This version of the form is not currently in use and is provided for reference only. Download this version of

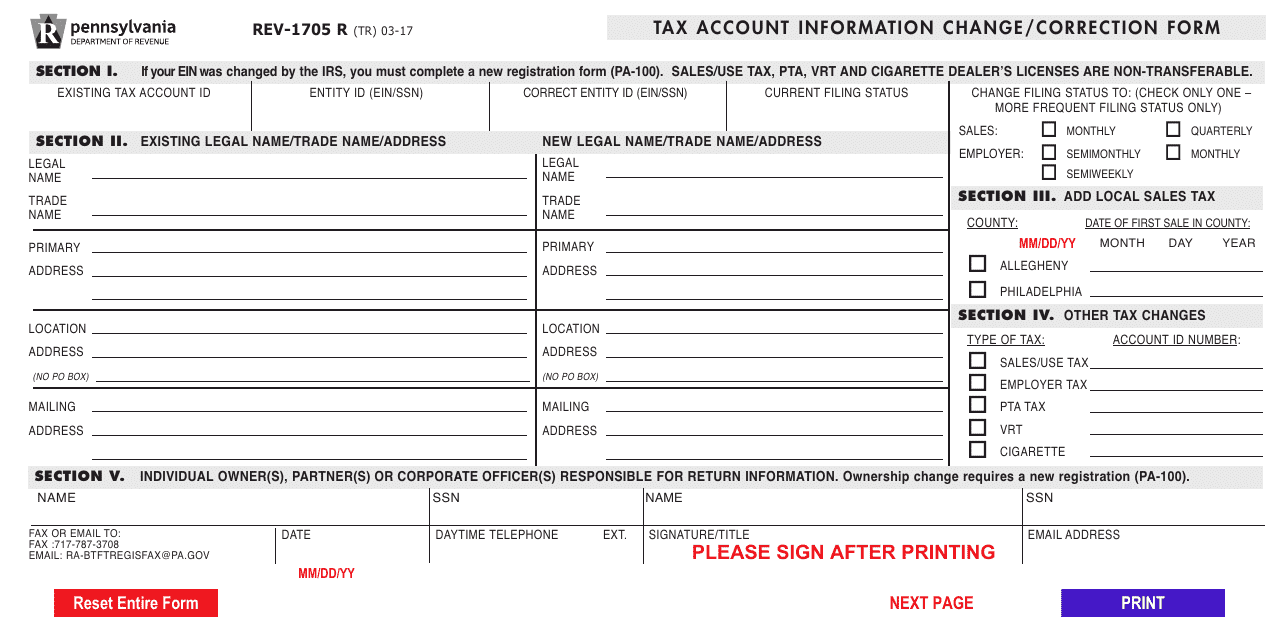

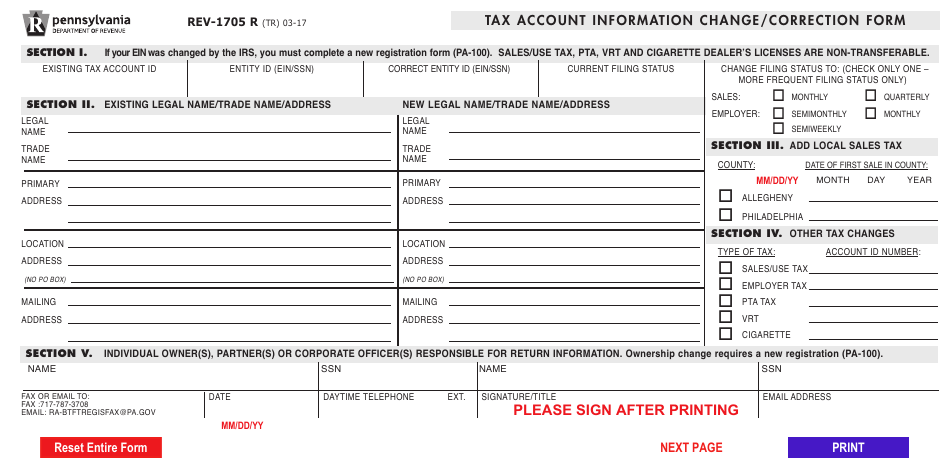

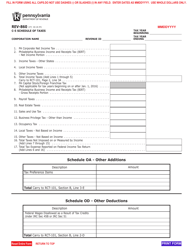

Form REV-1705R

for the current year.

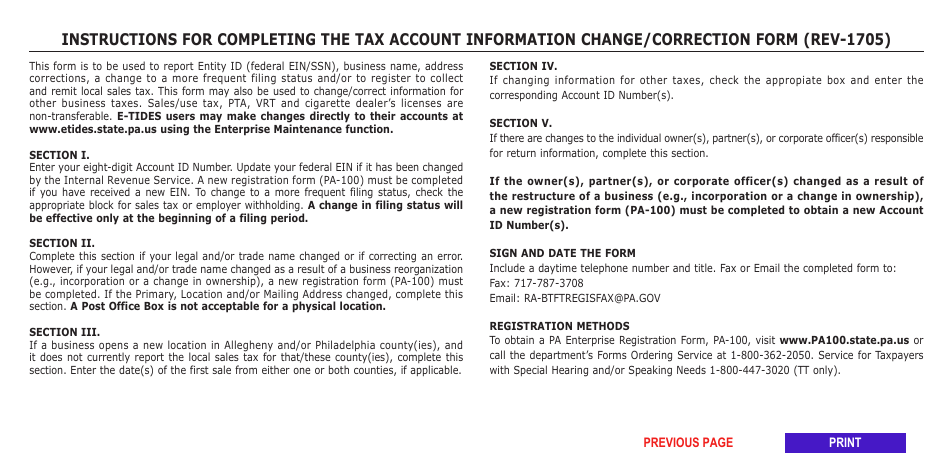

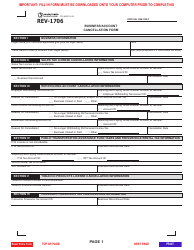

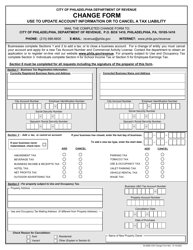

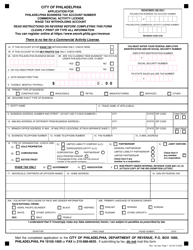

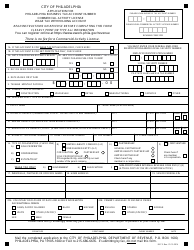

Form REV-1705R Tax Account Information Change / Correction Form - Pennsylvania

What Is Form REV-1705R?

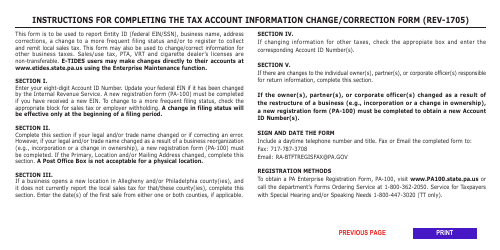

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the REV-1705R form?

A: The REV-1705R form is the Tax Account Information Change/Correction Form used in Pennsylvania.

Q: What is the purpose of the REV-1705R form?

A: The REV-1705R form is used to update or correct tax account information in Pennsylvania.

Q: Who should use the REV-1705R form?

A: The REV-1705R form should be used by individuals or businesses who need to make changes or correct information on their tax account in Pennsylvania.

Q: What information can be changed or corrected using the REV-1705R form?

A: The REV-1705R form allows for changes or corrections to be made to taxpayer name, address, account number, filing status, and other pertinent tax information.

Q: Are there any fees associated with filing the REV-1705R form?

A: No, there are no fees associated with filing the REV-1705R form.

Q: When should the REV-1705R form be filed?

A: The REV-1705R form should be filed as soon as possible when there are changes or corrections needed on your tax account in Pennsylvania.

Q: Is there a deadline for filing the REV-1705R form?

A: There is no specific deadline for filing the REV-1705R form, but it is recommended to submit it promptly to ensure accurate tax account information.

Q: What should I do after submitting the REV-1705R form?

A: After submitting the REV-1705R form, you should keep a copy of the completed form for your records and follow any additional instructions provided by the Pennsylvania Department of Revenue.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1705R by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.