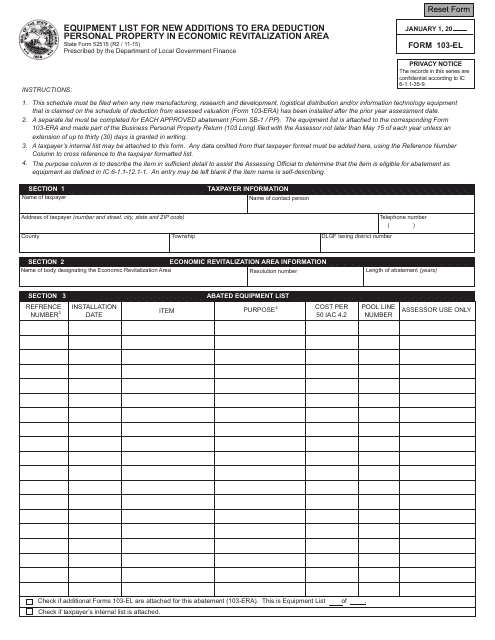

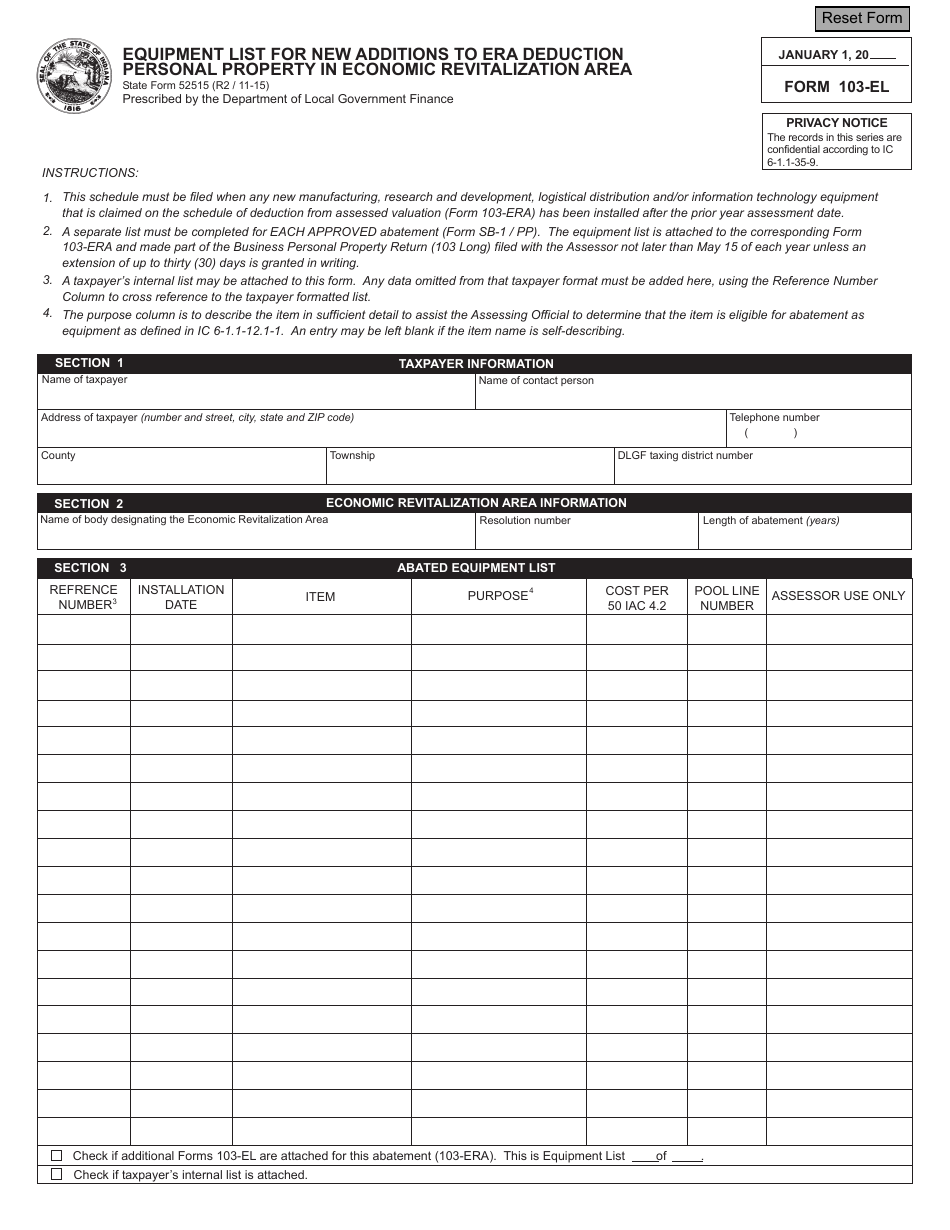

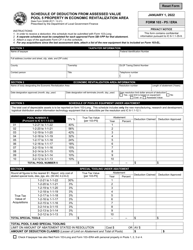

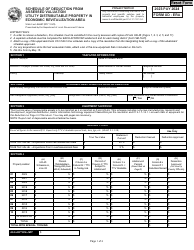

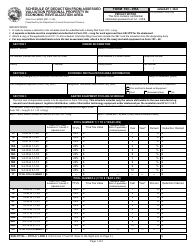

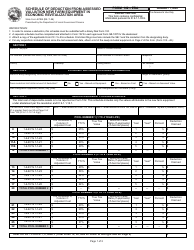

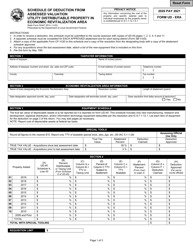

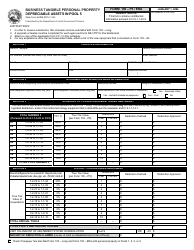

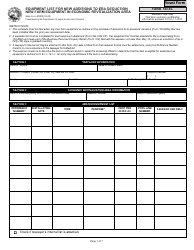

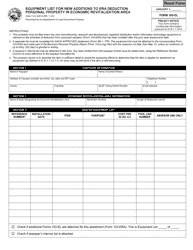

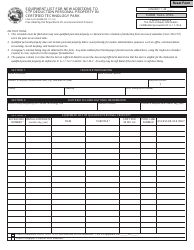

Form 103-EL (State Form 52515) Equipment List for New Additions to Era Deduction Personal Property in Economic Revitalization Area - Indiana

What Is Form 103-EL (State Form 52515)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 103-EL?

A: Form 103-EL is a document used in Indiana to list new additions to Era Deduction Personal Property in Economic Revitalization Areas.

Q: What is the purpose of Form 103-EL?

A: The purpose of Form 103-EL is to provide a detailed equipment list for new additions to personal property that qualifies for the Era Deduction in an Economic Revitalization Area.

Q: Who needs to fill out Form 103-EL?

A: Form 103-EL needs to be filled out by individuals or businesses that have made new additions to Era Deduction Personal Property in an Economic Revitalization Area in Indiana.

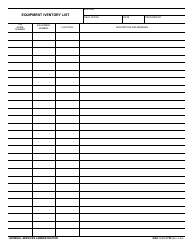

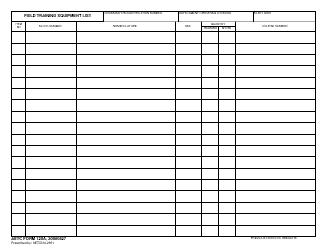

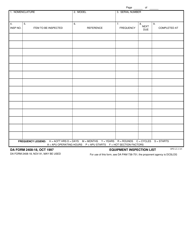

Q: What information is required on Form 103-EL?

A: Form 103-EL requires you to provide detailed information about the new additions to personal property, including their description, year placed in service, and cost.

Q: Are there any deadlines for submitting Form 103-EL?

A: Yes, Form 103-EL must be submitted to the county auditor within 30 days after the additions are placed in service.

Q: Is there a fee associated with filing Form 103-EL?

A: No, there is no fee for filing Form 103-EL.

Q: Can I make changes to my Form 103-EL after it has been submitted?

A: Yes, you can make changes to your Form 103-EL by filing an amended Form 103-EL with the county auditor.

Q: What happens after I submit Form 103-EL?

A: After submitting Form 103-EL, the county auditor will review the information provided and determine the eligibility for the Era Deduction on the new additions to personal property.

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 103-EL (State Form 52515) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.