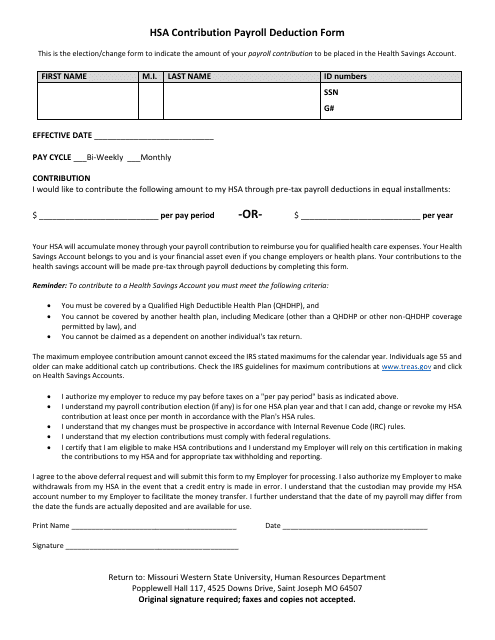

Hsa Contribution Payroll Deduction Form - Missouri Western State University

The HSA Contribution Payroll Deduction Form at Missouri Western State University is used for employees to authorize the deduction of funds from their paychecks to contribute to their Health Savings Account (HSA). The form allows employees to specify the amount they would like to contribute towards their HSA on a regular basis.

FAQ

Q: What is the HSA Contribution Payroll Deduction Form?

A: The HSA Contribution Payroll Deduction Form is a form used by employees of Missouri Western State University to authorize deductions from their paycheck for contributions to a Health Savings Account (HSA).

Q: What is a Health Savings Account (HSA)?

A: A Health Savings Account (HSA) is a tax-advantaged savings account that can be used to pay for qualified medical expenses. It is available to individuals who are enrolled in a high-deductible health plan.

Q: How does the HSA Contribution Payroll Deduction Form work?

A: The form allows employees to specify the amount they want to contribute to their HSA on a pre-tax basis. The specified amount will then be deducted from their paycheck and deposited into their HSA.

Q: Why would someone want to contribute to an HSA?

A: Contributions to an HSA are tax-deductible, and the funds in the account can be invested and grow tax-free. Additionally, withdrawals from an HSA for qualified medical expenses are tax-free.

Q: Who is eligible to contribute to an HSA?

A: To contribute to an HSA, you must be enrolled in a high-deductible health plan and not be covered by any other health insurance that is not also a high-deductible plan. Additionally, you cannot be enrolled in Medicare.

Q: Are there limits to how much can be contributed to an HSA?

A: Yes, there are annual contribution limits set by the IRS. For 2021, the limit for an individual with self-only coverage is $3,600, and the limit for an individual with family coverage is $7,200.

Q: What happens to the funds in an HSA if they are not used?

A: Unlike a Flexible Spending Account (FSA), funds in an HSA roll over from year to year and continue to earn interest or investment returns. There is no "use it or lose it" provision for HSA funds.

Q: Can HSA funds be used for non-medical expenses?

A: Yes, but if HSA funds are used for non-medical expenses before age 65, they may be subject to income tax and a 20% penalty. After age 65, HSA funds can be used for non-medical expenses without penalty, but they will still be subject to income tax.

Q: How do I get started with an HSA?

A: To get started with an HSA, you should contact your employer or an HSA provider to set up an account. You will need to meet the eligibility requirements and complete any required forms or paperwork.

Q: Can I change my HSA contribution amount?

A: Yes, you can change your HSA contribution amount at any time. You may need to submit a new HSA Contribution Payroll Deduction Form to your employer to authorize the change.