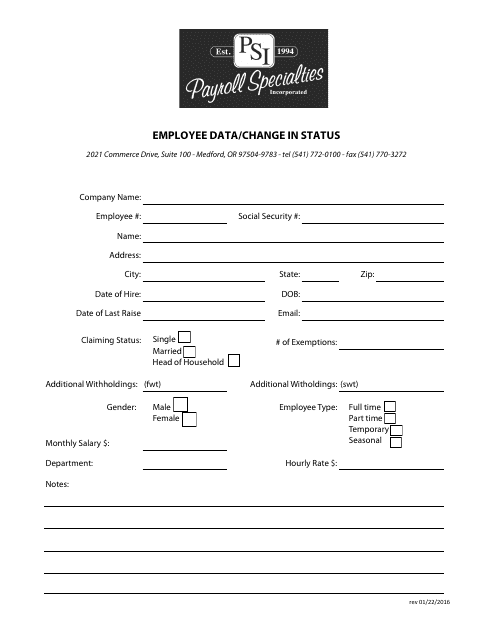

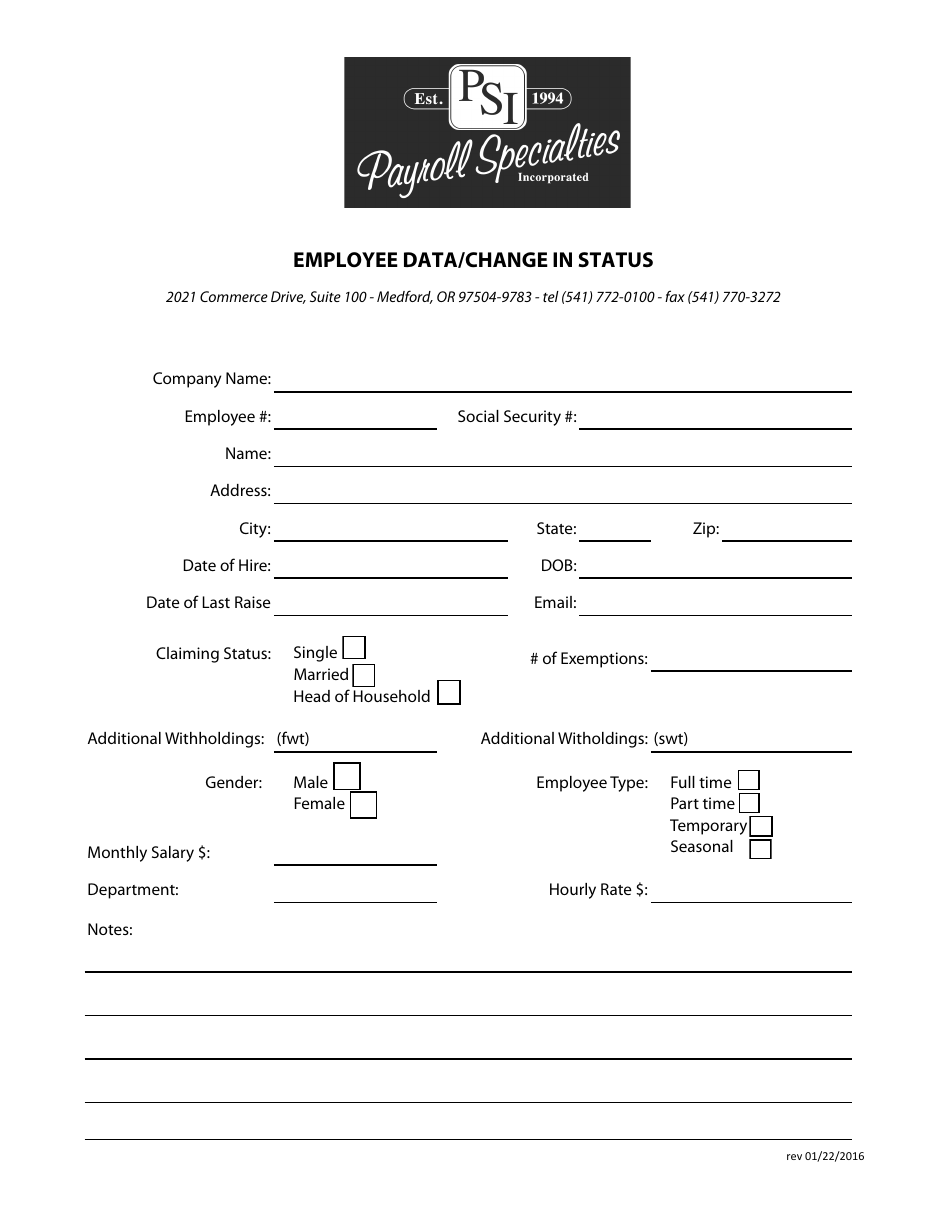

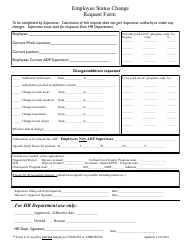

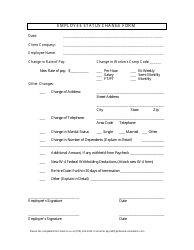

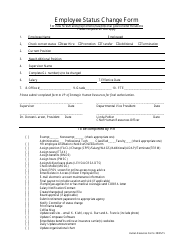

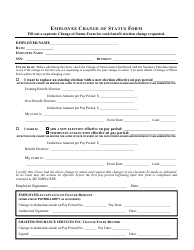

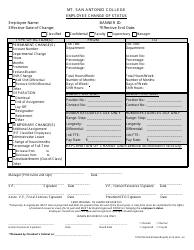

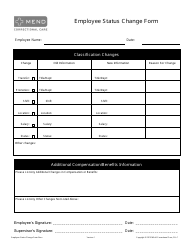

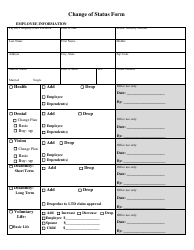

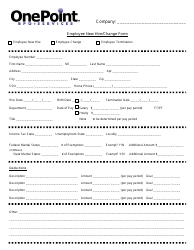

Employee Data / Change in Status Form - Payroll Specialities

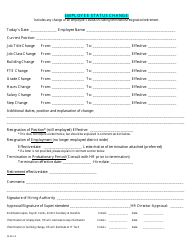

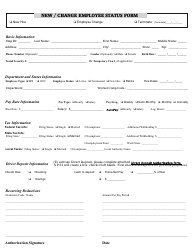

The Employee Data/Change in Status Form - Payroll Specialties is used to update and maintain accurate employee information within the payroll system. It allows employers to record changes in an employee's status, such as changes in name, address, tax withholding status, and employment details. This form ensures that payroll records are up to date and enables employers to process accurate employee paychecks and tax withholding.

The Employee Data/Change in Status Form - Payroll Specialities is usually filed by the employer or the HR department.

FAQ

Q: What is an Employee Data/Change in Status Form?

A: An Employee Data/Change in Status Form is a form used to update or change an employee's information in the payroll system.

Q: What information can be updated or changed using this form?

A: This form can be used to update or change an employee's personal information, such as name, address, contact details, tax withholding information, and banking details for direct deposit.

Q: Is this form mandatory?

A: The requirement to use this form may vary depending on the employer's policies and procedures. It is best to check with your HR or payroll department for specific instructions.

Q: What should I do once I have completed the form?

A: Once you have completed the form, submit it to your HR or payroll department as instructed. They will process the changes and update the employee's information in the payroll system.

Q: How long does it take for changes to take effect?

A: The processing time for changes may vary depending on the employer's policies and procedures. It is best to check with your HR or payroll department for an estimate.

Q: Can I make multiple changes on one form?

A: Yes, you can make multiple changes on one Employee Data/Change in Status Form. Just make sure to provide accurate and complete information for each change you are requesting.

Q: Can I make changes to my payroll information myself?

A: This may depend on the employer's policies and procedures. Some employers may allow employees to update certain information themselves through a self-service portal or system.

Q: What should I do if I made a mistake on the form?

A: If you made a mistake on the form, notify your HR or payroll department as soon as possible. They will guide you on how to correct the mistake.

Q: Is there a deadline for submitting this form?

A: The deadline for submitting this form may vary depending on the employer's policies and procedures. It is best to check with your HR or payroll department for specific deadlines.