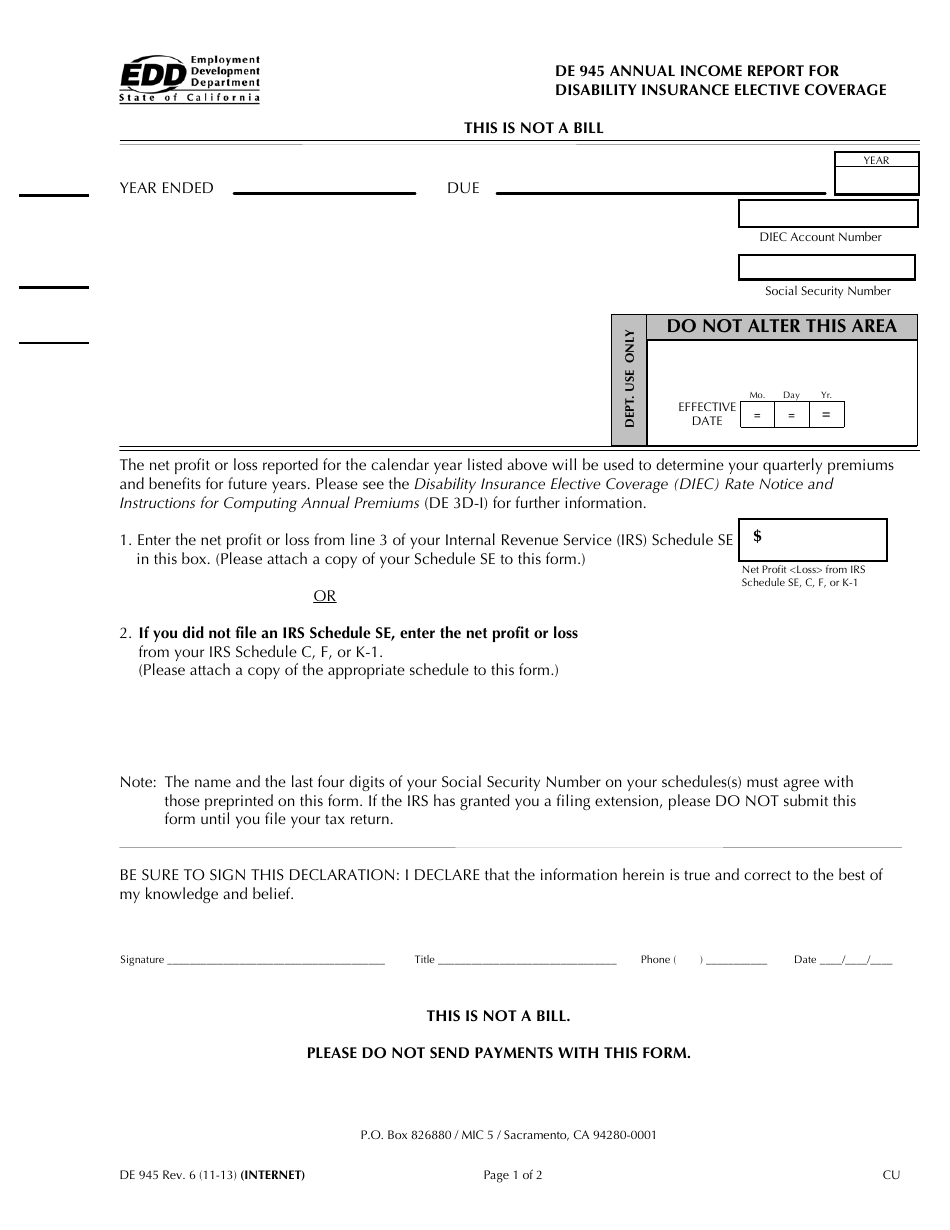

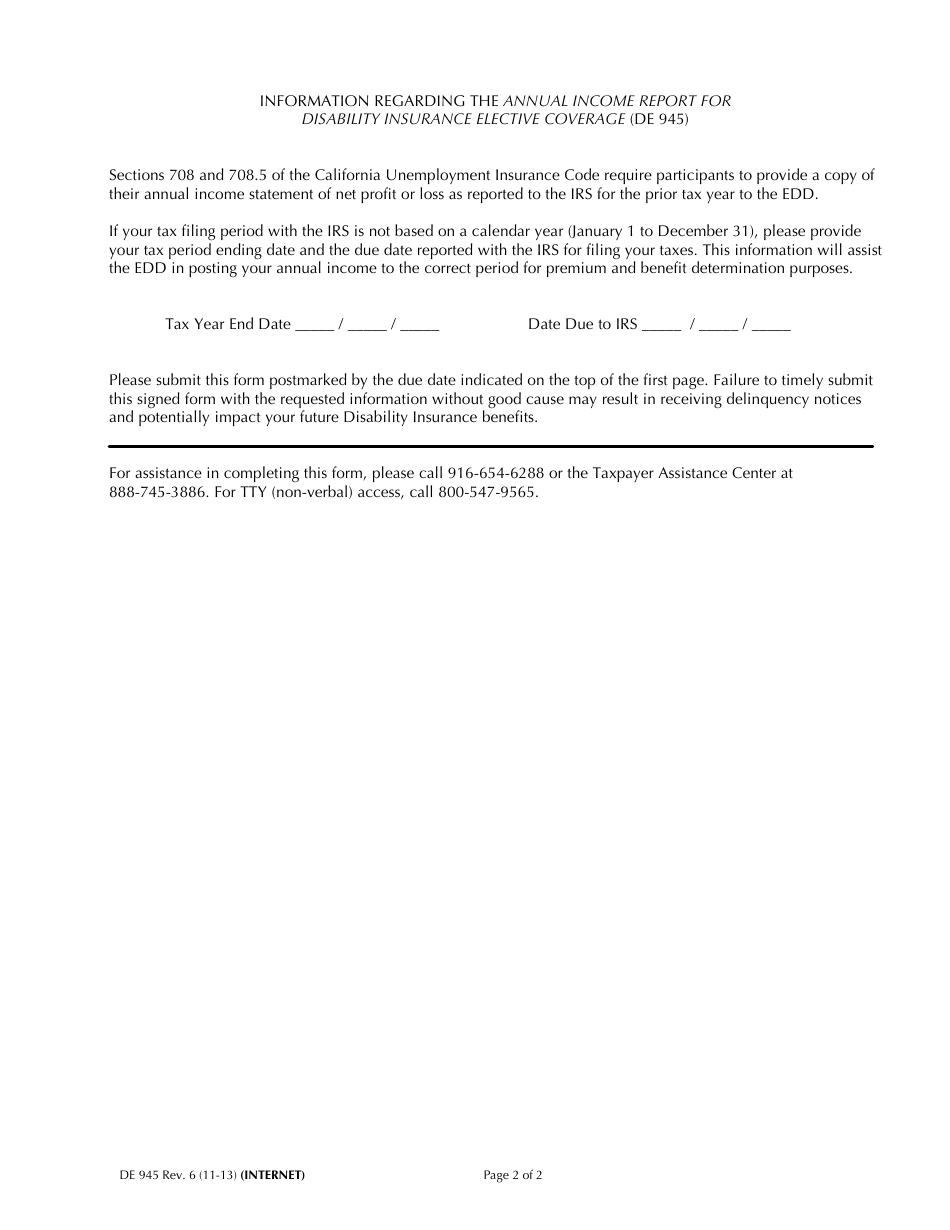

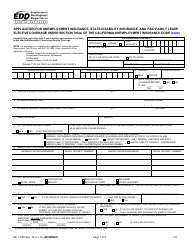

Form DE945 Annual Income Report for Disability Insurance Elective Coverage - California

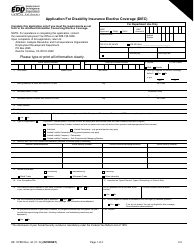

What Is Form DE945?

This is a legal form that was released by the California Employment Development Department - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

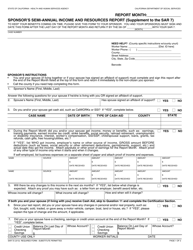

Q: What is a DE945 Annual Income Report?

A: The DE945 Annual Income Report is a form used in California to report annual income for Disability InsuranceElective Coverage.

Q: Who needs to file a DE945 report?

A: Employers in California who have Disability Insurance Elective Coverage need to file a DE945 Annual Income Report.

Q: When is the DE945 report due?

A: The DE945 Annual Income Report is due by April 30th of each year.

Q: What information is required in the DE945 report?

A: The DE945 report requires the employer to provide information about the covered employees, total wages paid, and other relevant information.

Form Details:

- Released on November 1, 2013;

- The latest edition provided by the California Employment Development Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DE945 by clicking the link below or browse more documents and templates provided by the California Employment Development Department.