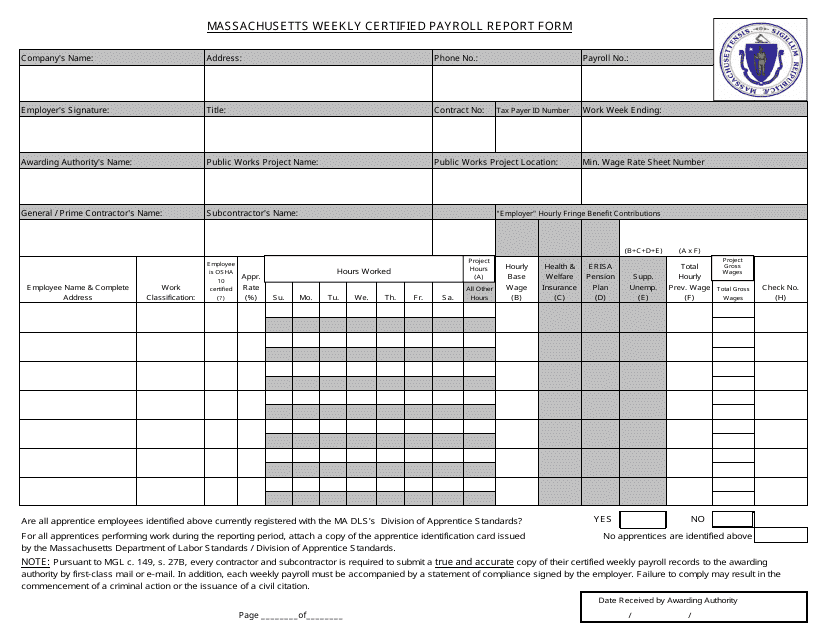

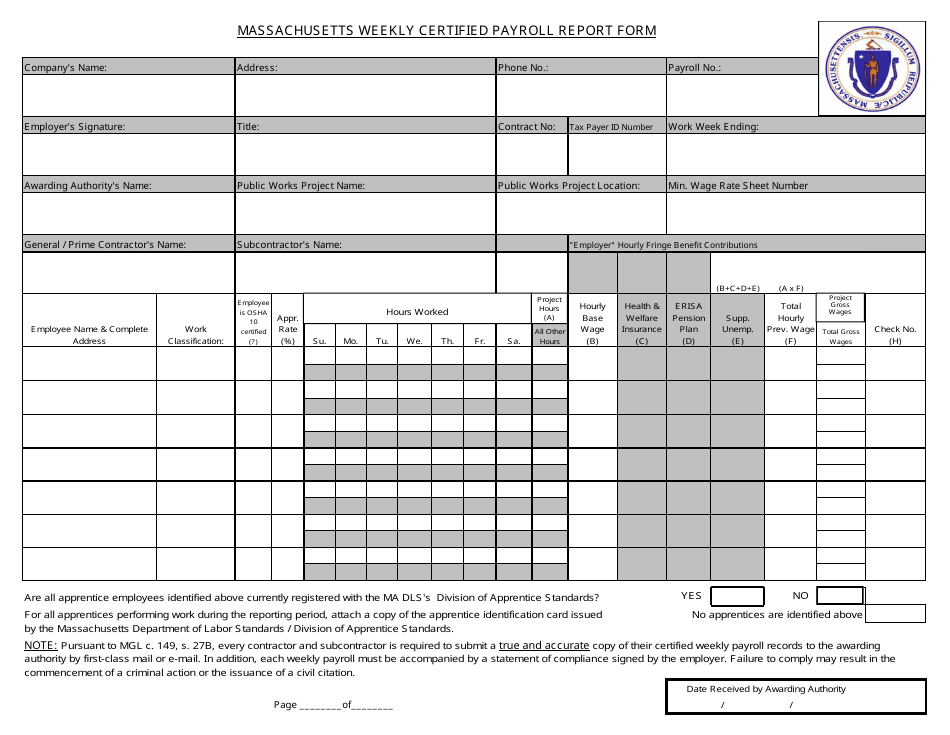

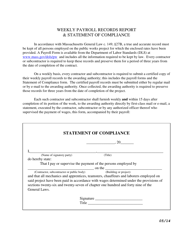

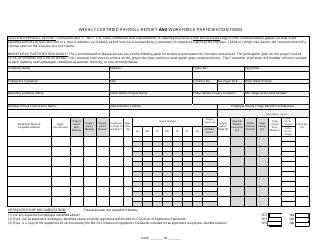

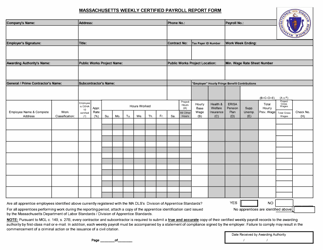

Weekly Certified Payroll Report Form - Massachusetts

Weekly Certified Payroll Report Form is a legal document that was released by the Massachusetts Department of Labor Standards - a government authority operating within Massachusetts.

FAQ

Q: What is a Certified Payroll Report Form?

A: A Certified Payroll Report Form is a document used in Massachusetts to report wages paid by contractors on public works projects.

Q: Who is required to submit a Certified Payroll Report Form?

A: Contractors and subcontractors working on public works projects in Massachusetts are required to submit a Certified Payroll Report Form.

Q: What information is included in a Certified Payroll Report Form?

A: A Certified Payroll Report Form typically includes information such as employee names, job classifications, hours worked, wages paid, and fringe benefits provided.

Q: How often should a Certified Payroll Report Form be submitted?

A: In Massachusetts, a Certified Payroll Report Form must be submitted weekly.

Q: Are there any penalties for not submitting a Certified Payroll Report Form?

A: Yes, failure to submit a Certified Payroll Report Form in Massachusetts may result in penalties and could impact the contractor's ability to bid on future public works projects.

Q: Are there any exemptions from the Certified Payroll Report requirement?

A: There are certain exemptions from the Certified Payroll Report requirement in Massachusetts. Contractors should consult the state's labor laws or seek legal advice to determine if they qualify for any exemptions.

Q: Is the Certified Payroll Report requirement the same in all states?

A: No, each state may have different requirements for Certified Payroll Reports on public works projects. It is important to comply with the specific regulations of the state in which the project is taking place.

Form Details:

- The latest edition currently provided by the Massachusetts Department of Labor Standards;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Labor Standards.