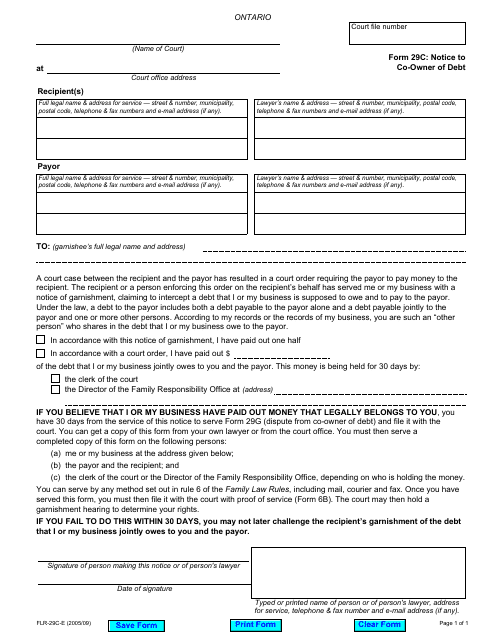

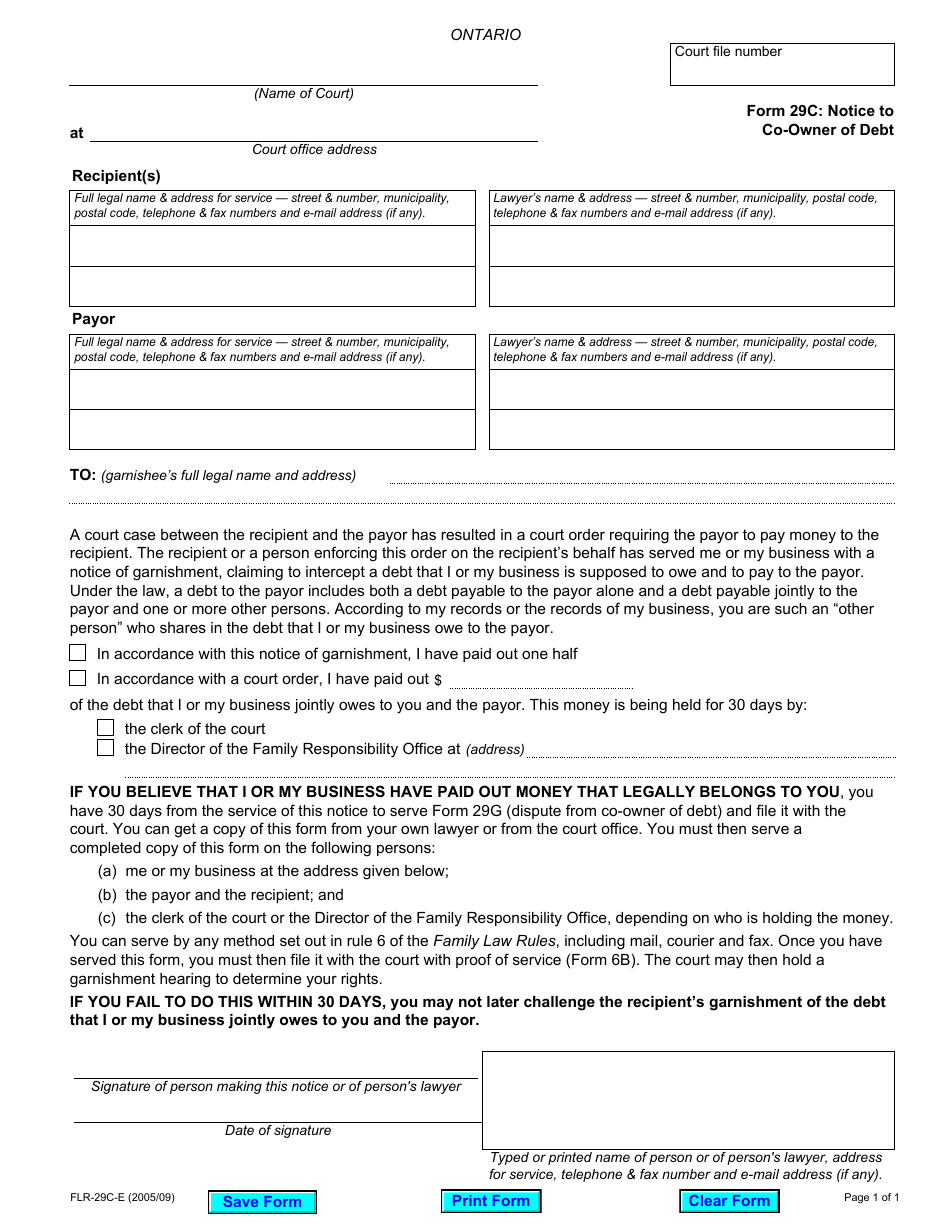

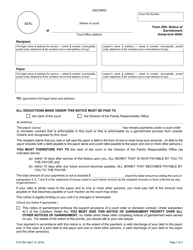

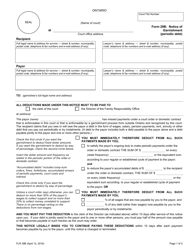

Form 29C Notice to Co-owner of Debt - Ontario, Canada

Form 29C, Notice to Co-owner of Debt, in Ontario, Canada, is used to inform a co-owner of a property about a debt owed by another co-owner.

The Form 29C Notice to Co-owner of Debt in Ontario, Canada is typically filed by the creditor, who is the person or entity owed money by the co-owner of the debt.

FAQ

Q: What is Form 29C?

A: Form 29C is a notice that is used in Ontario, Canada to inform a co-owner of a debt.

Q: Who uses Form 29C?

A: Form 29C is used by individuals or businesses in Ontario, Canada who want to notify a co-owner of a debt.

Q: What is the purpose of Form 29C?

A: The purpose of Form 29C is to provide a written notice to a co-owner of a debt, informing them of their liability and giving them an opportunity to dispute the debt.

Q: How should Form 29C be delivered?

A: Form 29C should be delivered to the co-owner by registered mail or in person, ensuring that there is proof of delivery.

Q: What information should be included in Form 29C?

A: Form 29C should include details about the debt, including the amount owed, the reason for the debt, and any supporting documents.

Q: What should the co-owner do after receiving Form 29C?

A: The co-owner should carefully review the notice, consult with legal counsel if necessary, and respond to the notice within the specified time period if they wish to dispute the debt.