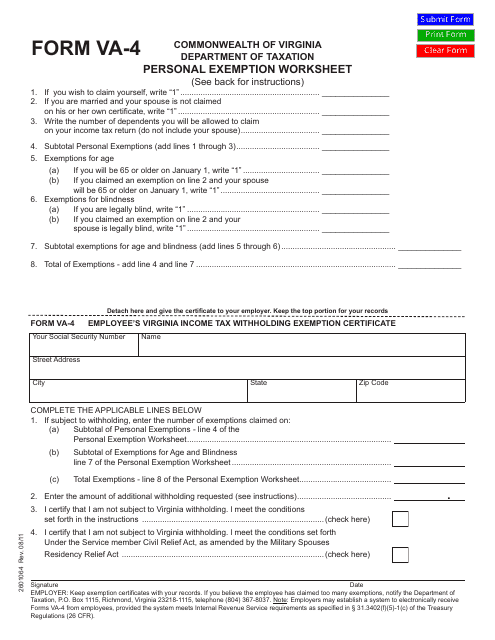

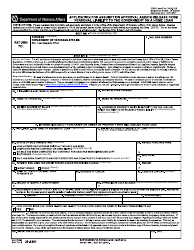

Form VA-4 Personal Exemption Worksheet - Virginia

What Is Form VA-4?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VA-4?

A: Form VA-4 is the Personal Exemption Worksheet for the state of Virginia.

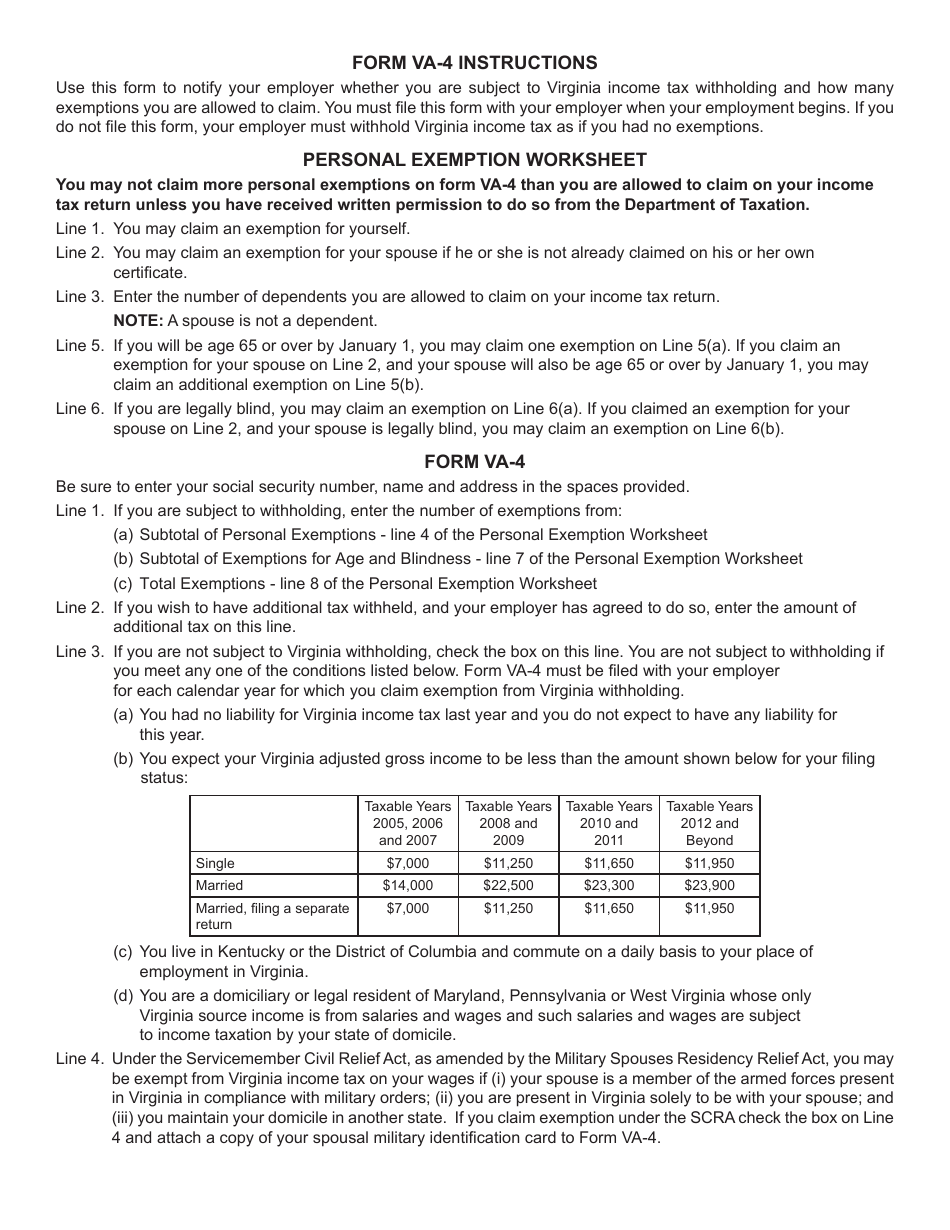

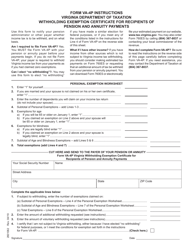

Q: What is the purpose of Form VA-4?

A: Form VA-4 is used to determine the correct amount of state income tax to withhold from an employee's wages.

Q: Who needs to fill out Form VA-4?

A: Form VA-4 needs to be filled out by any employee who wants to adjust their withholding amount for Virginia state income tax.

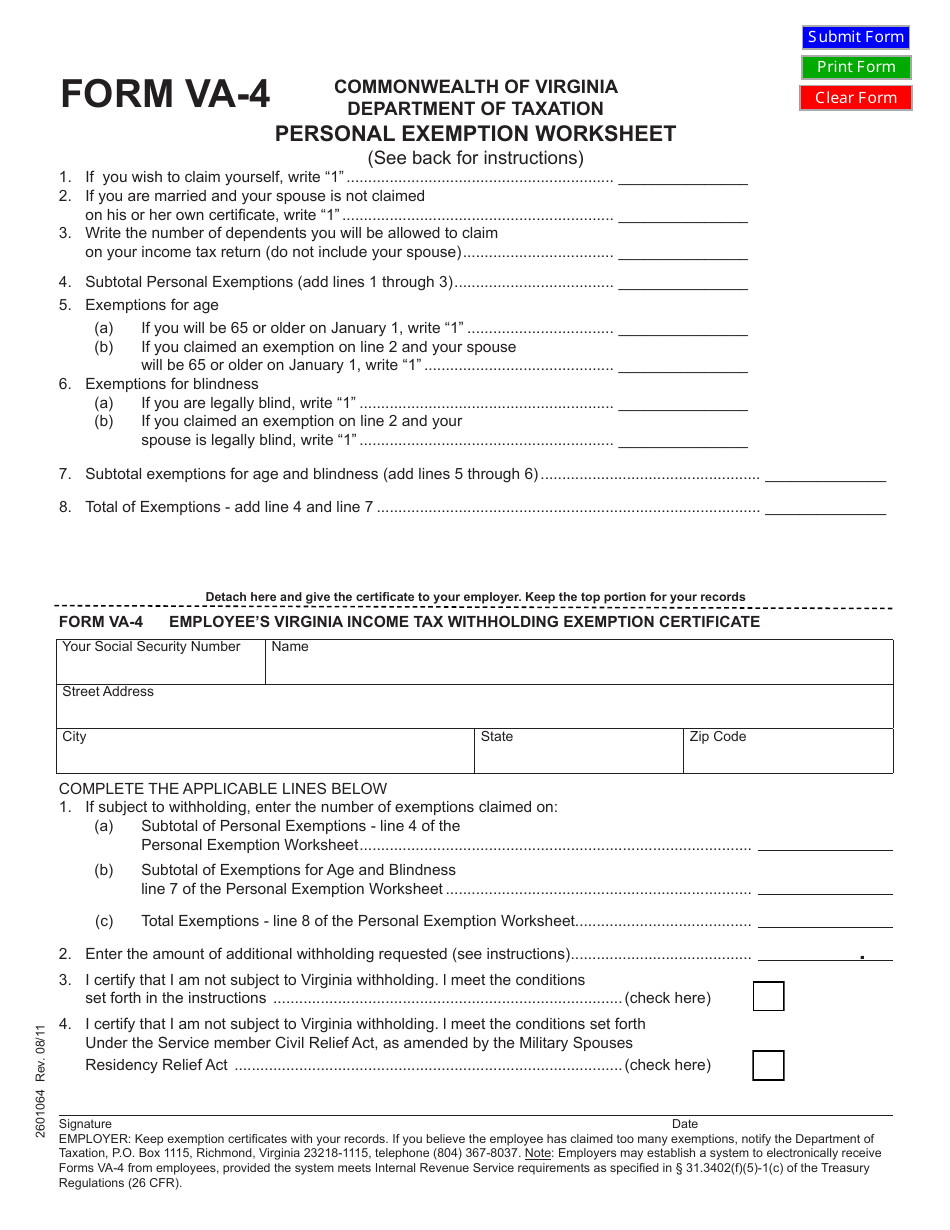

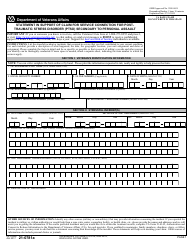

Q: How do I fill out Form VA-4?

A: Form VA-4 requires you to provide personal information, such as your name, Social Security number, and filing status, as well as details about exemptions and credits.

Q: When should Form VA-4 be submitted?

A: Form VA-4 should be submitted to your employer as soon as possible, preferably at the beginning of the tax year or whenever changes in your circumstances occur.

Q: Is Form VA-4 mandatory?

A: Form VA-4 is not mandatory, but it is recommended to fill out the form to ensure accurate withholding of state income tax.

Q: Can I make changes to my Form VA-4 throughout the year?

A: Yes, you can make changes to your Form VA-4 at any time during the tax year if your circumstances change.

Q: What happens if I do not fill out Form VA-4?

A: If you do not fill out Form VA-4, your employer will withhold Virginia state income tax based on the default withholding rate, which may not accurately reflect your tax liability.

Q: How long should I keep a copy of Form VA-4?

A: You should keep a copy of Form VA-4 for at least three years in case of any tax-related inquiries or audits.

Form Details:

- Released on August 1, 2011;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VA-4 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.