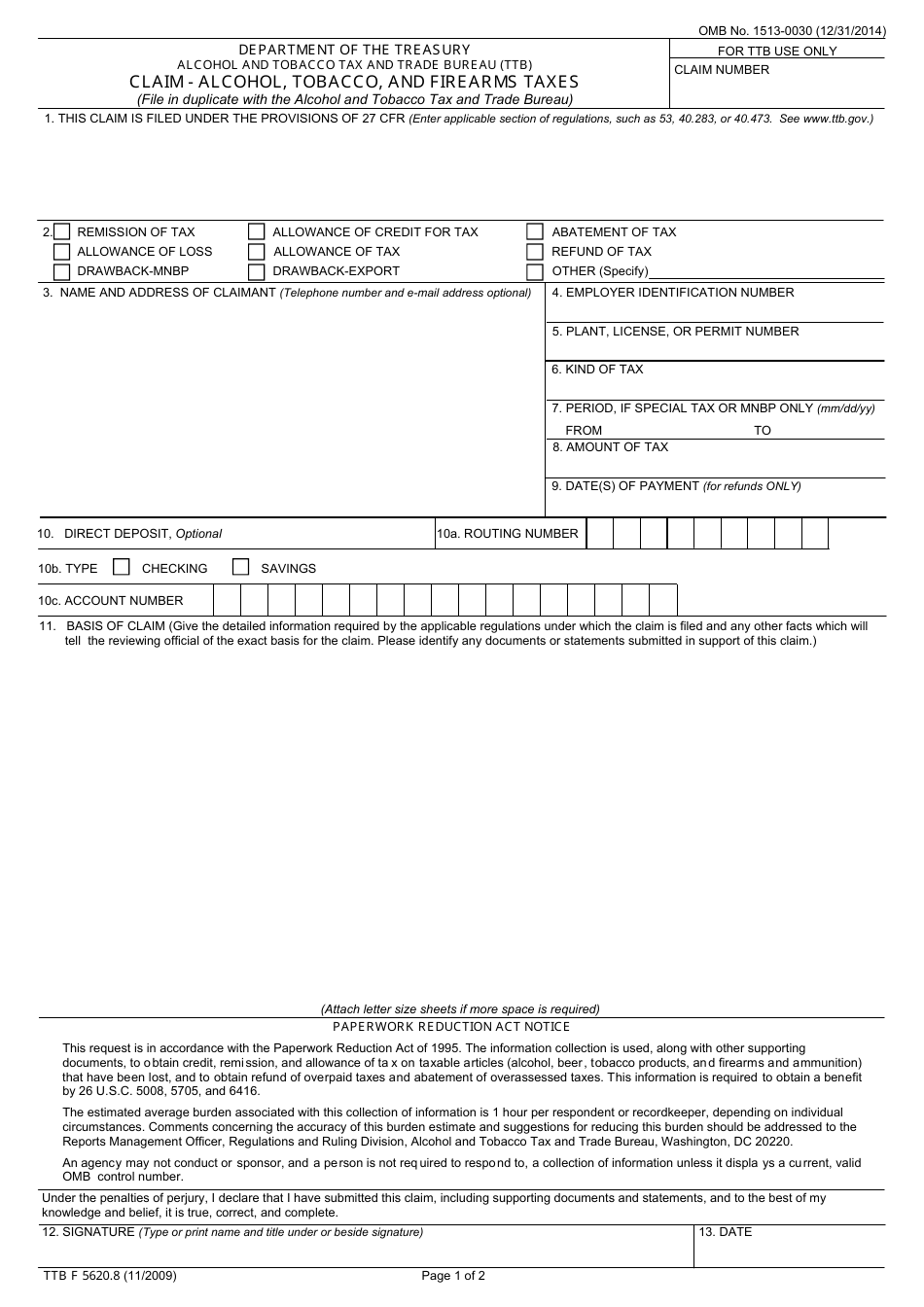

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on November 1, 2009 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5620.8?

A: TTB Form 5620.8 is a claim form used for alcohol, tobacco, and firearms taxes.

Q: What can I claim on TTB Form 5620.8?

A: You can claim refunds or adjustments for overpaid alcohol, tobacco, and firearms taxes.

Q: How do I submit TTB Form 5620.8?

A: You can submit TTB Form 5620.8 to the Alcohol and Tobacco Tax and Trade Bureau (TTB) by mail.

Q: Are there any fees or charges for filing TTB Form 5620.8?

A: No, there are no fees or charges for filing TTB Form 5620.8.

Q: Can I file TTB Form 5620.8 electronically?

A: No, currently TTB Form 5620.8 can only be filed by mail.

Q: How long does it take to process a TTB Form 5620.8 claim?

A: Processing times for TTB Form 5620.8 claims vary, but it can take several weeks or more.

Q: Can I track the status of my TTB Form 5620.8 claim?

A: Yes, you can track the status of your TTB Form 5620.8 claim by contacting the TTB.

Q: Are there any specific requirements or documentation needed for TTB Form 5620.8?

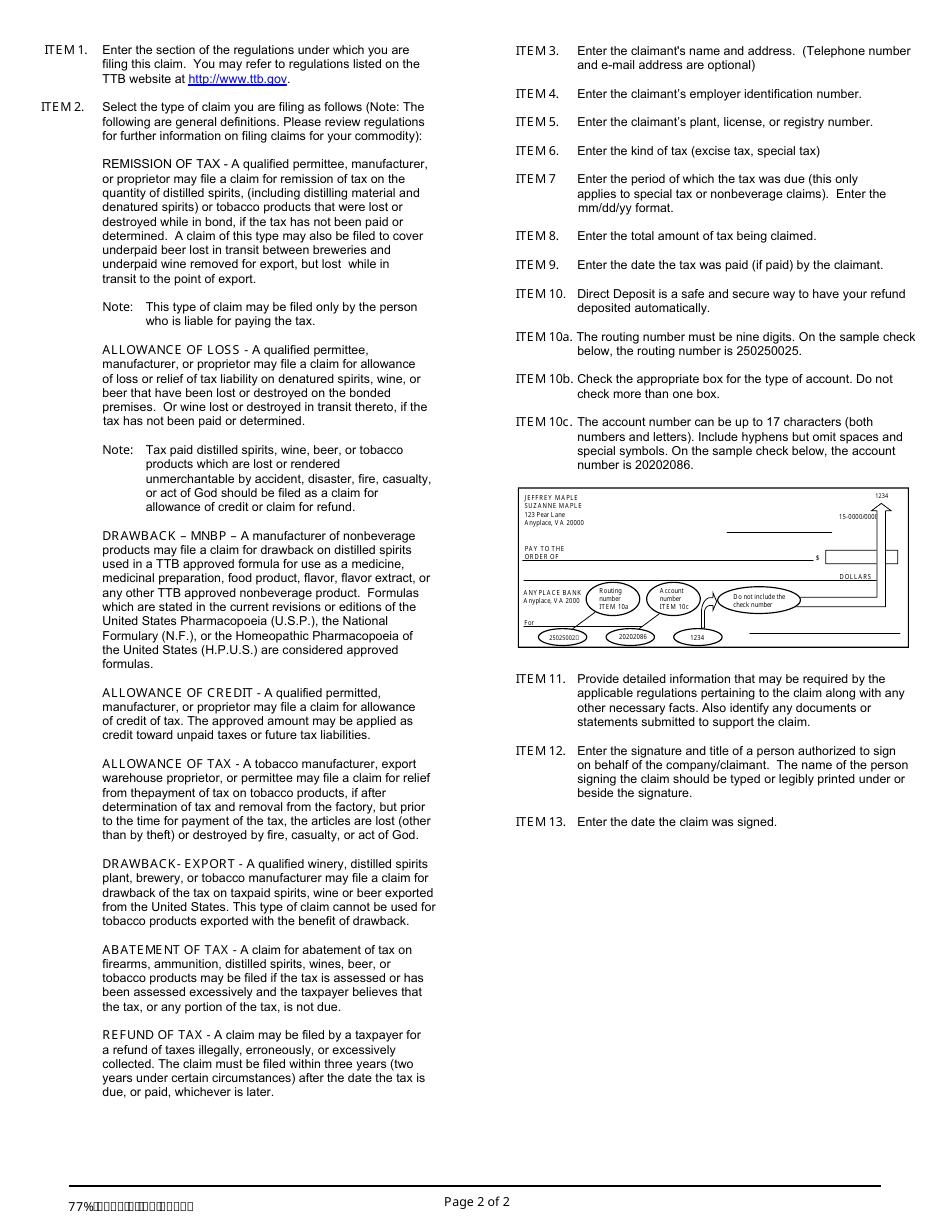

A: Yes, you will need to provide supporting documentation such as invoices, receipts, or other documentation to support your claim.

Q: Can I claim both alcohol and tobacco taxes on the same TTB Form 5620.8?

A: Yes, you can claim both alcohol and tobacco taxes on the same TTB Form 5620.8.

Form Details:

- Released on November 1, 2009;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5620.8 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.