Financial Ratio Formulas Template

The Financial Ratio Formulas Template is a tool used for calculating important financial ratios, such as profit margin, return on investment, and debt-to-equity ratio, to assess the financial health and performance of a company. However, as a document knowledge system, I do not have access to specific templates.

The Financial Ratio Formulas Template is typically filed by businesses and financial analysts for analysis and evaluation of a company's financial performance.

FAQ

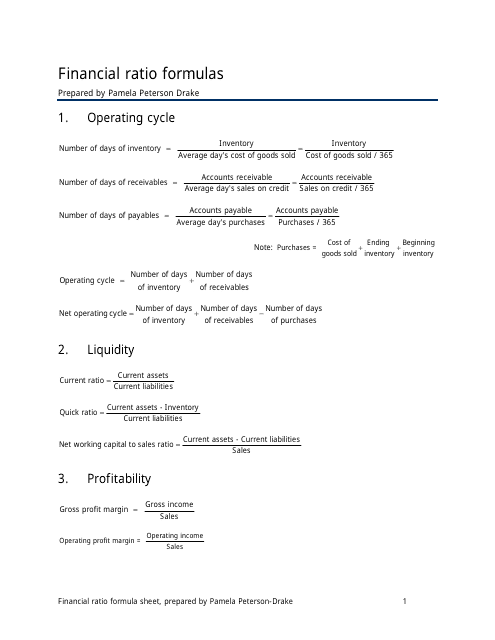

Q: What is a financial ratio?

A: A financial ratio is a relative measure that compares different financial values to assess the financial health and performance of a company.

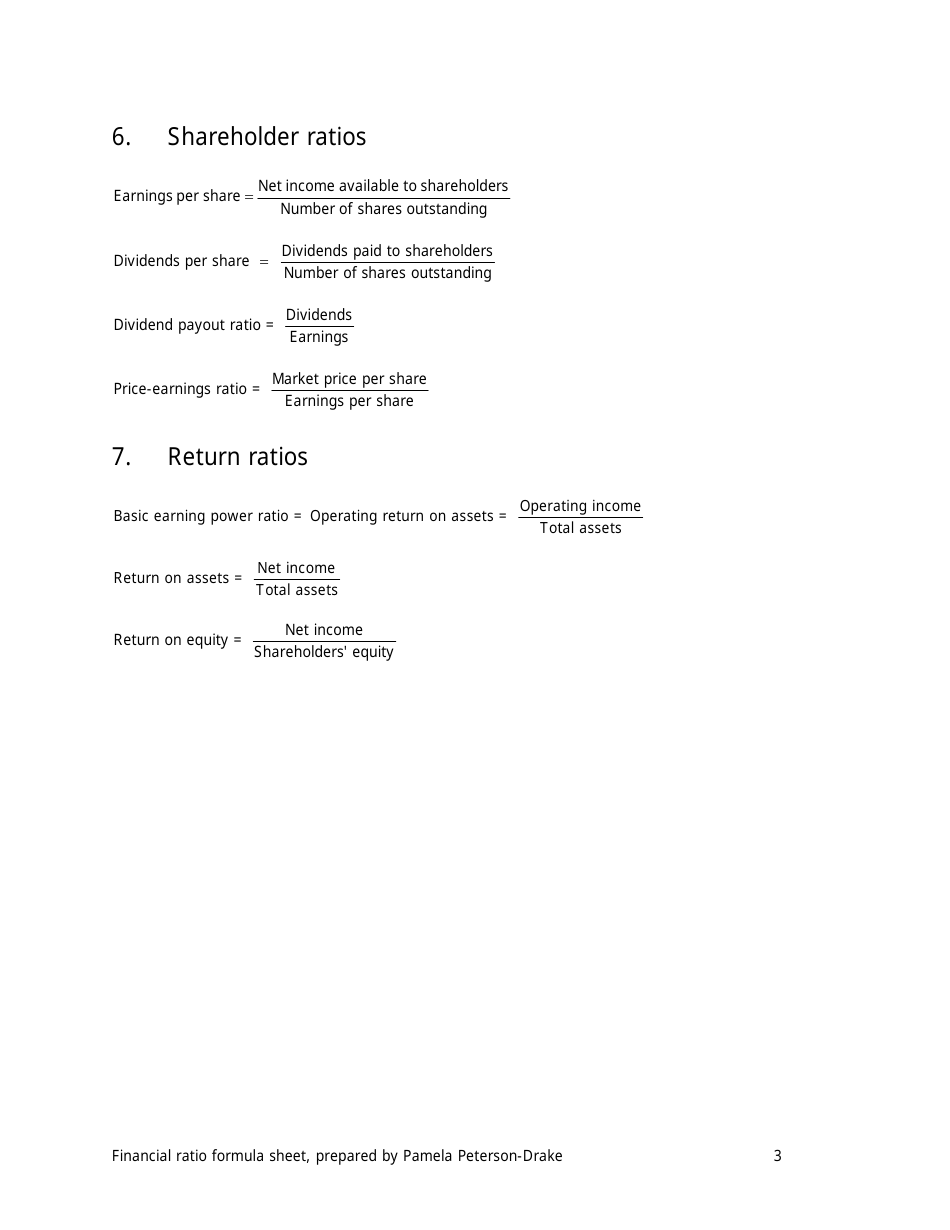

Q: What are some common financial ratios?

A: Some common financial ratios include the current ratio, debt-to-equity ratio, return on investment (ROI), and earnings per share (EPS).

Q: What is the current ratio formula?

A: The current ratio formula is current assets divided by current liabilities.

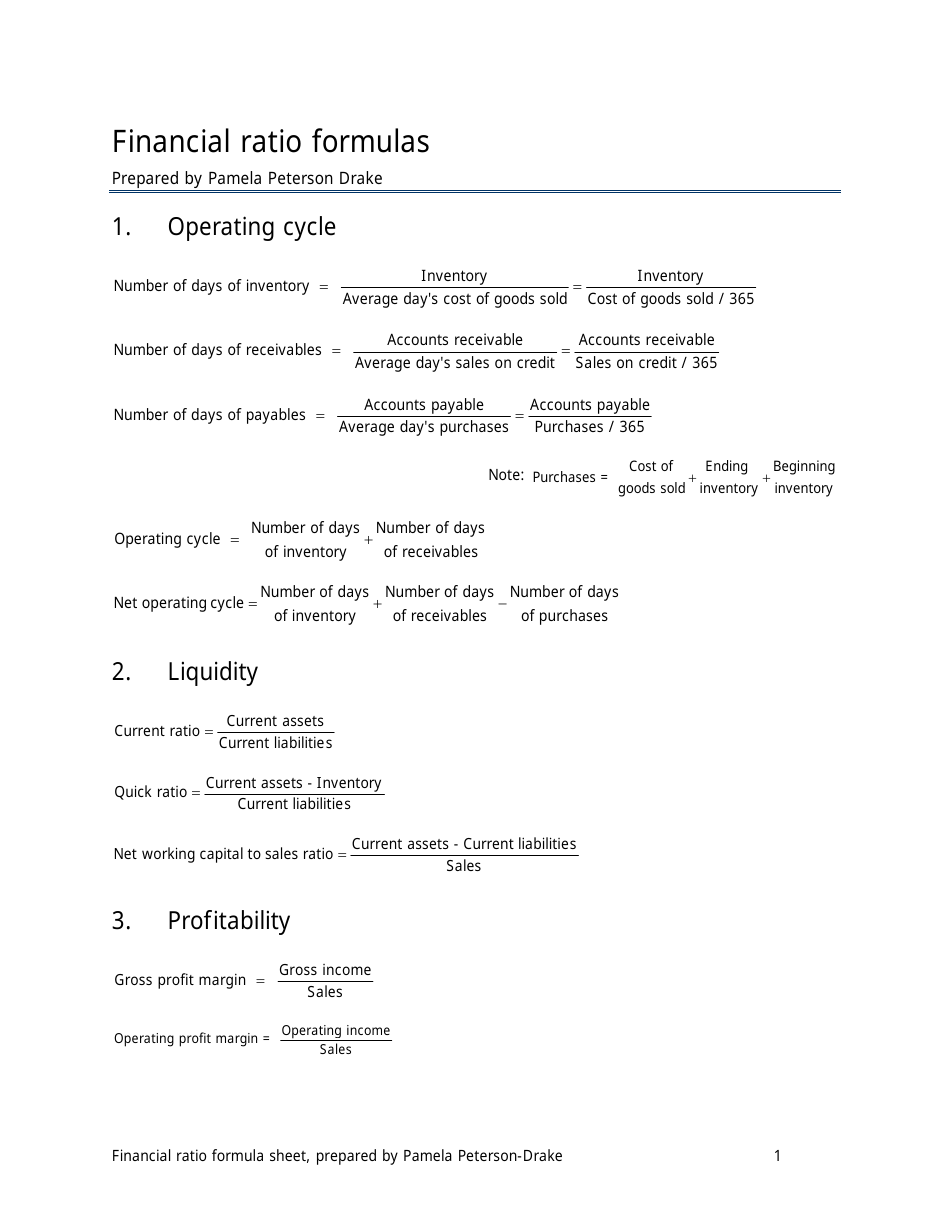

Q: What is the debt-to-equity ratio formula?

A: The debt-to-equity ratio formula is total debt divided by total equity.

Q: What is the return on investment (ROI) formula?

A: The ROI formula is net profit divided by total investment, multiplied by 100 to get a percentage.

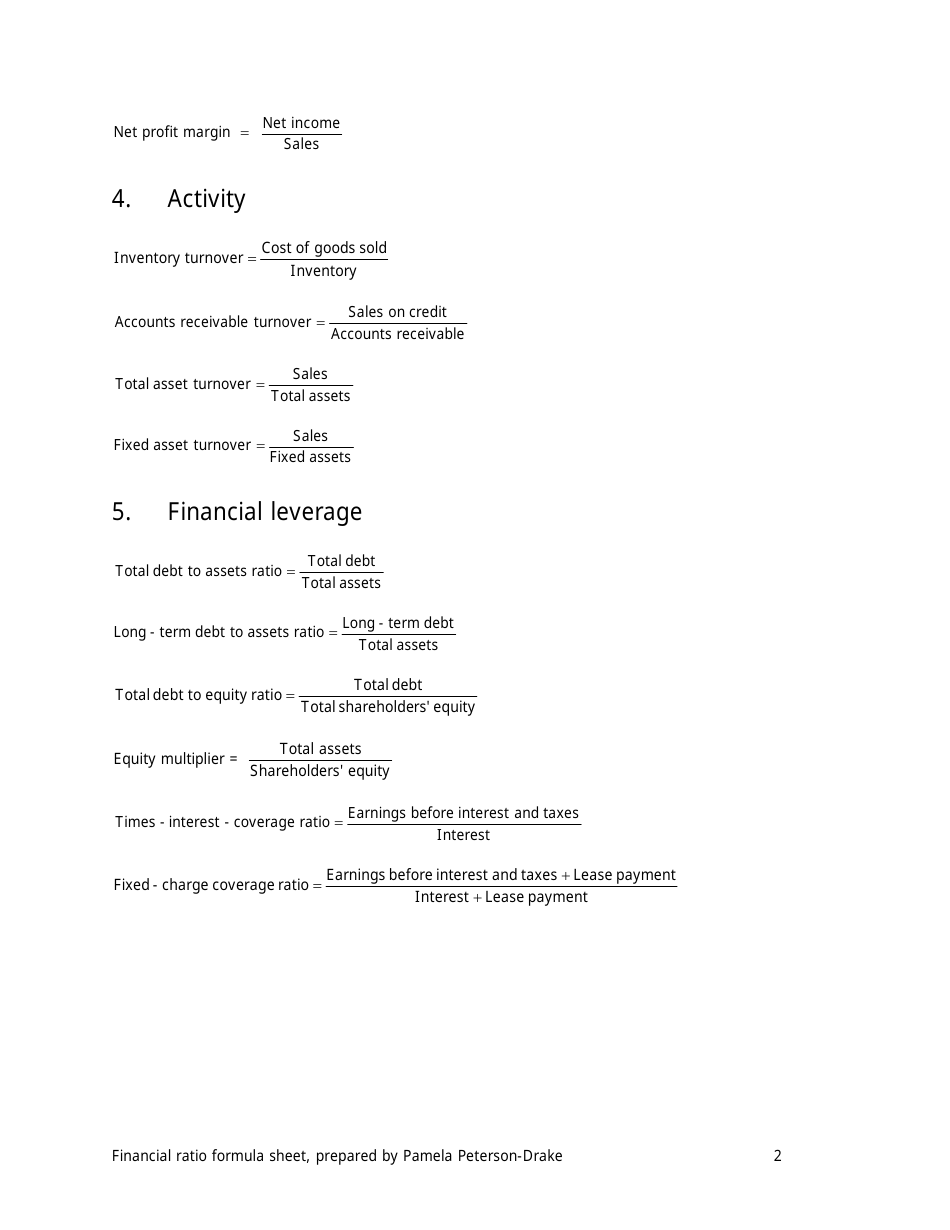

Q: What is the earnings per share (EPS) formula?

A: The EPS formula is net income divided by the number of outstanding shares of stock.

Q: What is the purpose of using financial ratios?

A: Financial ratios help investors, creditors, and analysts evaluate a company's financial performance, strength, and ability to meet financial obligations.

Q: What does a higher current ratio indicate?

A: A higher current ratio indicates that a company has more current assets to cover its current liabilities, which suggests a better ability to pay off debts.

Q: What does a higher debt-to-equity ratio indicate?

A: A higher debt-to-equity ratio indicates that a company relies more on debt financing rather than equity financing, which may pose higher financial risk.

Q: What does a higher ROI indicate?

A: A higher ROI indicates a higher return on investment relative to the amount invested, suggesting better profitability.

Q: What does a higher EPS indicate?

A: A higher EPS indicates higher earnings per share, which may be a positive sign for investors.

Q: Are financial ratios the only indicators of a company's financial health?

A: No, financial ratios are important, but they should be used in conjunction with other financial analysis tools and considerations.

Q: Can financial ratios be used to compare companies in different industries?

A: Financial ratios may be less meaningful when comparing companies in different industries, as different industries have different financial characteristics and requirements.