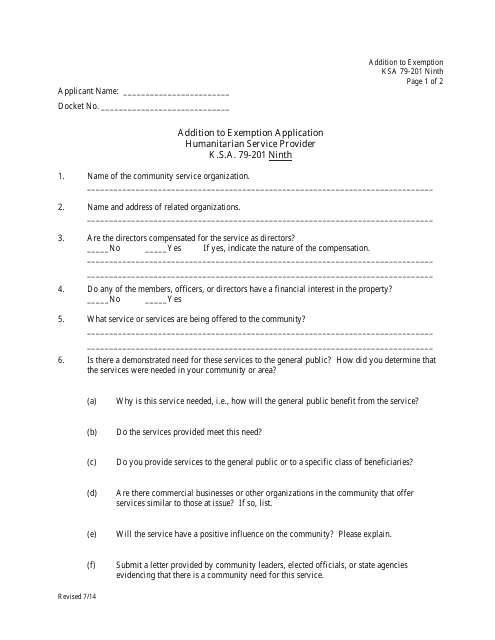

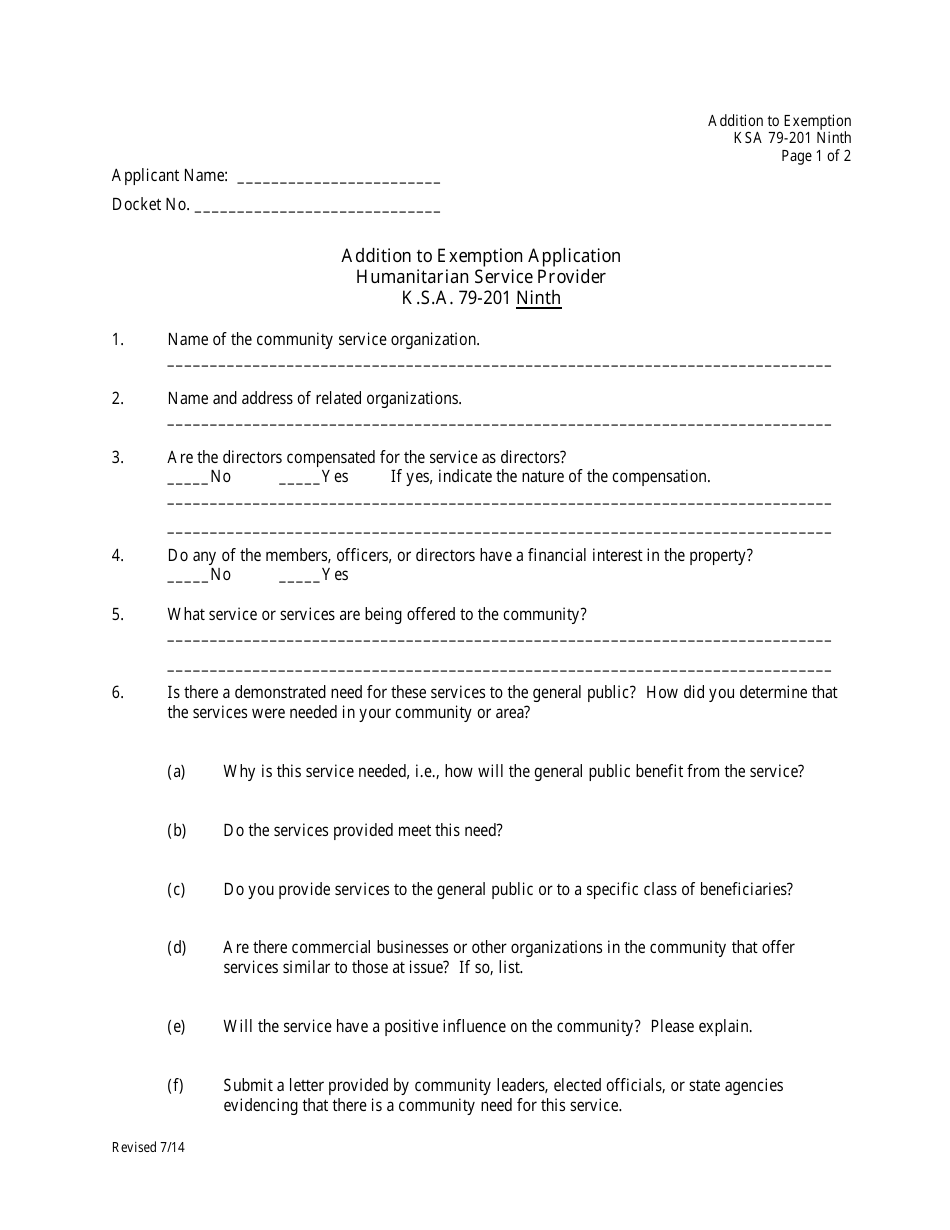

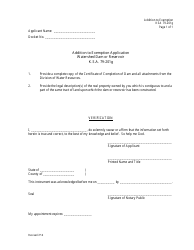

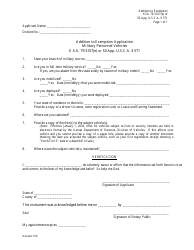

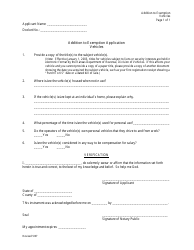

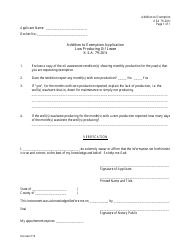

Addition to Exemption Application - Humanitarian Service Provider K.s.a. 79-201 Ninth - Kansas

Addition to Exemption Application - Humanitarian Service Provider K.s.a. 79-201 Ninth is a legal document that was released by the Kansas Board of Tax Appeals - a government authority operating within Kansas.

FAQ

Q: What is the Exemption Application - Humanitarian Service Provider K.s.a. 79-201 Ninth?

A: The Exemption Application - Humanitarian Service Provider K.s.a. 79-201 Ninth is a specific exemption application in Kansas.

Q: What is the purpose of this exemption application?

A: The purpose of this exemption application is to provide a tax exemption for certain humanitarian service providers in Kansas.

Q: Who is eligible to apply for this exemption?

A: Certain humanitarian service providers in Kansas are eligible to apply for this exemption.

Q: What is K.s.a. 79-201 Ninth?

A: K.s.a. 79-201 Ninth is a specific section of the Kansas Statutes Annotated that provides the legal basis for this exemption application.

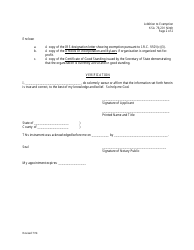

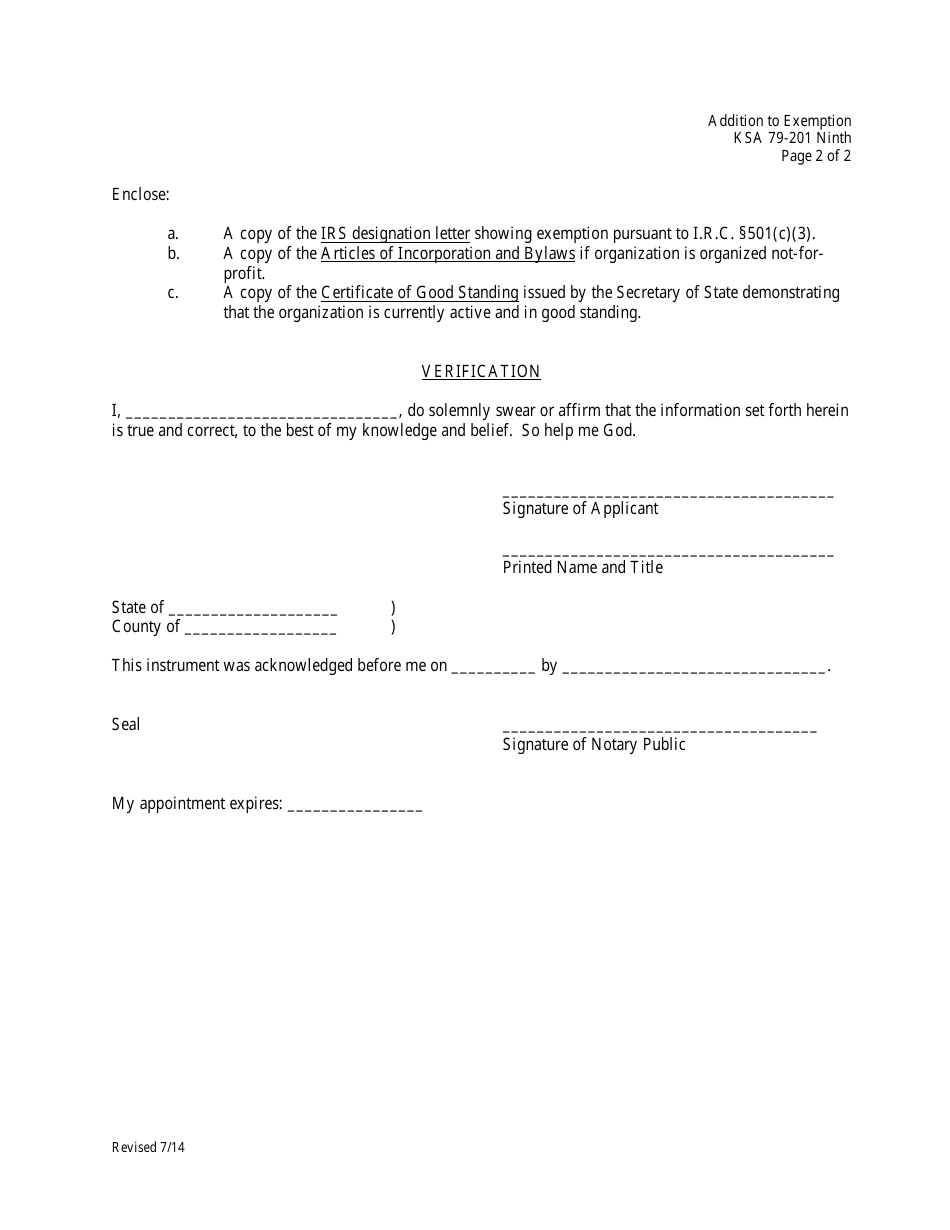

Q: What information is required for the addition to the exemption application?

A: The specific information required for the addition to the exemption application may vary, but generally, it will require detailed information about the organization and its humanitarian services.

Q: Are there any fees associated with this exemption application?

A: The fees associated with this exemption application may vary. It is advisable to check with the relevant tax authority in Kansas for the current fee structure.

Q: Are all humanitarian service providers eligible for this exemption?

A: No, not all humanitarian service providers are eligible for this exemption. Eligibility criteria and requirements may apply.

Q: How long does it take to process the addition to the exemption application?

A: The processing time for the addition to the exemption application may vary. It is advisable to check with the relevant tax authority in Kansas for the current processing times.

Q: What are the potential benefits of obtaining this exemption?

A: Obtaining this exemption can provide tax benefits for eligible humanitarian service providers, allowing them to focus more resources on their charitable activities.

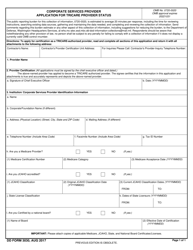

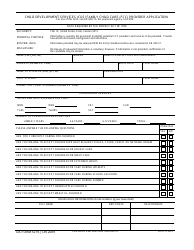

Form Details:

- Released on July 1, 2014;

- The latest edition currently provided by the Kansas Board of Tax Appeals;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Kansas Board of Tax Appeals.