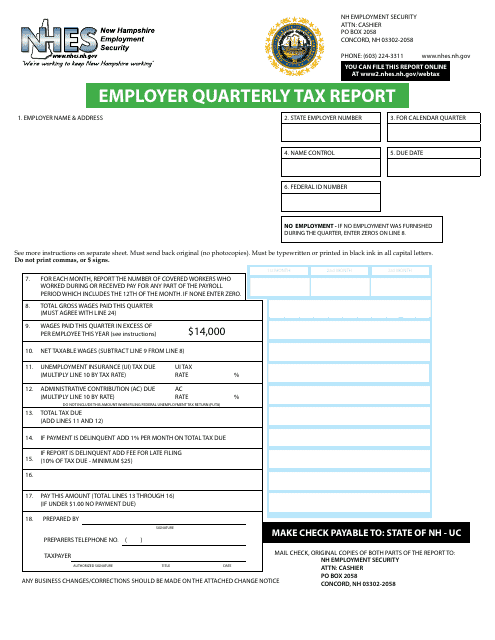

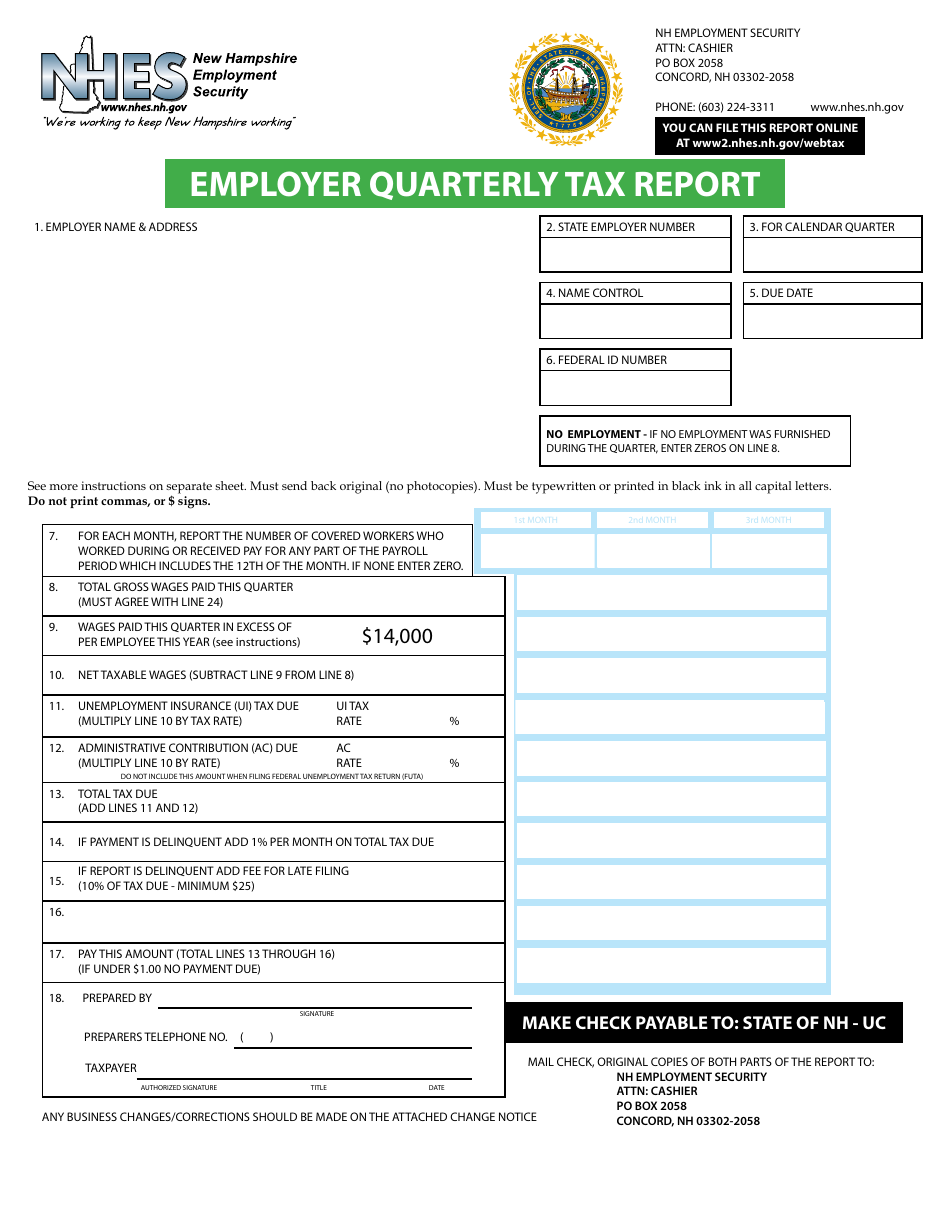

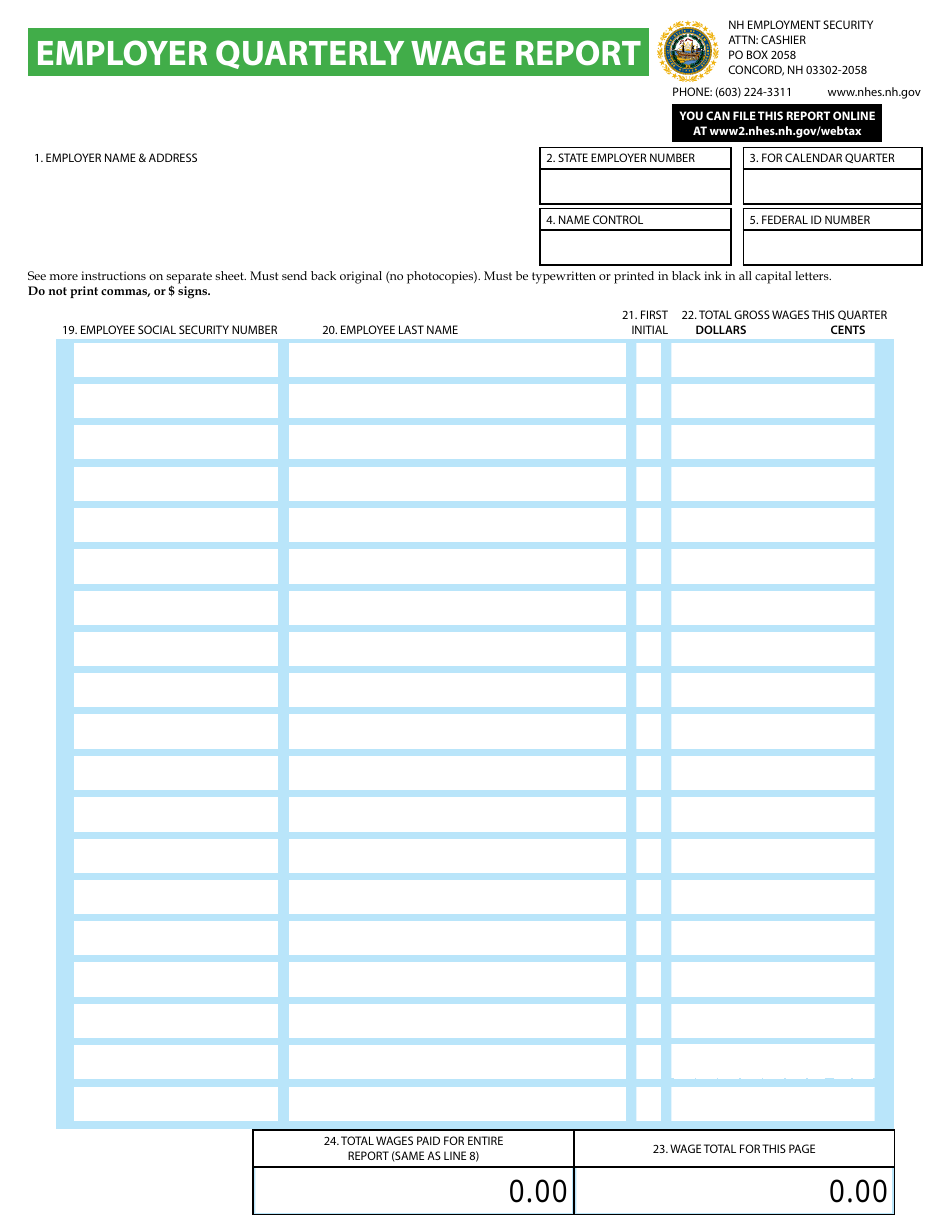

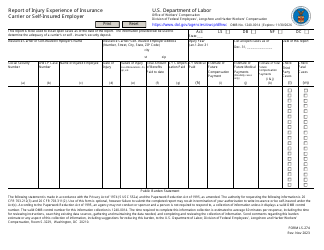

Employer Quarterly Tax Report - New Hampshire

Employer Quarterly Tax Report is a legal document that was released by the New Hampshire Employment Security - a government authority operating within New Hampshire.

FAQ

Q: Who needs to file an Employer Quarterly Tax Report in New Hampshire?

A: All employers who have employees subject to New Hampshire state income tax withholding are required to file an Employer Quarterly Tax Report.

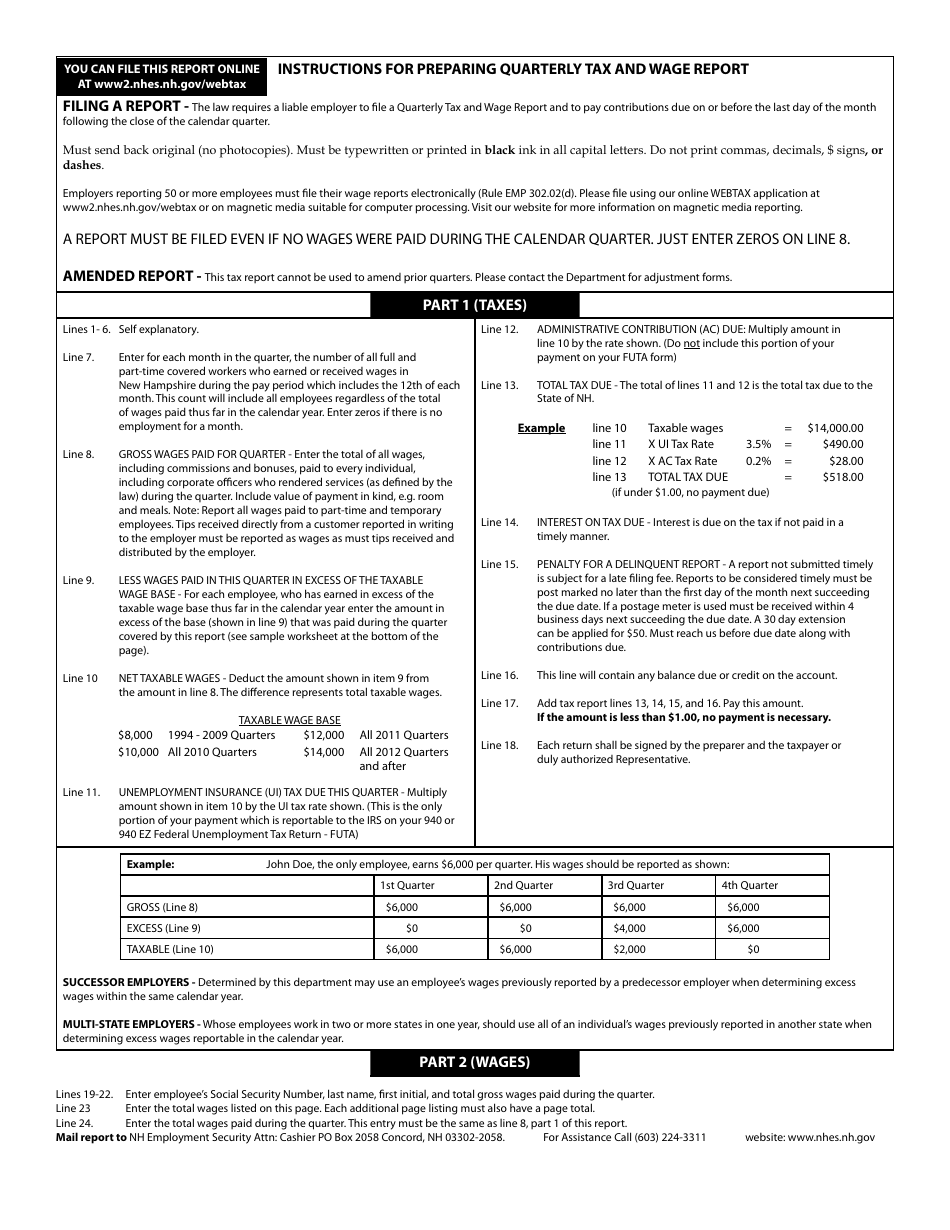

Q: What is the purpose of the Employer Quarterly Tax Report?

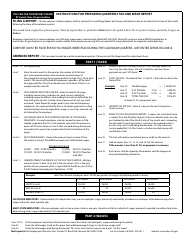

A: The Employer Quarterly Tax Report is used to report employee wages, state income tax withheld, and unemployment compensation paid by the employer.

Q: When is the due date for filing the Employer Quarterly Tax Report?

A: The Employer Quarterly Tax Report is due on the last day of the month following the end of the quarter.

Q: Are there any penalties for late filing or non-filing of the Employer Quarterly Tax Report?

A: Yes, there may be penalties for late filing or non-filing of the Employer Quarterly Tax Report, including interest charges and potential legal action.

Form Details:

- The latest edition currently provided by the New Hampshire Employment Security;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Hampshire Employment Security.