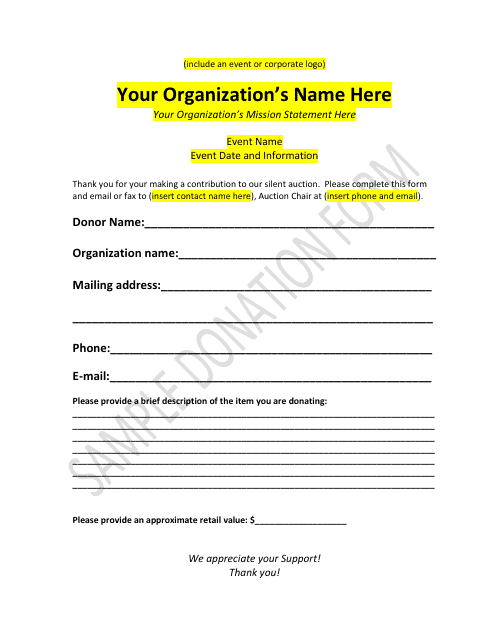

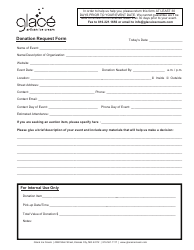

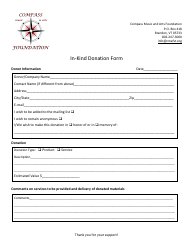

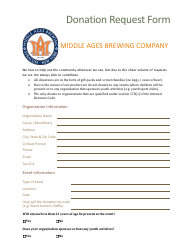

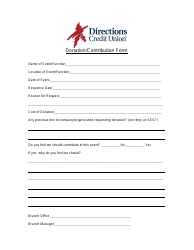

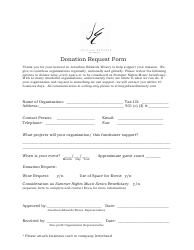

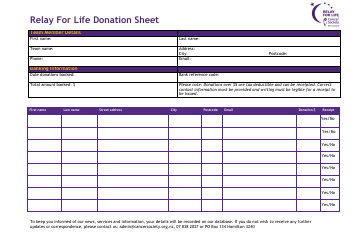

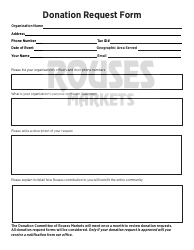

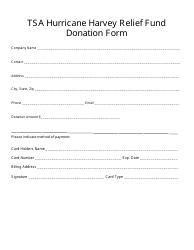

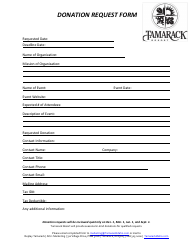

Donation Form - Sample

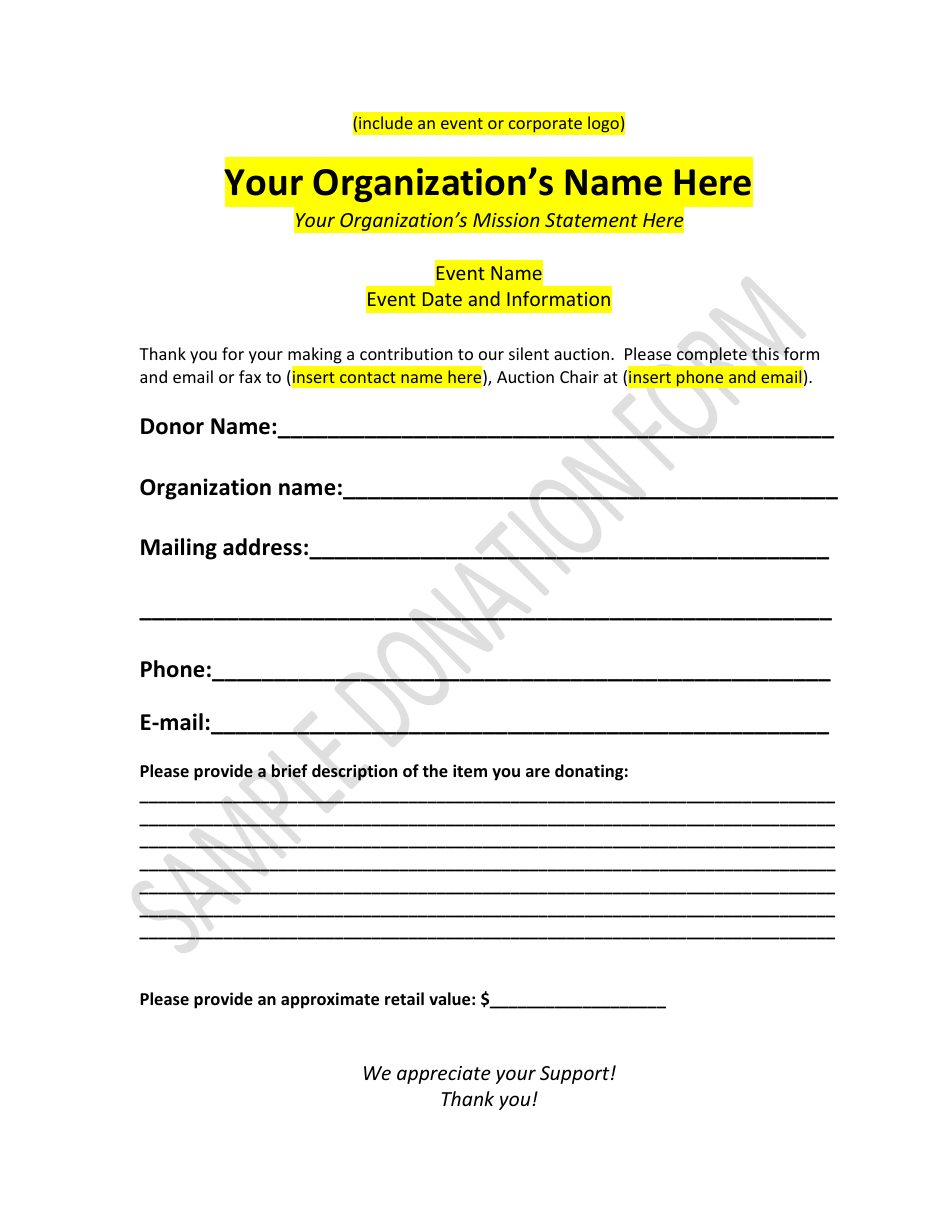

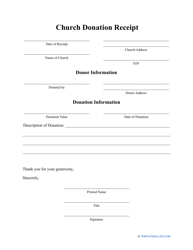

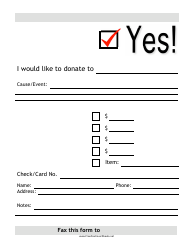

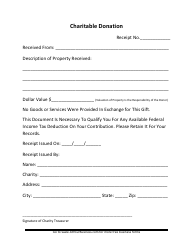

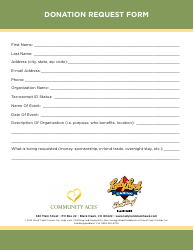

A donation form is a document used to collect information from individuals or organizations who wish to donate money or resources to a specific cause or organization. It helps facilitate the donation process by gathering important details such as the donor's contact information, donation amount, and any special instructions or preferences. The sample donation form serves as a template or example for creating customized donation forms.

The donor files the donation form.

FAQ

Q: How do I fill out a donation form?

A: Fill out the required information on the form, including your name, contact information, and donation amount.

Q: What information is typically required on a donation form?

A: Typically, donation forms require your name, address, email address, donation amount, and payment information.

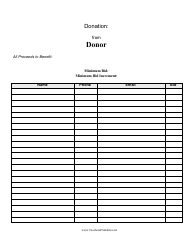

Q: Is my donation tax-deductible?

A: In most cases, donations to registered nonprofit organizations are tax-deductible. However, it's always best to consult with a tax professional or the organization itself to confirm.

Q: Can I request a receipt for my donation?

A: Yes, most organizations will provide a receipt for your donation upon request. This receipt can be used for tax purposes or for your own records.

Q: Can I donate anonymously?

A: Some organizations may offer the option to donate anonymously. Check with the organization to see if this is possible.

Q: How can I cancel or modify a donation made through a donation form?

A: If you need to cancel or modify a donation made through a donation form, it's best to contact the organization directly as soon as possible. They will be able to assist you with any necessary changes.

Q: Are there any fees associated with donating through a donation form?

A: Some organizations may charge a processing fee or administrative fee for accepting donations. Check with the organization to see if any fees apply to your donation.