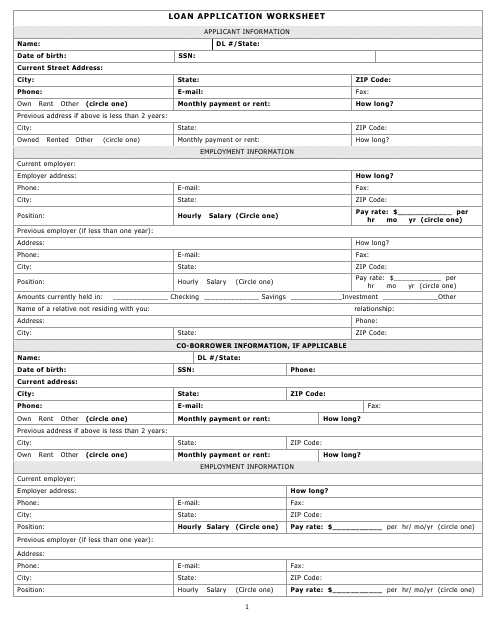

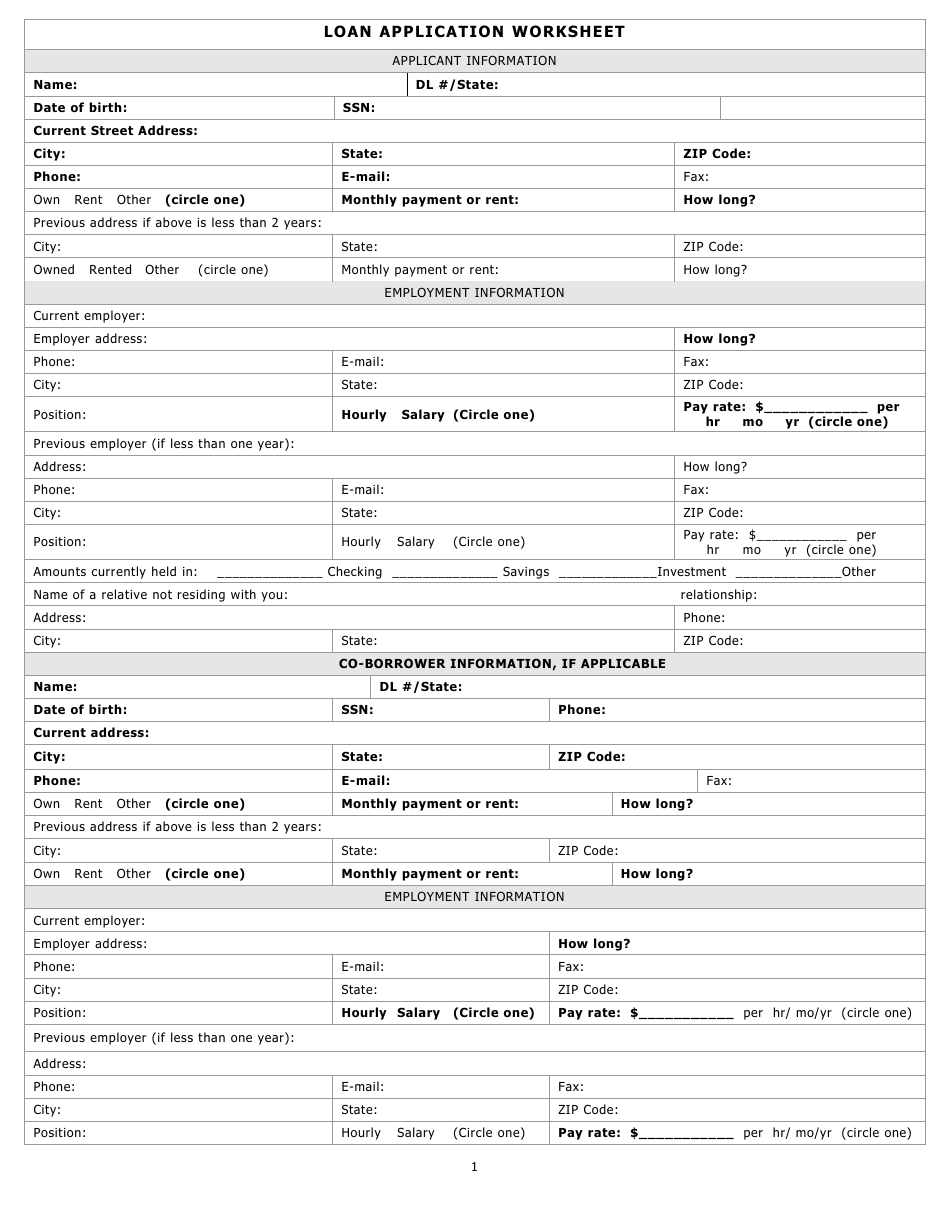

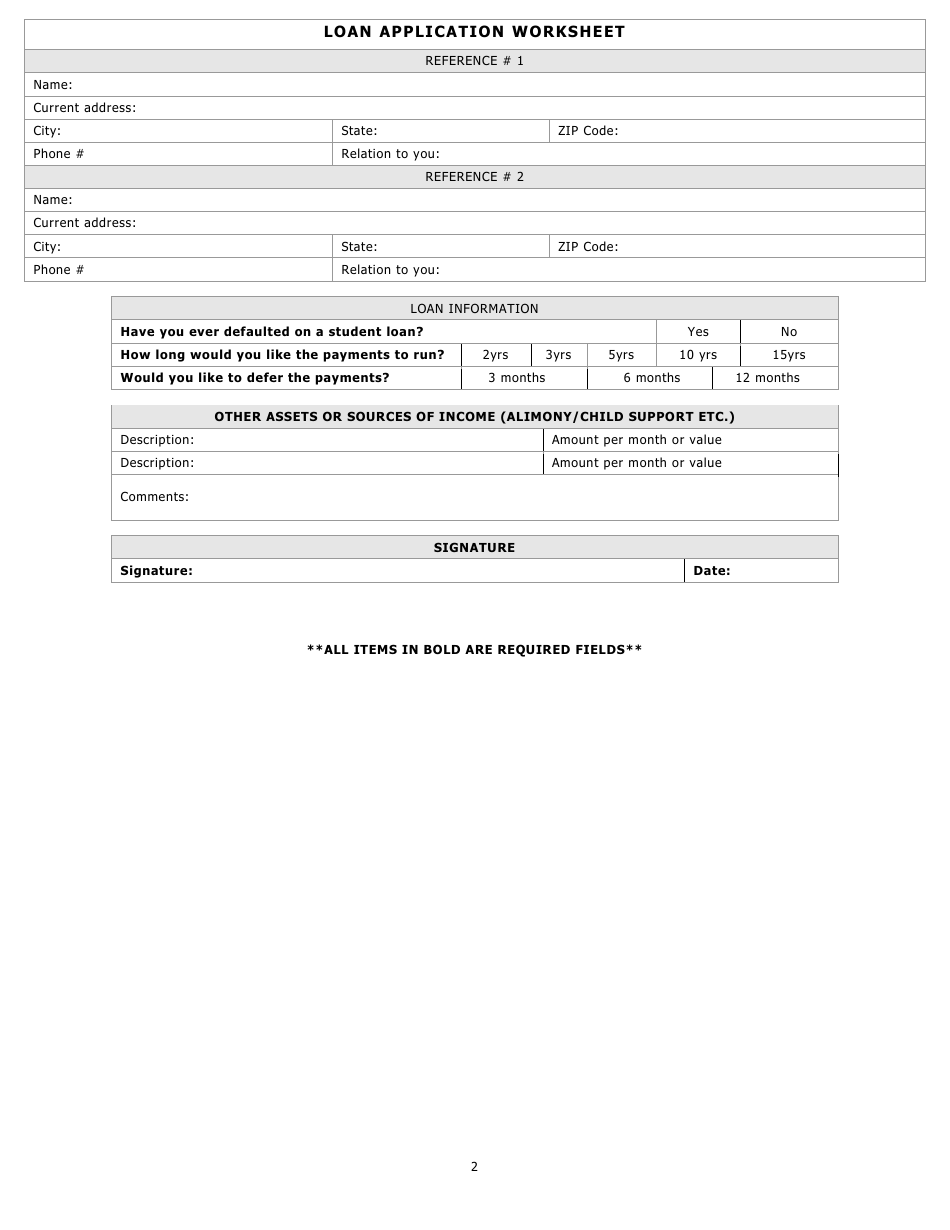

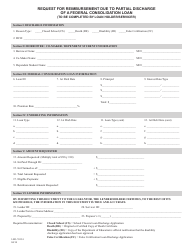

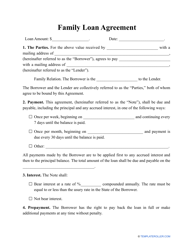

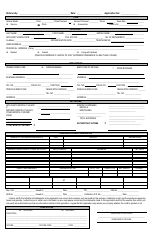

Loan Application Form

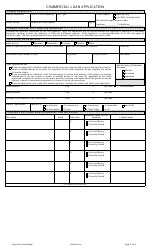

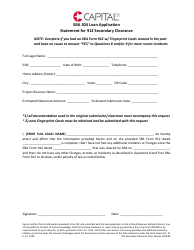

A Loan Application Form is used to apply for a loan from a financial institution, such as a bank. It provides the necessary information about the applicant's financial situation, employment, and other details that are required for the loan approval process.

The borrower typically files the loan application form.

FAQ

Q: What is a loan application form?

A: A loan application form is a document that individuals fill out to request a loan from a bank or lender.

Q: Why do I need to fill out a loan application form?

A: Lenders require a loan application form to gather information about your financial situation and determine whether you are eligible for a loan.

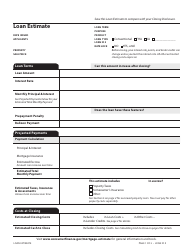

Q: What information do I need to provide on a loan application form?

A: You will typically need to provide personal information such as your name, address, and social security number, as well as details about your income, expenses, and employment.

Q: What happens after I submit a loan application form?

A: Once you submit a loan application form, the lender will review your information, assess your creditworthiness, and make a decision on whether to approve your loan.

Q: Is there a fee for submitting a loan application form?

A: Some lenders may charge an application fee, while others do not. It is important to check with the lender beforehand to understand their policies.

Q: How long does it take to get a decision on a loan application?

A: The time it takes to receive a decision on a loan application can vary depending on the lender. It may take anywhere from a few days to a few weeks.

Q: What should I do if my loan application is rejected?

A: If your loan application is rejected, you can try to improve your creditworthiness or consider alternative lenders. It is also important to understand the reasons for the rejection and learn from the experience.