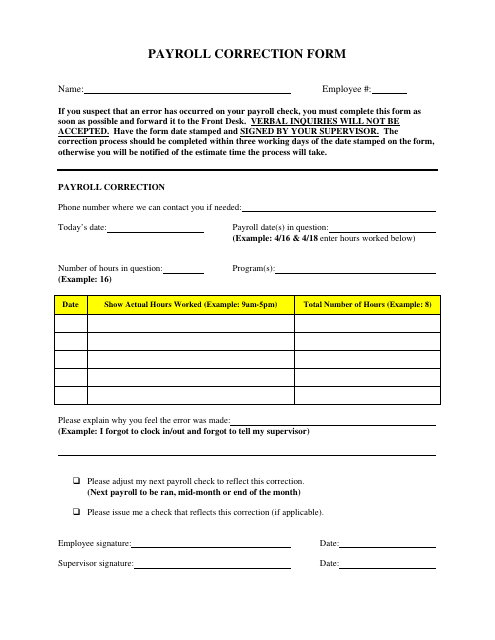

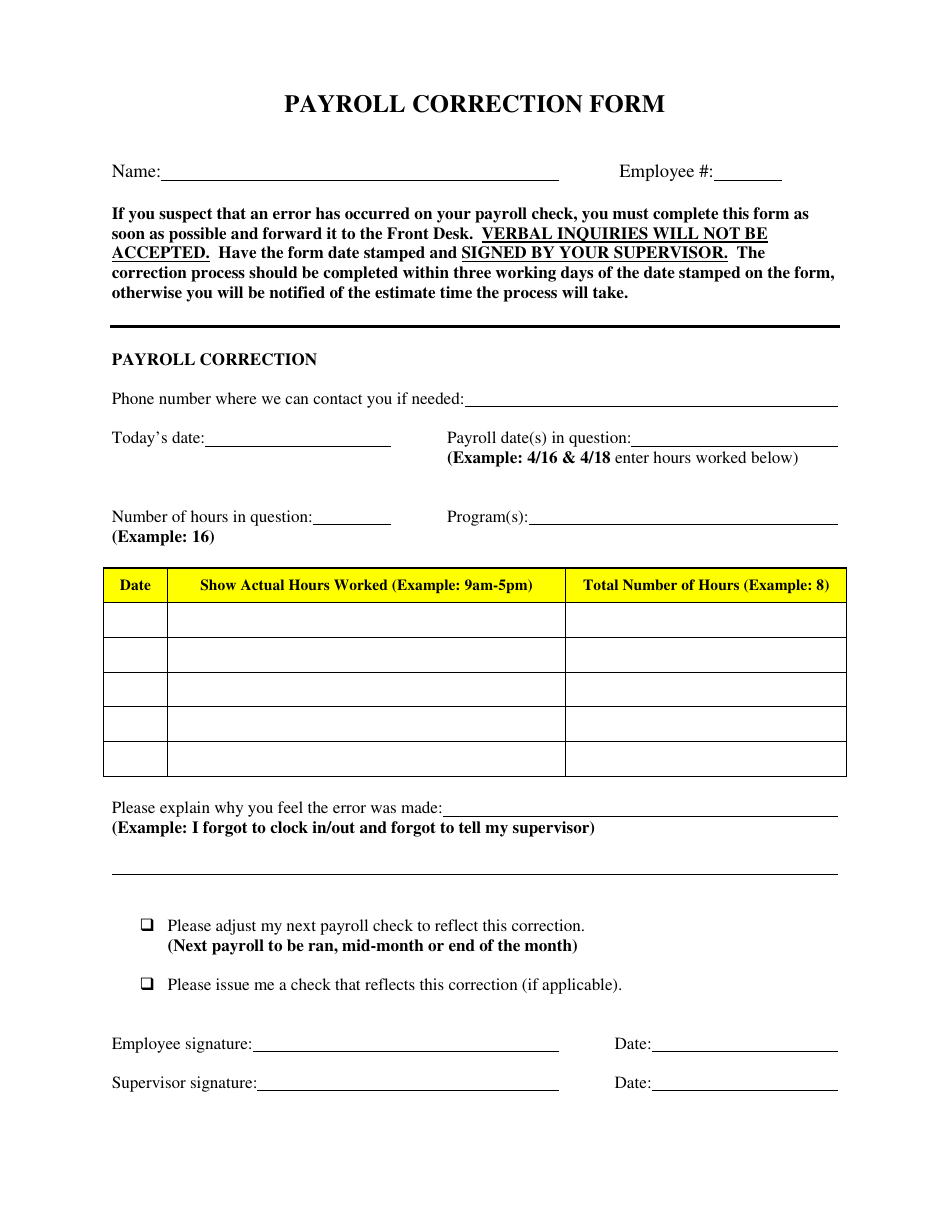

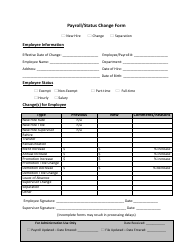

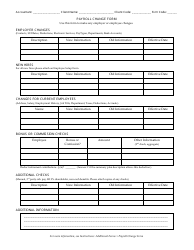

Payroll Correction Form

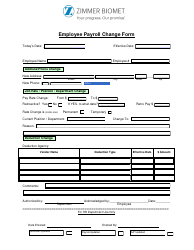

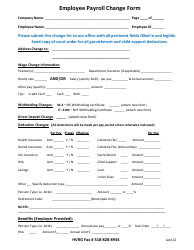

A Payroll Correction Form is used to make changes or corrections to an employee's payroll information, such as wages, deductions, or hours worked. It ensures accurate and updated payroll records.

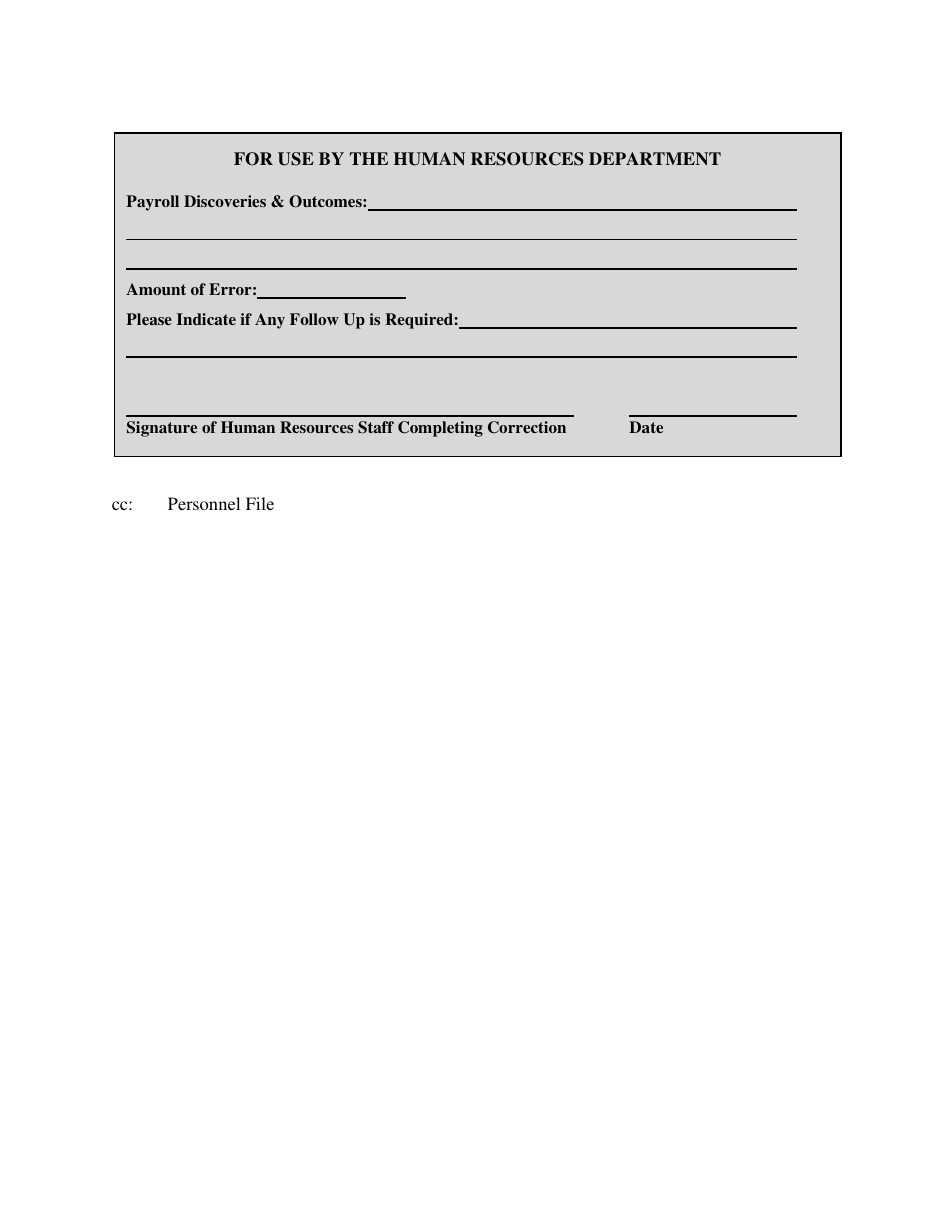

The Payroll Correction Form is typically filed by the employer or the person responsible for payroll administration.

FAQ

Q: What is a Payroll Correction Form?

A: A Payroll Correction Form is a document used to correct errors or make changes to an employee's payroll information.

Q: When should I use a Payroll Correction Form?

A: You should use a Payroll Correction Form when you need to make corrections or updates to an employee's payroll information, such as correcting an incorrect salary or updating their tax withholding.

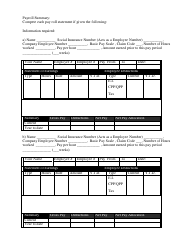

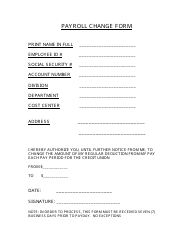

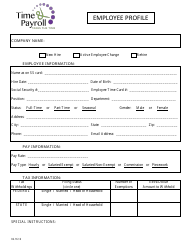

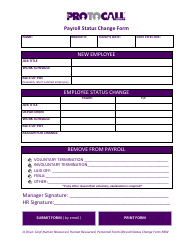

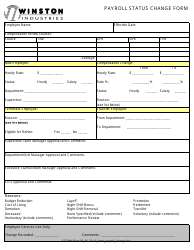

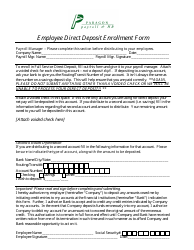

Q: What information is required on a Payroll Correction Form?

A: The required information on a Payroll Correction Form may vary, but generally you will need to provide the employee's name, employee ID or social security number, details of the correction or update, and any supporting documentation if applicable.

Q: How do I submit a Payroll Correction Form?

A: You should follow the instructions provided by your employer on how to submit the Payroll Correction Form. This may include submitting it electronically, mailing it to a specific address, or handing it in directly to the payroll department.

Q: How long does it take for a Payroll Correction Form to be processed?

A: The processing time for a Payroll Correction Form can vary depending on your employer's internal processes. It is recommended to follow up with your employer or payroll department to inquire about the status of your request.

Q: Can I make corrections to my payroll information without using a Payroll Correction Form?

A: It is best to use a Payroll Correction Form to ensure that your corrections are properly documented and processed by the payroll department. However, you should consult with your employer to understand their specific policies and procedures for making corrections to payroll information.

Q: What should I do if there is an error on my paycheck?

A: If you notice an error on your paycheck, you should immediately report it to your employer's payroll department or human resources department. They will guide you on the necessary steps to correct the error and ensure that you receive the correct payment.

Q: Can I make retroactive changes to my payroll information using a Payroll Correction Form?

A: It is possible to make retroactive changes to your payroll information using a Payroll Correction Form, depending on your employer's policies and the specific circumstances. It is recommended to consult with your employer or payroll department to understand the process for retroactive changes.

Q: What if my employer refuses to make the requested payroll corrections?

A: If your employer refuses to make the requested payroll corrections and you believe that the corrections are valid, you may want to consult with an employment lawyer or contact your local labor department for guidance on how to proceed.