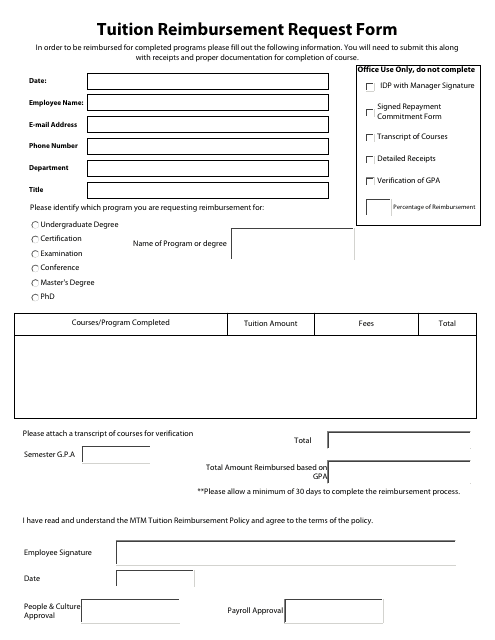

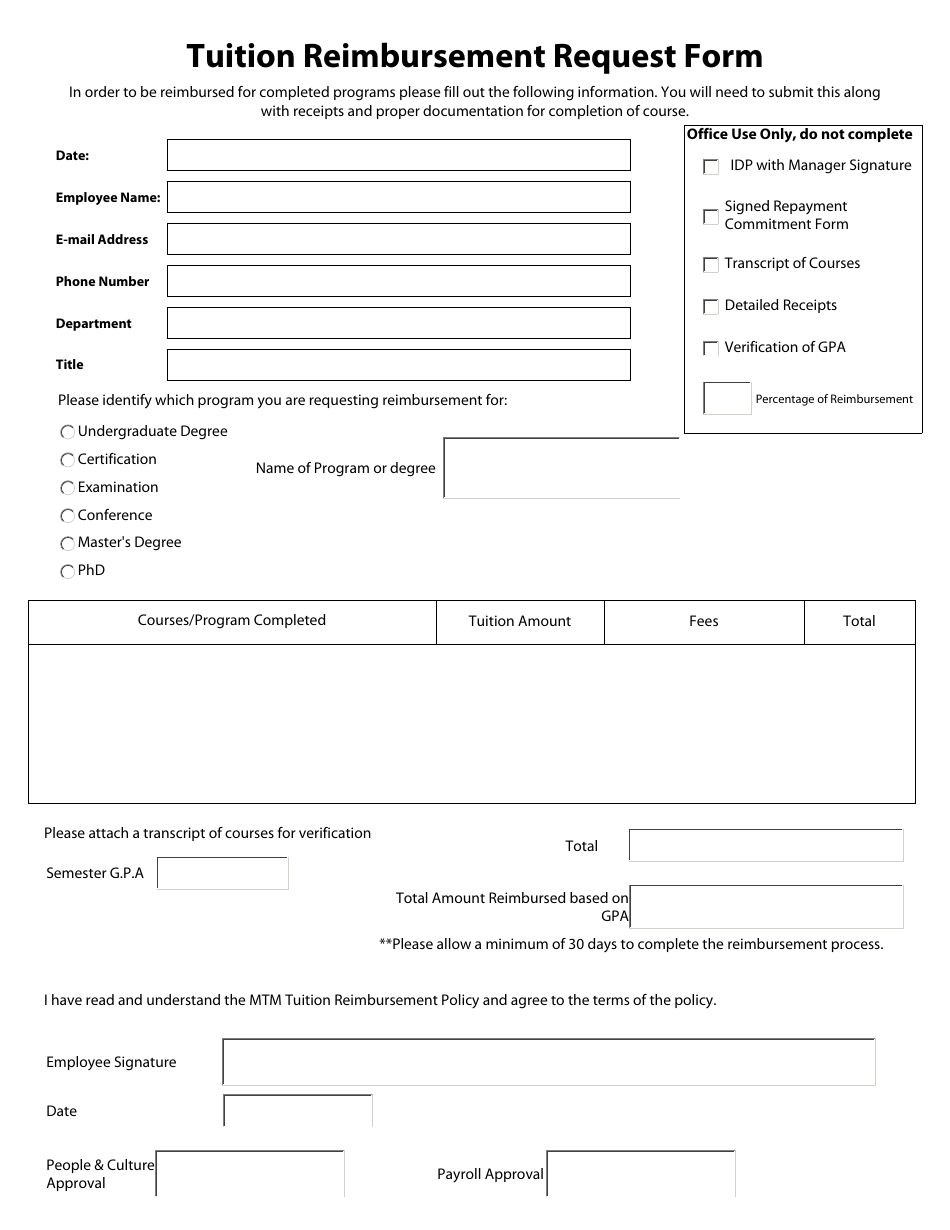

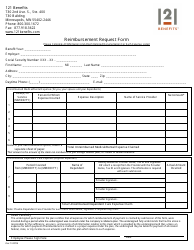

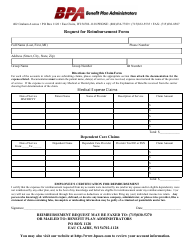

Tuition Reimbursement Request Form

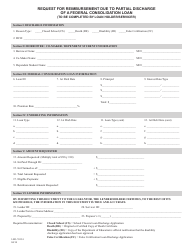

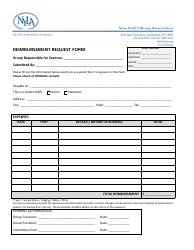

A Tuition Reimbursement Request Form is used by employees to request reimbursement for tuition expenses related to education or training provided by an employer.

The employee who wishes to receive tuition reimbursement typically files the Tuition Reimbursement Request Form.

FAQ

Q: What is a tuition reimbursement request form?

A: A tuition reimbursement request form is a document used to request financial assistance from an employer for educational expenses.

Q: Why would someone need to fill out a tuition reimbursement request form?

A: Someone would need to fill out a tuition reimbursement request form to seek financial assistance from their employer for educational expenses.

Q: What can tuition reimbursement be used for?

A: Tuition reimbursement can typically be used for educational expenses such as tuition fees, textbooks, and course materials.

Q: How does the tuition reimbursement process work?

A: The tuition reimbursement process typically involves filling out a form, submitting it to the employer with required documentation, and awaiting approval or denial of the request.

Q: Are there any eligibility requirements for tuition reimbursement?

A: Yes, eligibility requirements for tuition reimbursement vary by employer, but commonly include factors such as length of employment, job performance, and pursuing a degree related to the employee's work.

Q: What happens if a tuition reimbursement request is approved?

A: If a tuition reimbursement request is approved, the employer will typically provide financial assistance to the employee for their educational expenses as agreed upon.

Q: What happens if a tuition reimbursement request is denied?

A: If a tuition reimbursement request is denied, the employee may need to explore other options for funding their educational expenses, such as scholarships, loans, or personal savings.

Q: Is tuition reimbursement taxable?

A: Tuition reimbursement may be subject to taxes. It is recommended to consult with a tax professional or refer to IRS guidelines for more information.

Q: Can an employer set a limit on tuition reimbursement?

A: Yes, an employer may set a limit on the amount of tuition reimbursement an employee can receive. This limit is usually determined by company policy or budget constraints.