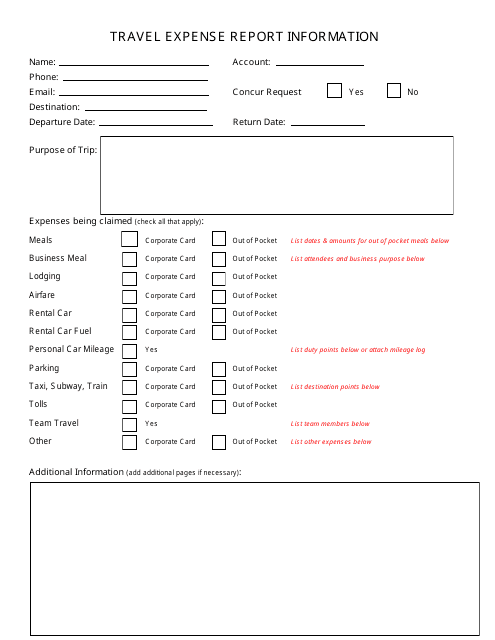

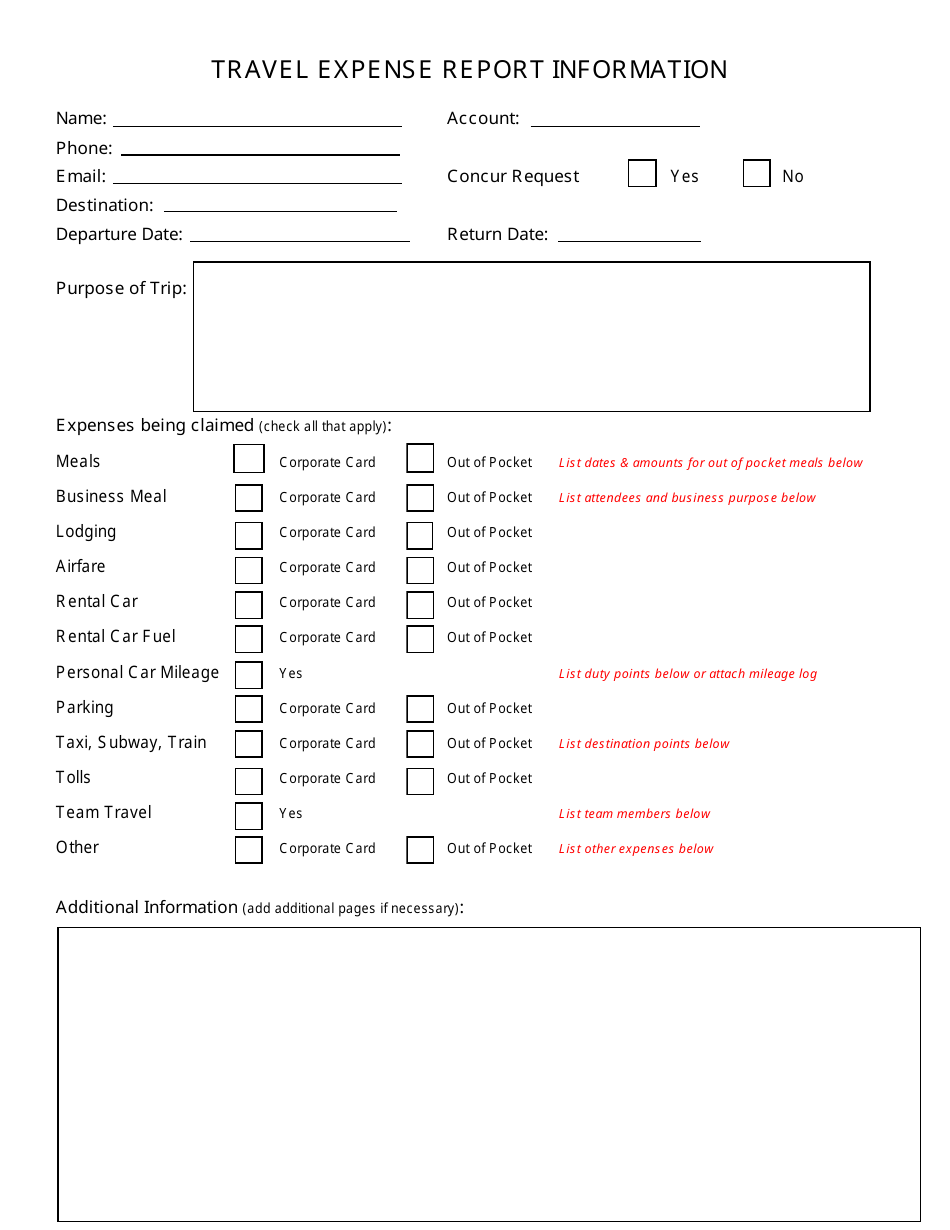

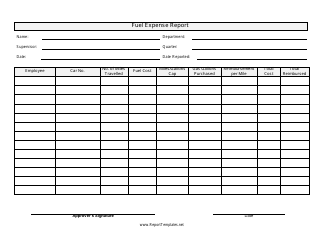

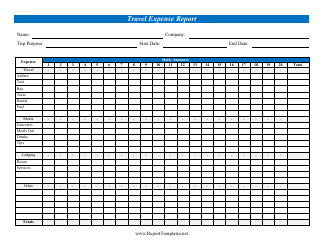

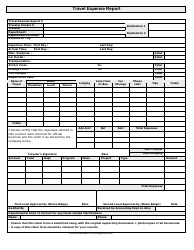

Travel Expense Report Information Template

The Travel Expense Report Information Template is used to track and document expenses incurred during business travel. It helps individuals or employees to organize and report their travel expenses, including transportation, accommodation, meals, and other associated costs.

The travel expense report information template is typically filed by the employee who incurred the travel expenses.

FAQ

Q: What is a travel expense report?

A: A travel expense report is a document used to record and submit expenses incurred during business travel.

Q: Why is a travel expense report important?

A: A travel expense report is important because it provides documentation for reimbursement and helps in tracking and managing travel expenses.

Q: What information is typically included in a travel expense report?

A: A travel expense report typically includes details such as the dates of travel, transportation expenses, accommodation expenses, meals and incidental expenses, and any other relevant expenses.

Q: Who is responsible for preparing a travel expense report?

A: The individual who has incurred the travel expenses is usually responsible for preparing a travel expense report.

Q: How should receipts be included in a travel expense report?

A: Receipts should be attached to the travel expense report as supporting documentation for each expense claimed.

Q: What is the process for submitting a travel expense report?

A: The process for submitting a travel expense report usually involves filling out the required form, attaching receipts, and submitting it to the appropriate department or individual for review and reimbursement.

Q: Is there a deadline for submitting a travel expense report?

A: Yes, there is usually a deadline for submitting a travel expense report. It is important to submit the report within the designated timeframe to ensure timely reimbursement.

Q: What should be done if there are discrepancies or missing receipts in a travel expense report?

A: If there are discrepancies or missing receipts in a travel expense report, it is important to communicate with the relevant parties or department to resolve the issues and provide any necessary explanations or replacements.

Q: Are there any specific policies or guidelines to follow when preparing a travel expense report?

A: Yes, organizations may have specific policies or guidelines regarding travel expense reports. It is important to familiarize oneself with these policies and guidelines to ensure compliance.

Q: Can personal expenses be included on a travel expense report?

A: No, personal expenses should not be included on a travel expense report. Only expenses directly related to business travel should be included.