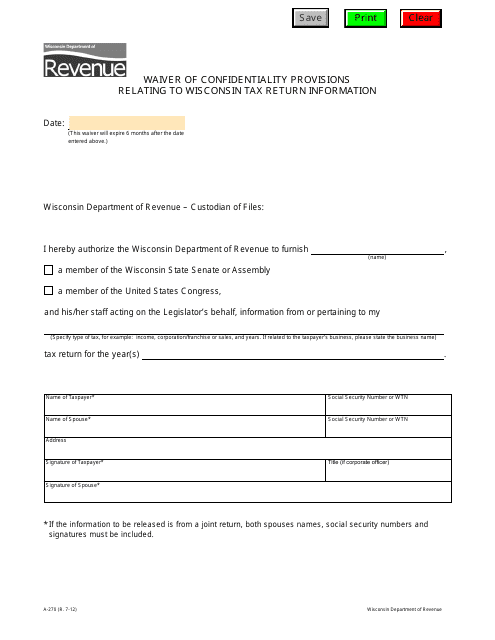

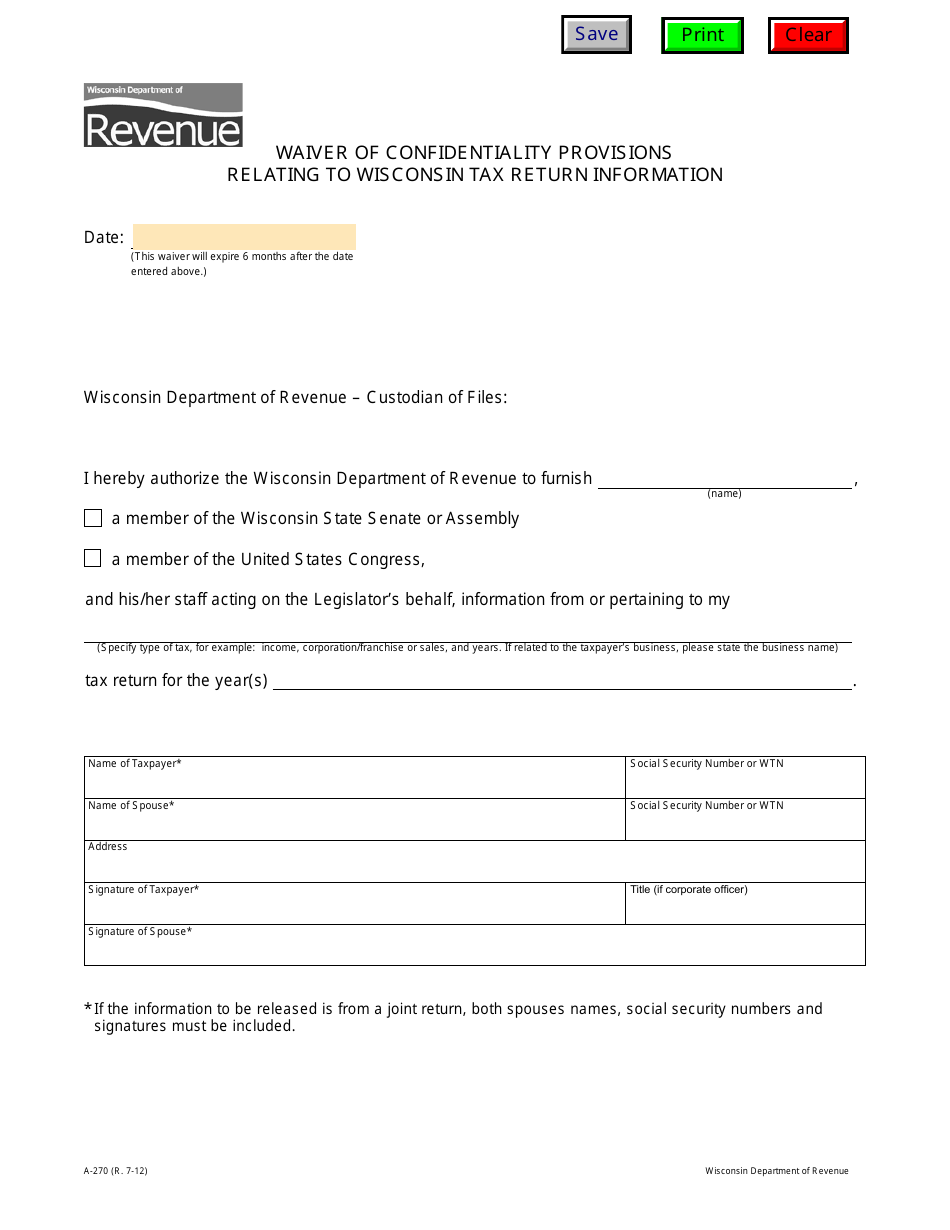

Form A-270 Waiver of Confidentiality Provisions Relating to Wisconsin Tax Return Information - Wisconsin

What Is Form A-270?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-270?

A: Form A-270 is a waiver of confidentiality provisions relating to Wisconsin tax return information.

Q: What is the purpose of Form A-270?

A: The purpose of Form A-270 is to allow the disclosure of Wisconsin tax return information to a third party.

Q: Who may use Form A-270?

A: Any individual or entity who wants to disclose their Wisconsin tax return information to a third party may use Form A-270.

Q: What information is required on Form A-270?

A: Form A-270 requires the taxpayer's name, social security number or employer identification number, and a description of the tax return information to be disclosed.

Q: Is there a deadline for submitting Form A-270?

A: There is no specific deadline for submitting Form A-270, but it is recommended to submit it in a timely manner before the requested disclosure.

Q: Can I revoke my waiver of confidentiality?

A: Yes, you may revoke your waiver of confidentiality by submitting a written request to the Wisconsin Department of Revenue.

Q: Are there any fees associated with Form A-270?

A: There are no fees associated with Form A-270.

Q: Can the Wisconsin Department of Revenue deny my request for disclosure?

A: Yes, the Wisconsin Department of Revenue has the discretion to deny a request for disclosure if they determine it is not in the best interest of the taxpayer or the state.

Q: Is Form A-270 applicable to any other state's tax return information?

A: No, Form A-270 is specific to Wisconsin tax return information only.

Form Details:

- Released on July 1, 2012;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-270 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.