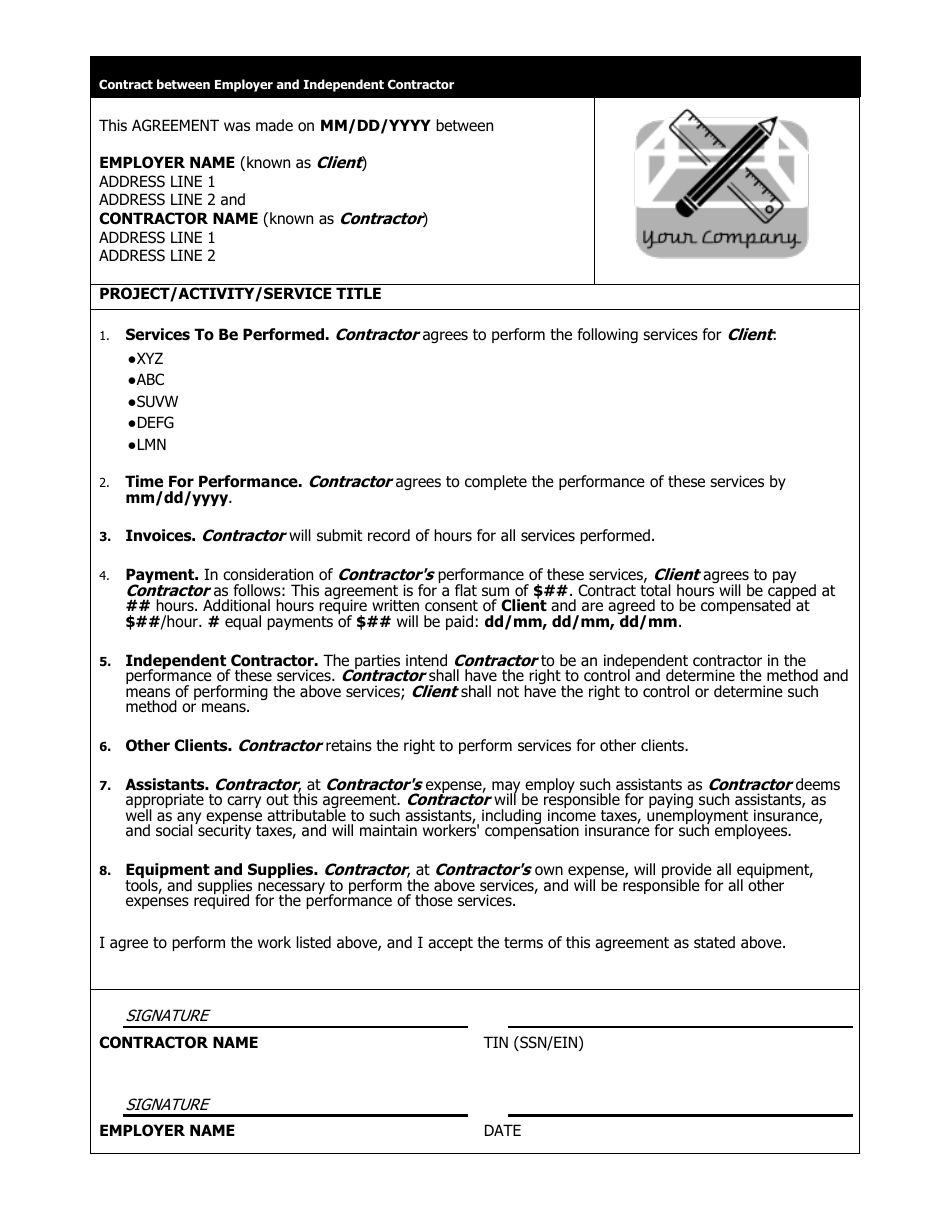

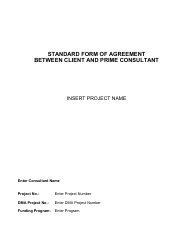

Sample Contract Between Employer and Independent Contractor

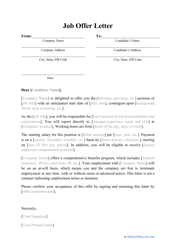

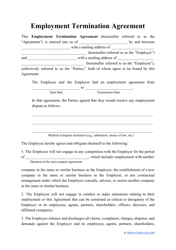

A sample contract between an employer and an independent contractor is a document used to outline the terms and conditions of the working relationship between the two parties. It specifies the scope of work, payment terms, responsibilities, and other important details to ensure clarity and protection for both parties.

Typically, either the employer or the independent contractor can draft and file the sample contract. However, it is advisable to consult with legal professionals to ensure the contract is accurate and legally binding.

FAQ

Q: What is an independent contractor?

A: An independent contractor is a person or business that provides services to another entity, but is not considered an employee.

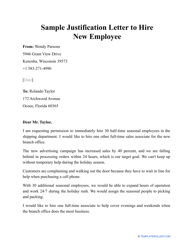

Q: Why would an employer hire an independent contractor?

A: Employers often hire independent contractors to fulfill specific tasks or projects, without the legal obligations and costs associated with hiring an employee.

Q: What are the differences between an employee and an independent contractor?

A: Employees typically work under the direct control and supervision of the employer, while independent contractors have more autonomy in how they perform their work.

Q: What should be included in a contract between an employer and an independent contractor?

A: A contract between an employer and an independent contractor should include the scope of work, payment terms, duration of the engagement, confidentiality provisions, and any other relevant details specific to the project.

Q: Is it necessary to have a written contract with an independent contractor?

A: Although not legally required in all cases, having a written contract is strongly recommended to clarify the expectations and responsibilities of both parties and to minimize any potential disputes.

Q: Can an independent contractor work for multiple clients at the same time?

A: Yes, independent contractors have the flexibility to work for multiple clients simultaneously.

Q: Are independent contractors entitled to benefits like health insurance or paid time off?

A: No, independent contractors are not entitled to employee benefits. However, they may negotiate compensation rates that consider their own expenses for benefits.

Q: Is an independent contractor responsible for paying their own taxes?

A: Yes, independent contractors are responsible for paying their own taxes, including self-employment taxes.

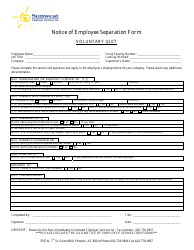

Q: Can an independent contractor be terminated before the completion of the contract?

A: Yes, an independent contractor can be terminated before the completion of the contract, but the terms for termination should be clearly outlined in the contract.

Q: What happens if there is a dispute between the employer and an independent contractor?

A: If there is a dispute, it is typically resolved through negotiation or mediation. If necessary, legal action can be taken, but this can be costly and time-consuming.