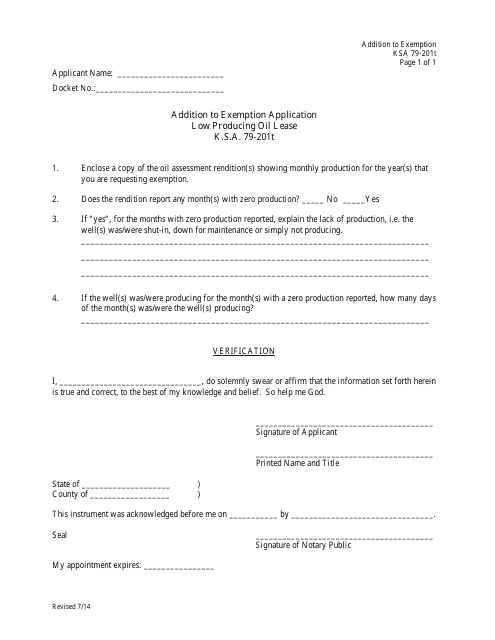

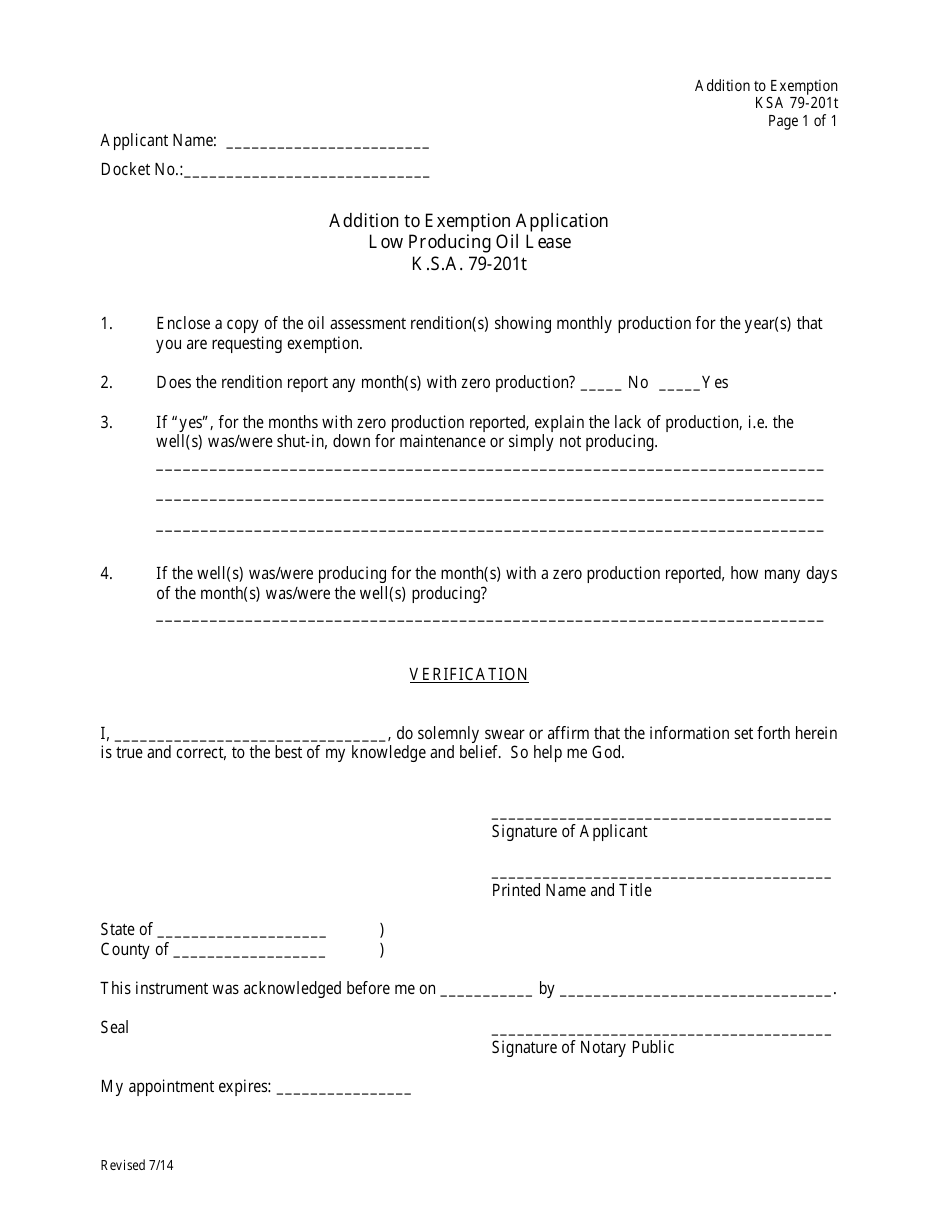

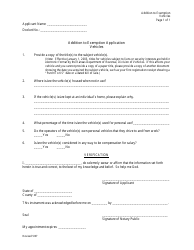

Addition to Exemption Application Low Producing Oil Lease - Kansas

Addition to Exemption Application Low Producing Oil Lease is a legal document that was released by the Kansas Board of Tax Appeals - a government authority operating within Kansas.

FAQ

Q: What is an Exemption Application for Low Producing Oil Lease in Kansas?

A: The Exemption Application for Low Producing Oil Lease in Kansas is a request for a tax exemption for oil leases that produce a low volume of oil.

Q: Who can apply for the Exemption Application for Low Producing Oil Lease in Kansas?

A: Oil lease operators in Kansas who have wells that produce a low volume of oil can apply for the exemption.

Q: What is considered a low producing oil lease in Kansas?

A: A low producing oil lease in Kansas is one that produces less than a certain amount of oil, as determined by the state regulations.

Q: What are the benefits of applying for the exemption?

A: The main benefit of applying for the exemption is the potential reduction or elimination of certain taxes and fees associated with the oil lease.

Q: How can I apply for the Exemption Application for Low Producing Oil Lease in Kansas?

A: You can apply for the exemption by completing the necessary application forms and submitting them to the appropriate state agency.

Q: Are there any specific requirements or criteria for eligibility?

A: Yes, there are specific criteria and requirements outlined by the state for eligibility. These may include production volume thresholds and other factors.

Q: Is there a deadline for submitting the Exemption Application?

A: Yes, there may be a deadline for submitting the application. It is important to review the guidelines and instructions provided by the state agency.

Q: What happens after I submit the Exemption Application?

A: After submitting the application, it will be reviewed by the state agency. They will determine if you meet the eligibility criteria and will notify you of the outcome.

Q: Can I appeal if my application is denied?

A: Yes, you may have the option to appeal the decision if your application is denied. This process will be outlined by the state agency.

Form Details:

- Released on July 1, 2014;

- The latest edition currently provided by the Kansas Board of Tax Appeals;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Kansas Board of Tax Appeals.