This version of the form is not currently in use and is provided for reference only. Download this version of

DD Form 2652

for the current year.

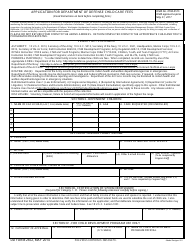

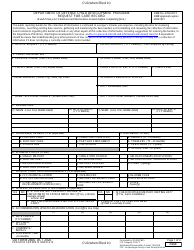

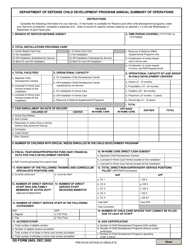

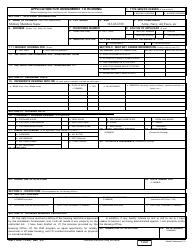

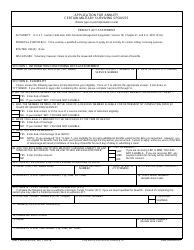

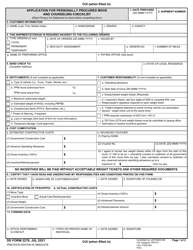

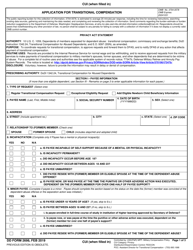

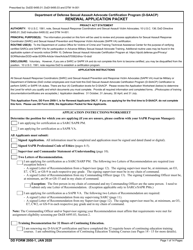

DD Form 2652 Application for Department of Defense Child Care Fees

What Is DD Form 2652?

DD Form 2652, Application for Department of Defense Child Care Fees, is a document used by Child Development Services (CDS) patrons to determine the appropriate childcare fees according to the total income of the family. A DD Form 2652 fillable version is available for digital filing and download below or can be obtained through the CDS.

The form - sometimes incorrectly referred to as the DA Form 2652 - was last released by the Department of Defense (DoD) on May 1, 2014 , with all previous editions obsolete.

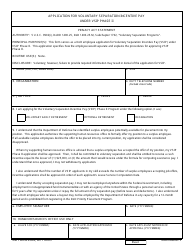

The CDS will ensure that all of the assistance required for completing the form is available to all parents. The information provided in the DD 2652 should be full and correct - a periodic audit from outside of the CDS may review the submitted data. Failure to provide necessary information may lead to having to pay the highest fee range.

How to Fill Out DD Form 2652?

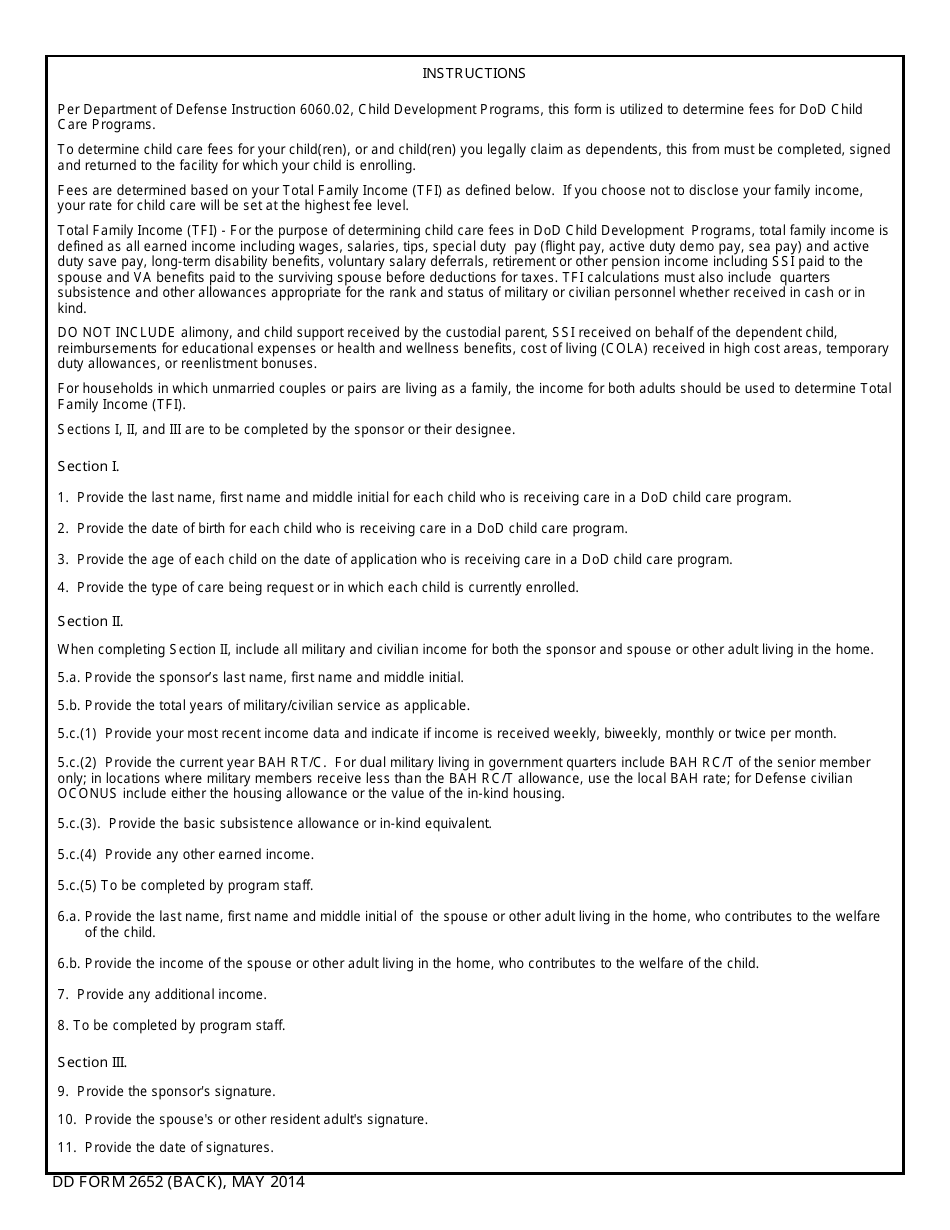

Procedural guidelines and additional information can be found in the Army Regulation 608-10 (Child Development Services) released in July 1997. DD Form 2652 instructions are as follows:

- The parents are required to complete only the first three sections of the form.

- Section I - Dependent Children - should contain the full names, dates of birth, and ages of all children receiving care under a DoD child care program in Columns 1, 2 and 3. Column 4 requires specifying the types of care being requested or already being received by each of the children.

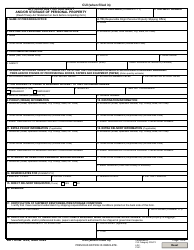

- Section II - Annual Family Income - requires the data on the annual income of a household. Boxes 5a and 5b require the sponsor's full name and the total number of years spent in military service. Box 5c is for providing data on the income of the sponsor.

- The information about the sponsor's spouse and other adults living in the same household is provided in Boxes 6a and 6b. Other earned income is disclosed in Box 7.

- Box 8 - Total Income - is filled in by the CDS staff. Total Family Income (TFI) should include all military and civilian income earned by both parents, including salaries, wages, tips, voluntarily salary deferrals, etc. Alimony or child support, variable housing allowance and cost of living allowances should not be included in TFI.

- Section III - Certification of Sponsor/Designee - requires the signatures of the sponsor and the spouse, as well as the date of filing form.

- Section IV is for Child Development Program use only.

The completed form requesting special child care fees should be returned to the CDS for an assignment of the applicable fee category.