An Employee's Guide to Health Benefits Under Cobra

An Employee's Guide to Health Benefits Under Cobra is a 17-page legal document that was released by the U.S. Department of Labor - Employee Benefits Security Administration on September 1, 2015 and used nation-wide.

FAQ

Q: What is COBRA?

A: COBRA is a federal law that allows employees to continue their health insurance coverage after leaving their job.

Q: Who is eligible for COBRA?

A: You are eligible for COBRA if you had health insurance through your employer and you experienced a qualifying event such as job loss or reduction in hours.

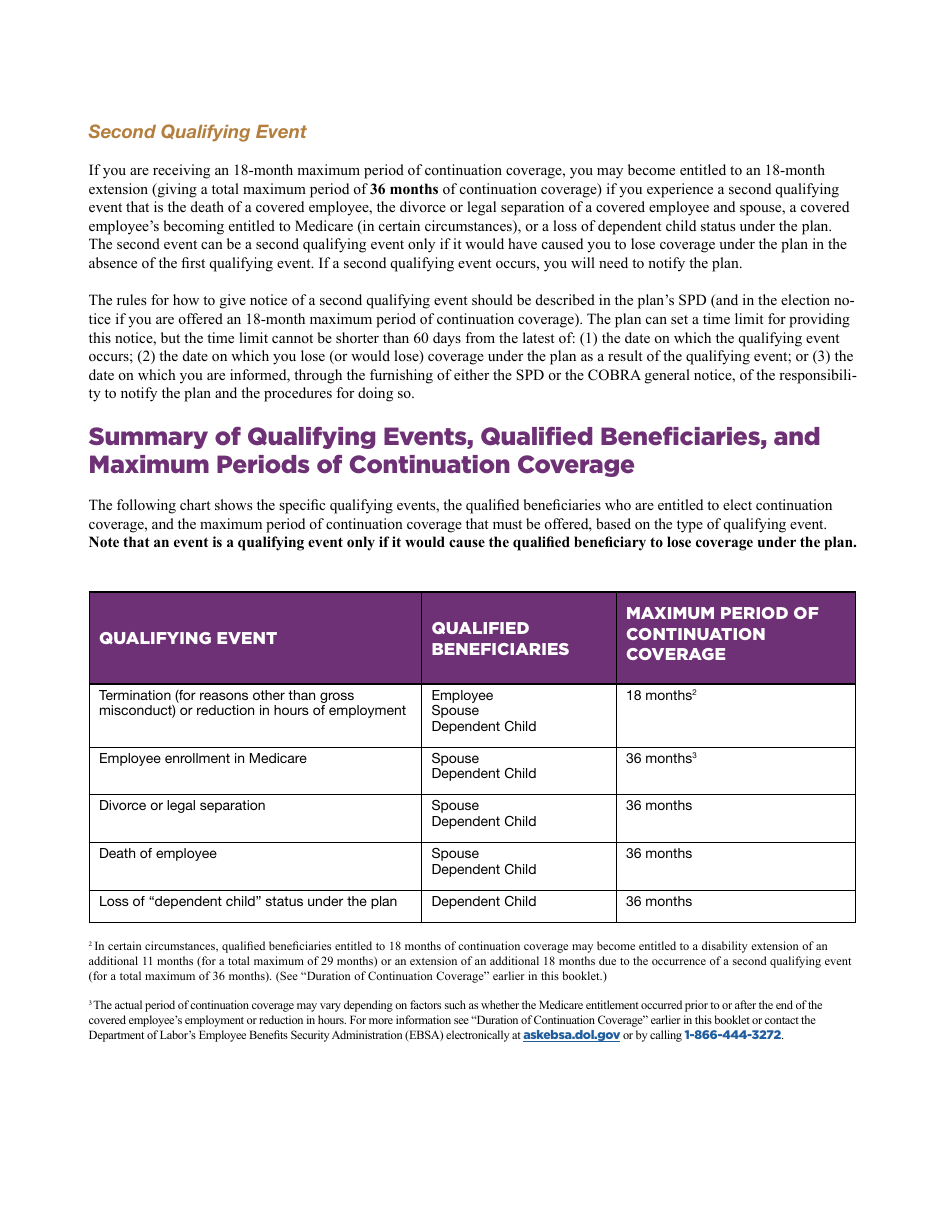

Q: How long can I continue coverage under COBRA?

A: You can continue coverage under COBRA for up to 18 or 36 months, depending on the qualifying event.

Q: Can I switch to a different health plan under COBRA?

A: No, under COBRA you can only continue the same health plan you had while employed.

Q: Is COBRA coverage expensive?

A: COBRA coverage can be more expensive than coverage through an employer, as you will be responsible for paying the full premium, including the portion previously paid by your employer.

Q: Are there alternatives to COBRA for health insurance?

A: Yes, you may be eligible for other health insurance options such as Medicaid, Marketplace plans, or coverage through a spouse's employer.

Q: Are dental and vision benefits included in COBRA coverage?

A: Dental and vision benefits may be included in COBRA coverage, but you should check with your employer or health insurance provider for specific details.

Q: What should I do if I become eligible for COBRA?

A: If you become eligible for COBRA, you should review your options carefully and consider factors such as cost, coverage, and duration before making a decision.

Q: Can I be denied COBRA coverage?

A: No, as long as you meet the eligibility requirements and pay the premiums, you cannot be denied COBRA coverage.

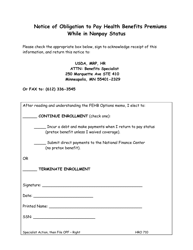

Q: What happens if I don't elect COBRA coverage?

A: If you don't elect COBRA coverage, you may lose your health insurance and be responsible for all medical expenses.

Q: Can I cancel my COBRA coverage before the end of the coverage period?

A: Yes, you can cancel your COBRA coverage before the end of the coverage period, but there may be restrictions and you may not be able to re-enroll.

Q: What if I have more questions about COBRA?

A: If you have more questions about COBRA, you should contact your employer's benefits department or your health insurance provider for assistance.

Form Details:

- The latest edition currently provided by the U.S. Department of Labor - Employee Benefits Security Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.