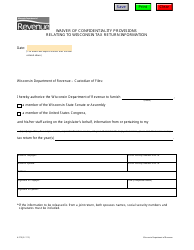

This version of the form is not currently in use and is provided for reference only. Download this version of

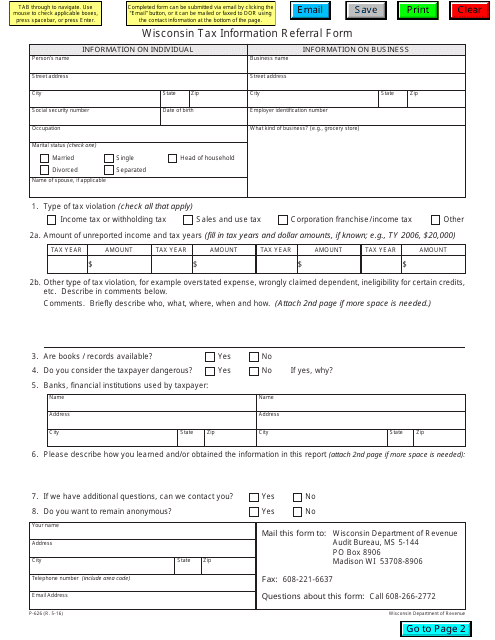

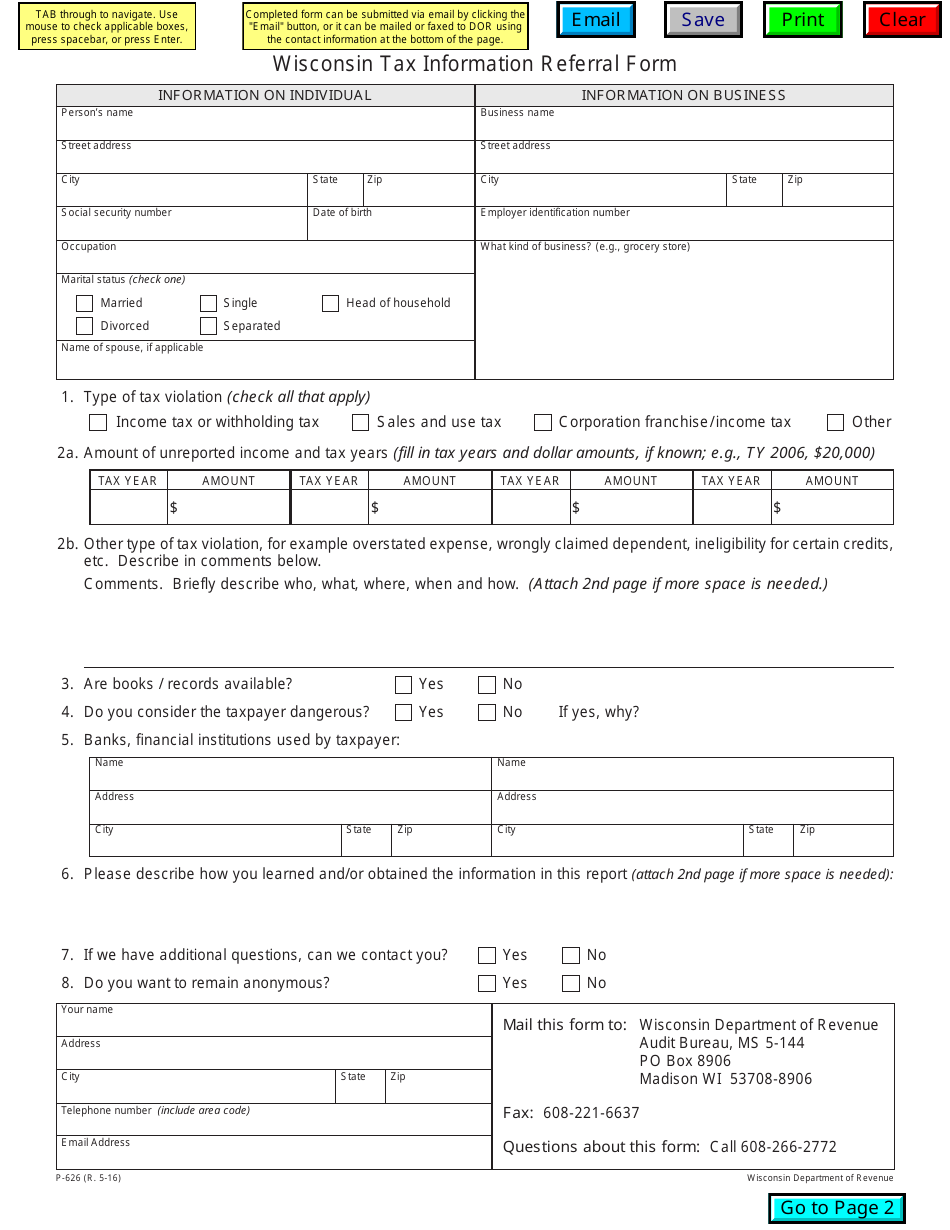

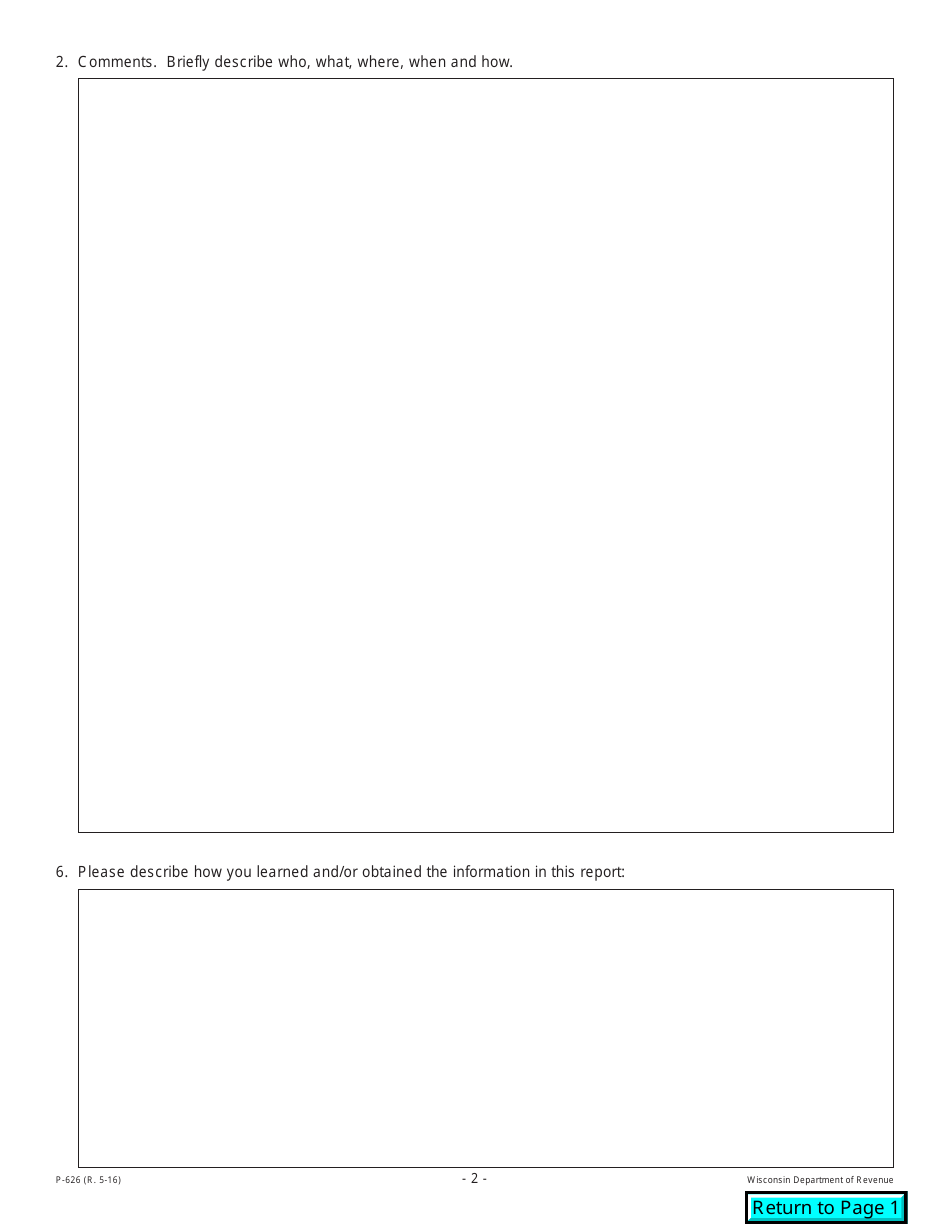

Form P-626

for the current year.

Form P-626 Wisconsin Tax Information Referral Form - Wisconsin

What Is Form P-626?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form P-626?

A: Form P-626 is the Wisconsin Tax Information Referral Form.

Q: Who should use Form P-626?

A: Form P-626 should be used by individuals or businesses who need to request specific tax information from the Wisconsin Department of Revenue.

Q: What information can be requested using Form P-626?

A: Any specific tax information can be requested using Form P-626, such as copies of tax returns, tax payment history, or other related documents.

Q: How do I submit Form P-626?

A: Form P-626 can be submitted by mail or fax to the Wisconsin Department of Revenue. The contact information can be found on the form itself.

Q: Is there a fee for submitting Form P-626?

A: There is no fee for submitting Form P-626. However, there may be fees associated with obtaining specific tax information.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form P-626 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.