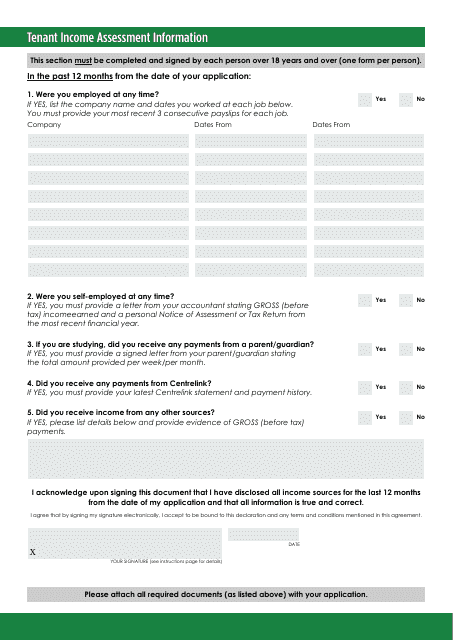

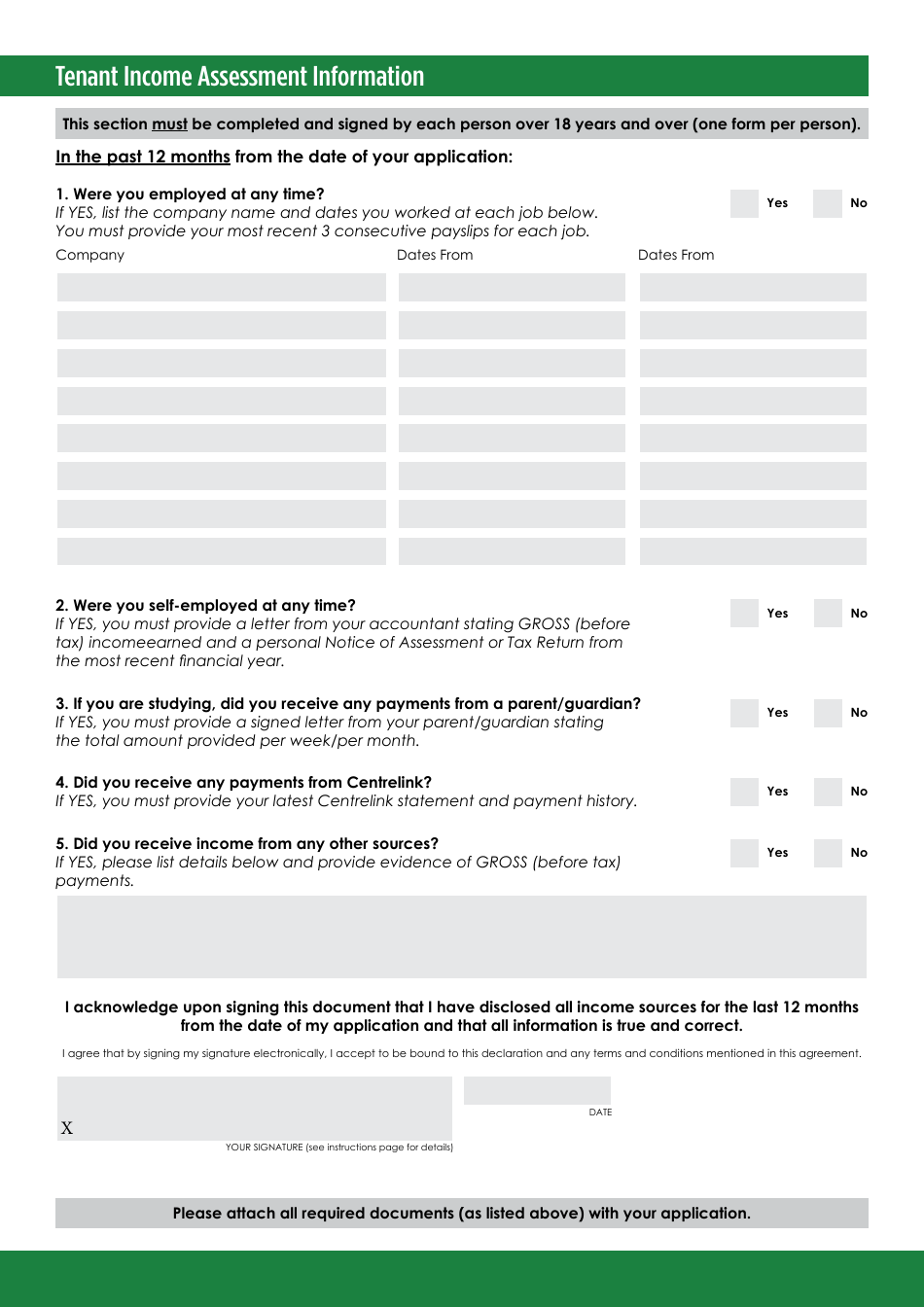

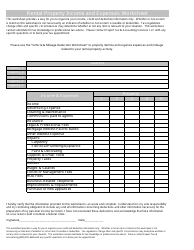

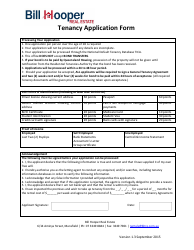

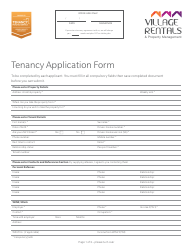

Tenant Income Assessment Information Form

The Tenant Income Assessment Information Form is used to assess the income of a tenant for the purpose of determining their eligibility for affordable housing programs or rental assistance. It helps to determine if the tenant meets the income requirements set by the housing provider or government agency.

The tenant files the Tenant Income Assessment Information Form.

FAQ

Q: What is the Tenant Income Assessment Information Form?

A: The Tenant Income Assessment Information Form is a document used to gather information about a tenant's income.

Q: Why is the Tenant Income Assessment Information Form important?

A: The form is important because it helps landlords or property managers assess a tenant's ability to pay rent.

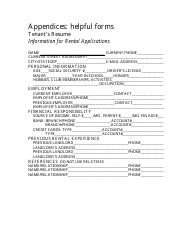

Q: What information is typically included on the Tenant Income Assessment Information Form?

A: The form generally includes details such as the tenant's employment status, annual income, and any additional sources of income.

Q: Can a landlord or property manager request supporting documentation for the income stated on the form?

A: Yes, they can request supporting documentation such as pay stubs or tax returns to verify the income provided.

Q: Is the Tenant Income Assessment Information Form required by law?

A: The requirement for this form may vary depending on local laws and regulations, so it's best to check with your local housing authority or legal counsel.

Q: Can a tenant refuse to provide the requested information on the form?

A: While tenants have a right to privacy, landlords may have the legal authority to request certain financial information as part of the rental application process. Refusing to provide the information may impact the tenant's chances of being approved for the rental property.

Q: Is the information provided on the Tenant Income Assessment Information Form kept confidential?

A: Landlords or property managers are generally required to keep the information provided on the form confidential and use it solely for the purpose of assessing the tenant's eligibility to rent the property.