This version of the form is not currently in use and is provided for reference only. Download this version of

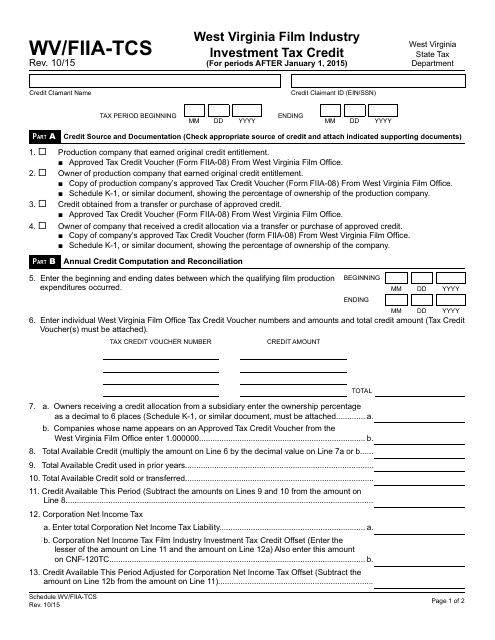

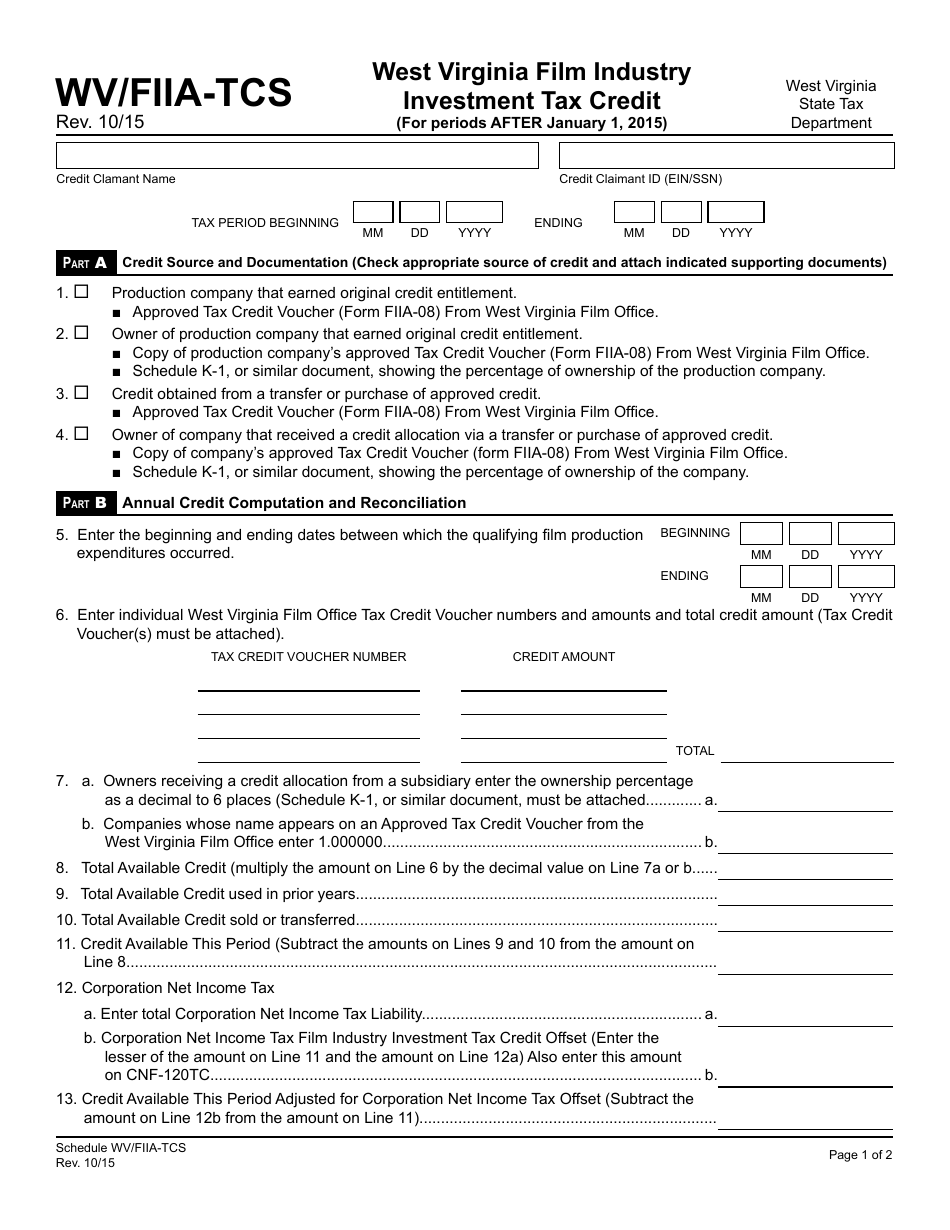

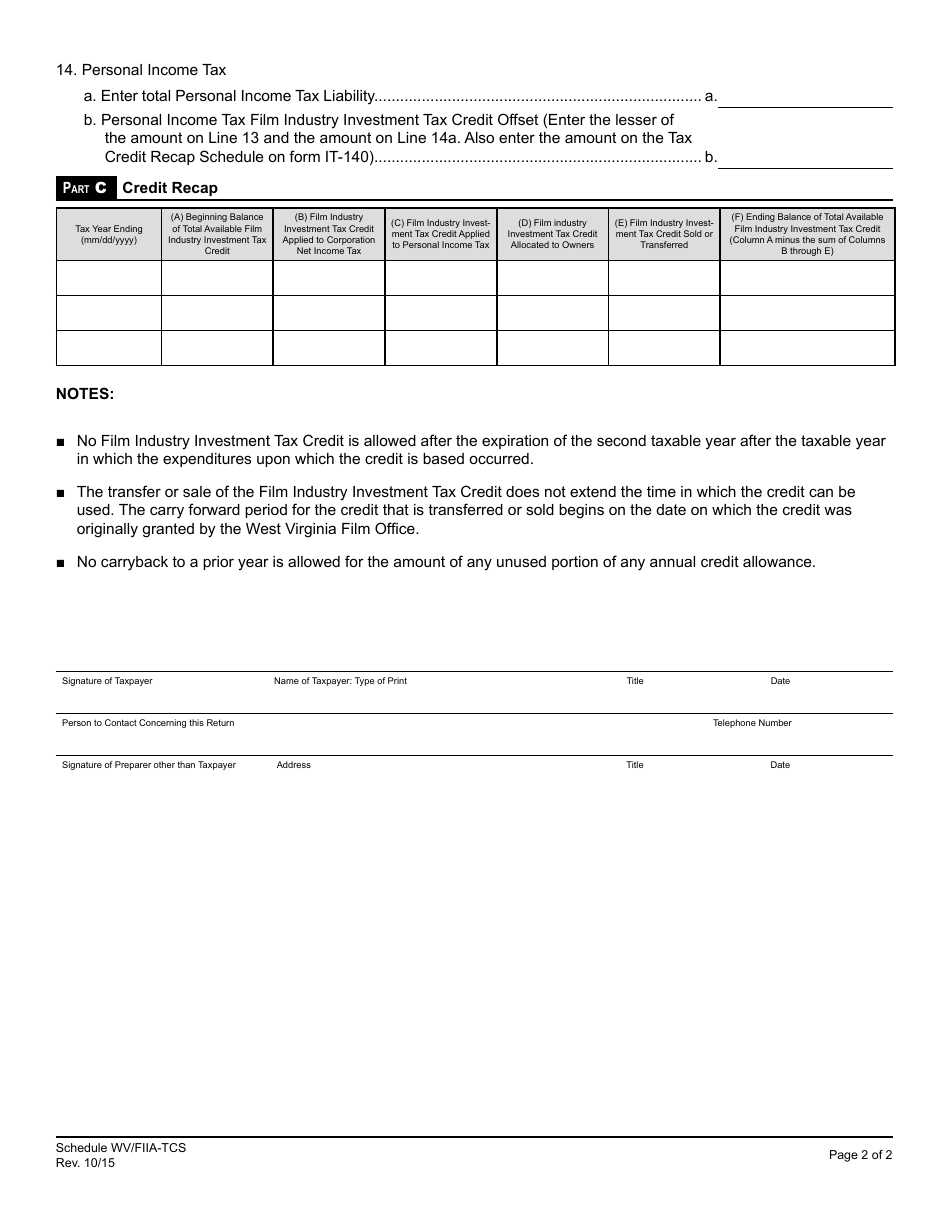

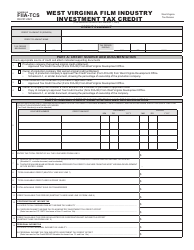

Schedule WV/FIIA-TCS

for the current year.

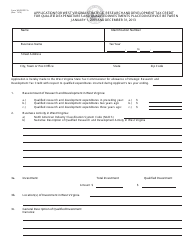

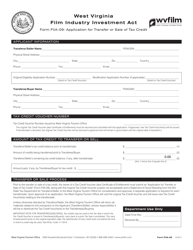

Schedule WV / FIIA-TCS West Virginia Film Industry Investment Tax Credit - West Virginia

What Is Schedule WV/FIIA-TCS?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the WV/FIIA-TCS West Virginia Film IndustryInvestment Tax Credit?

A: The WV/FIIA-TCS West Virginia Film Industry Investment Tax Credit is a tax credit available for individuals or businesses investing in the film industry in West Virginia.

Q: Who is eligible for the WV/FIIA-TCS West Virginia Film Industry Investment Tax Credit?

A: Individuals or businesses investing in qualified film production projects in West Virginia may be eligible for the tax credit.

Q: What is the benefit of the WV/FIIA-TCS West Virginia Film Industry Investment Tax Credit?

A: The tax credit provides a financial incentive to attract film industry investments and promote economic development in West Virginia.

Q: How much is the WV/FIIA-TCS West Virginia Film Industry Investment Tax Credit?

A: The tax credit amount varies depending on the specific details of the investment and the film production project.

Q: How can I apply for the WV/FIIA-TCS West Virginia Film Industry Investment Tax Credit?

A: To apply for the tax credit, individuals or businesses must complete and submit the appropriate application form to the West Virginia Film Office.

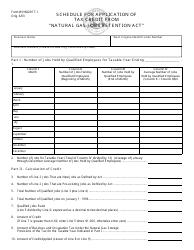

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule WV/FIIA-TCS by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.