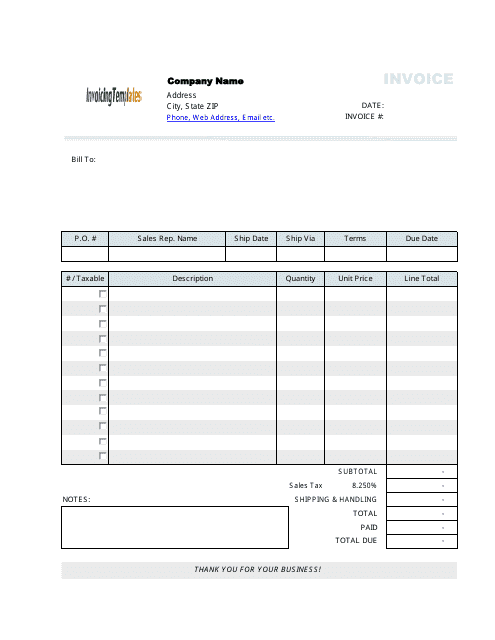

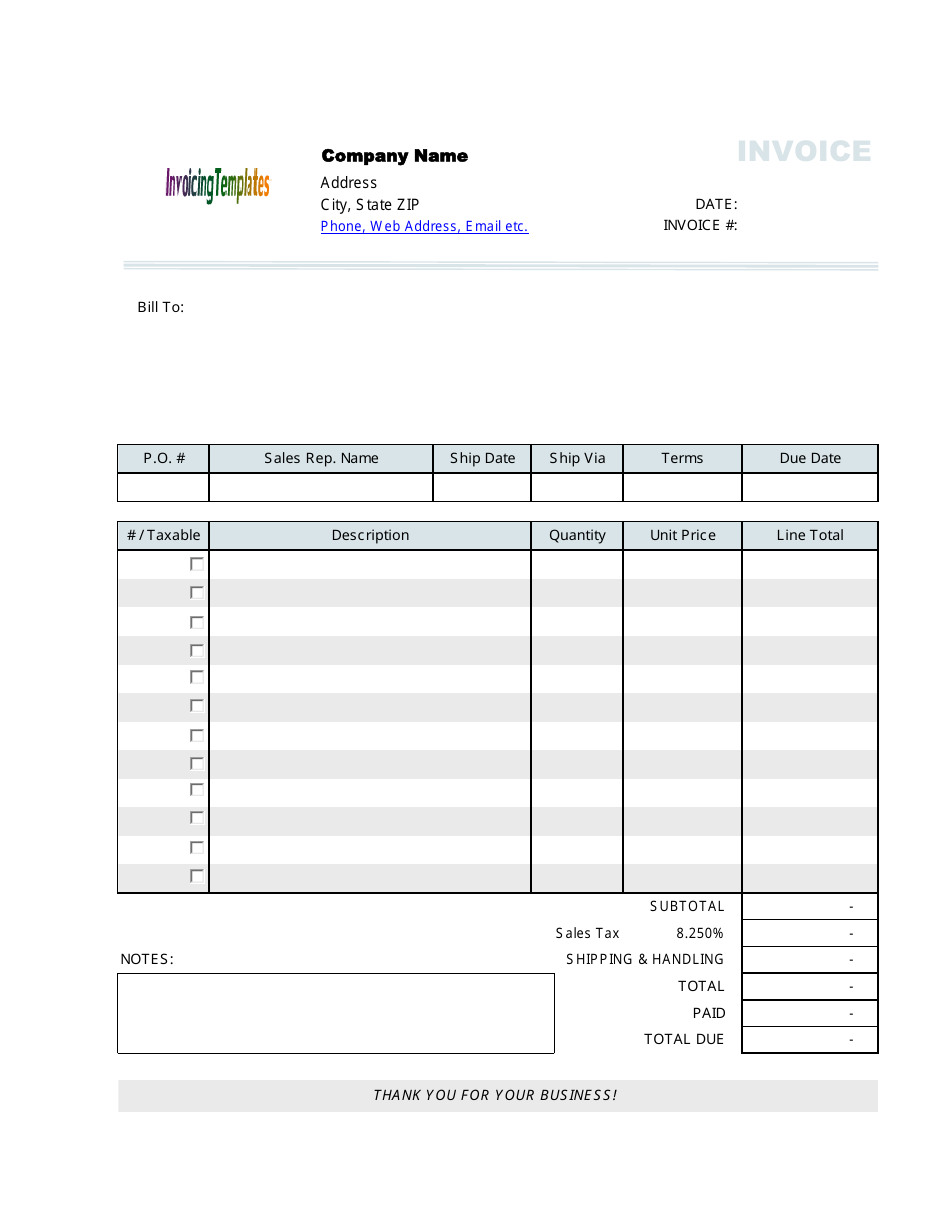

Billing Invoice Template With Profit and Taxable Column

A Billing Invoice Template with Profit and Taxable Column is used to generate invoices for goods or services provided. The profit column allows for calculating the profit margins, and the taxable column is used to record any applicable taxes on the invoice.

The billing invoice template with profit and taxable columns is typically filed by the person or company that is providing the goods or services and is issuing the invoice.

FAQ

Q: What is a billing invoice template?

A: A billing invoice template is a pre-designed document that helps individuals or businesses create professional and detailed invoices for their products or services.

Q: What is a profit column in a billing invoice template?

A: The profit column in a billing invoice template is used to calculate the profit made from a specific product or service. It shows the total revenue minus the cost of producing or delivering the product or service.

Q: What is a taxable column in a billing invoice template?

A: The taxable column in a billing invoice template is used to indicate whether a product or service is subject to sales tax. It helps in calculating the total amount of tax that needs to be added to the invoice.

Q: Why is it important to include a profit column in a billing invoice template?

A: Including a profit column in a billing invoice template helps businesses track and monitor their profitability by clearly showing the revenue and costs associated with each product or service.

Q: Why is it important to include a taxable column in a billing invoice template?

A: Including a taxable column in a billing invoice template helps businesses comply with tax regulations by clearly indicating which products or services are taxable and the corresponding tax amount.