This version of the form is not currently in use and is provided for reference only. Download this version of

SBA Form 912

for the current year.

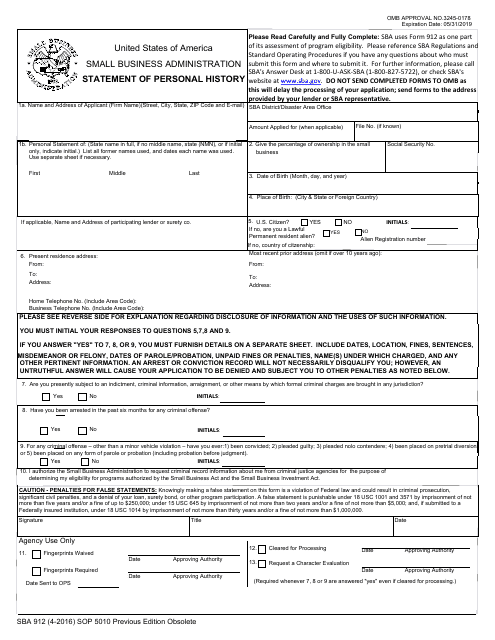

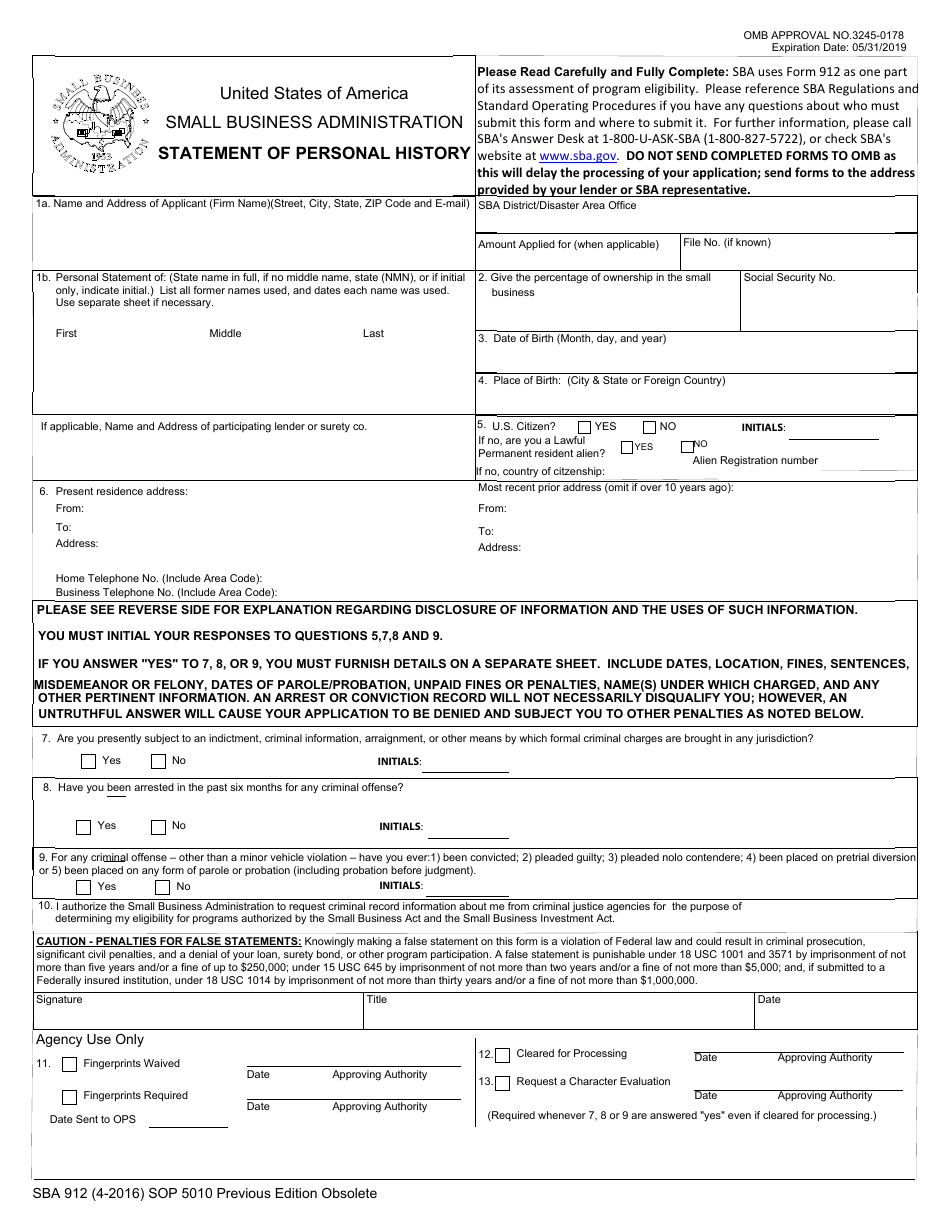

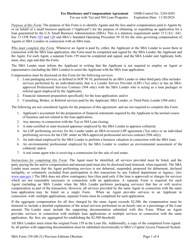

SBA Form 912 Statement of Personal History

What Is SBA Form 912?

This is a legal form that was released by the U.S. Small Business Administration on April 1, 2016 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 912?

A: SBA Form 912 is the Statement of Personal History that applicants must complete when applying for certain SBA loan programs.

Q: What is the purpose of SBA Form 912?

A: The purpose of SBA Form 912 is to collect information about the personal history and character of the applicant.

Q: Which loan programs require SBA Form 912?

A: SBA Form 912 is required for loan programs like 7(a), 504, and microloans.

Q: What information is needed on SBA Form 912?

A: The form asks for personal information, employment history, criminal records, civil court actions, and more.

Q: Is SBA Form 912 confidential?

A: Yes, the information provided on SBA Form 912 is considered confidential and is protected by law.

Q: What happens after submitting SBA Form 912?

A: The lender will review the form along with the rest of your loan application to assess your eligibility for the loan program.

Q: Can I get assistance in completing SBA Form 912?

A: Yes, you can seek assistance from an SBA resource partner, such as a Small Business Development Center (SBDC) or SCORE, to help you complete the form accurately.

Q: Are there any fees associated with submitting SBA Form 912?

A: No, there are no fees associated with submitting SBA Form 912. However, you may have to pay loan origination fees or other costs related to the loan program.

Form Details:

- Released on April 1, 2016;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 912 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.