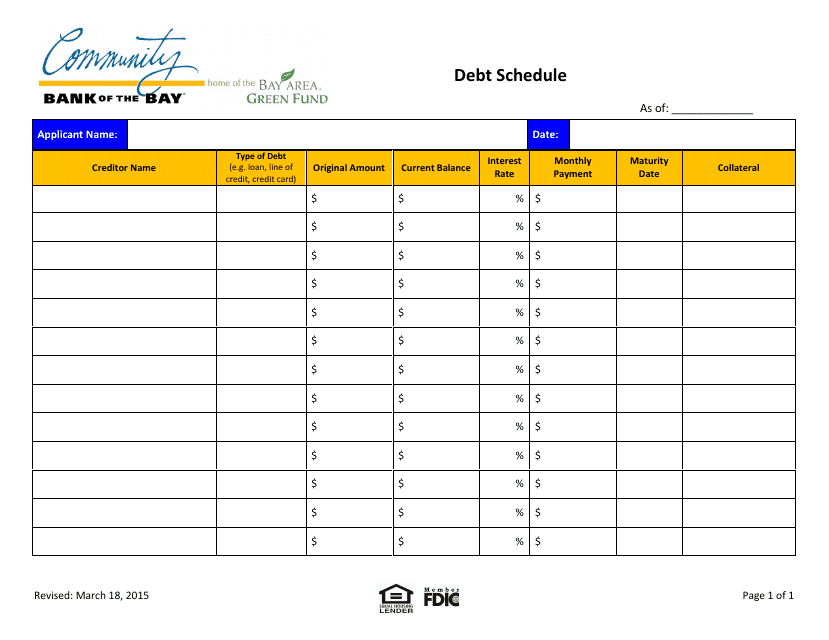

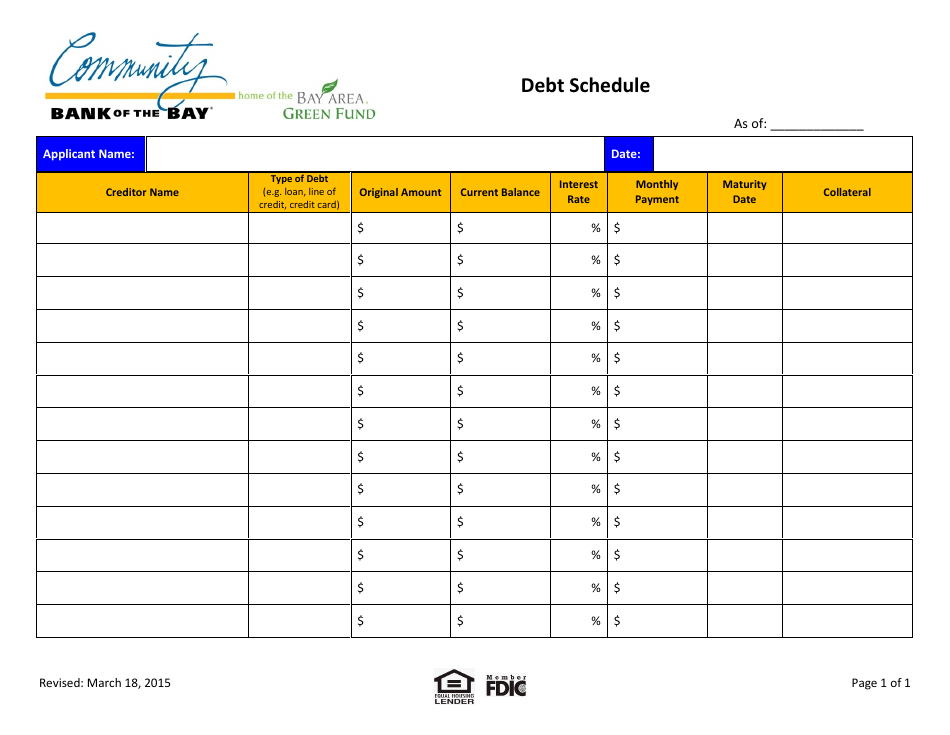

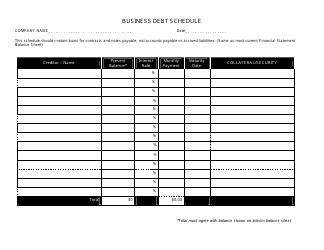

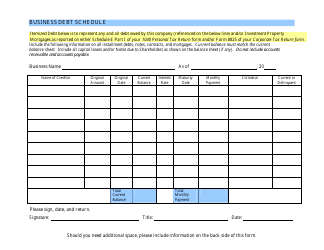

Debt Schedule Template - Community Bank of the Bay

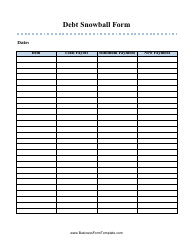

The Debt Schedule Template - Community Bank of the Bay is a tool used by the bank to manage and track their debt obligations. It helps them organize and monitor their loan repayments and interest payments.

FAQ

Q: What is a debt schedule?

A: A debt schedule is a table that outlines a company's debt obligations over a specific period of time.

Q: Why is a debt schedule important?

A: A debt schedule helps to track and manage a company's debt, including principal and interest payments.

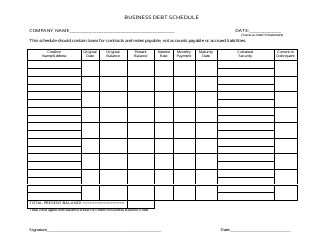

Q: What information is included in a debt schedule?

A: A debt schedule includes details of each debt, such as the principal amount, interest rate, repayment period, and payment schedule.

Q: How can a debt schedule help a company?

A: A debt schedule helps a company understand its debt obligations, plan for future payments, and assess the impact of new debt on its financials.

Q: What is Community Bank of the Bay?

A: Community Bank of the Bay is a bank that serves local communities in the Bay Area of California.

Q: Can I use the Community Bank of the Bay debt schedule template for other banks?

A: The Community Bank of the Bay debt schedule template is specifically designed for their customers. It may not align with the requirements of other banks.