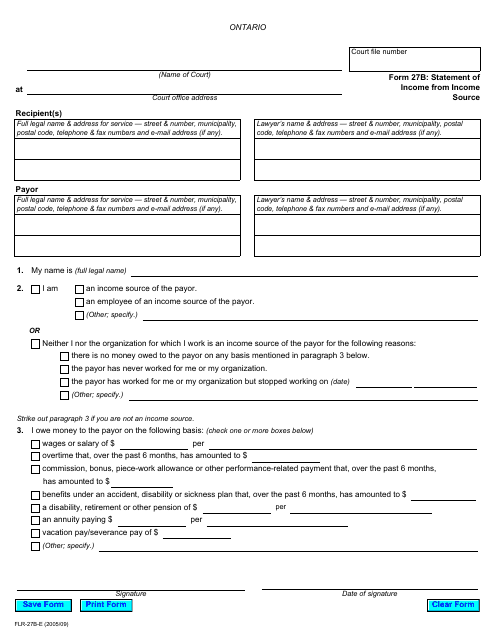

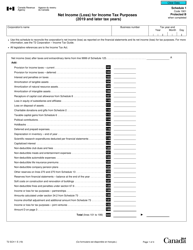

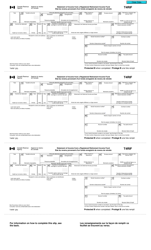

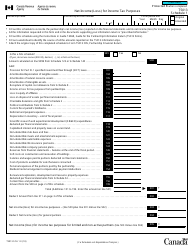

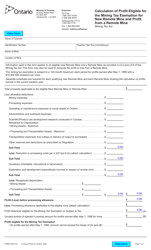

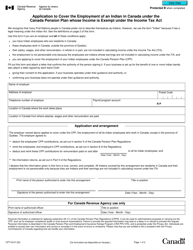

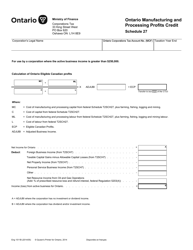

Form 27B Statement of Income From Income Source - Ontario, Canada

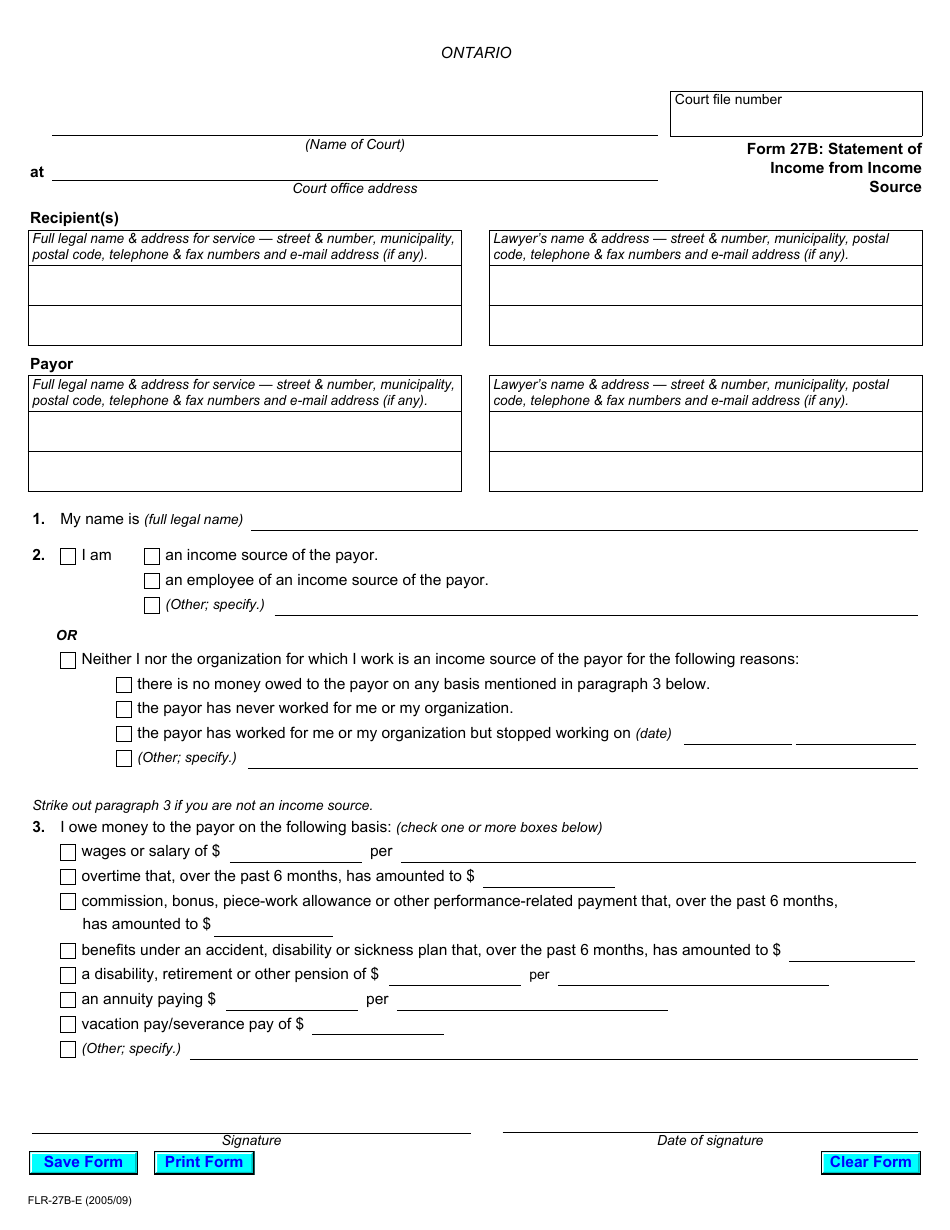

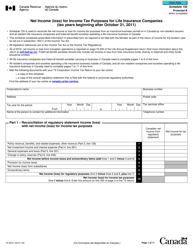

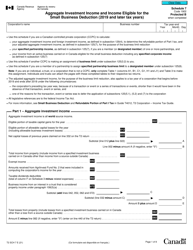

Form 27B Statement of Income From Income Source in Ontario, Canada is used to report income from various sources for tax purposes. It provides information about the income earned by an individual or business in Ontario, which is needed for calculating taxes owed to the government.

Individuals who have income from an Ontario source are required to file the Form 27B Statement of Income From Income Source in Ontario, Canada.

FAQ

Q: What is Form 27B?

A: Form 27B is a statement of income from an income source in Ontario, Canada.

Q: Who needs to file Form 27B?

A: Anyone who has income from an income source in Ontario, Canada needs to file Form 27B.

Q: When is Form 27B due?

A: Form 27B is generally due on or before April 30th of the following year.

Q: Can I e-file Form 27B?

A: Yes, you can e-file Form 27B using approved tax filing software.

Q: What information is required in Form 27B?

A: Form 27B requires information about your income source, including the amount of income earned.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing, so it's important to file on time.