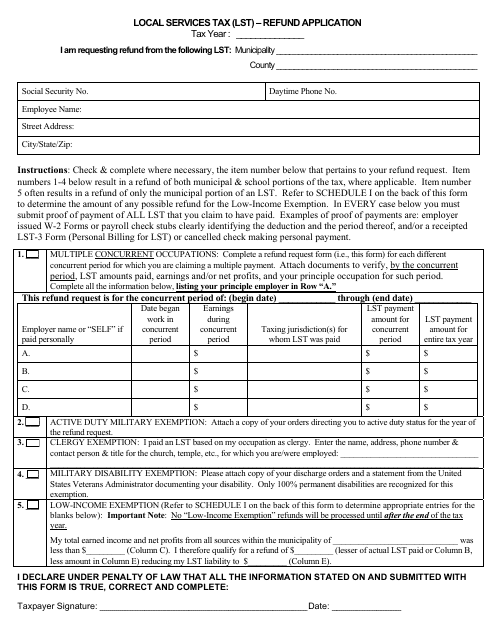

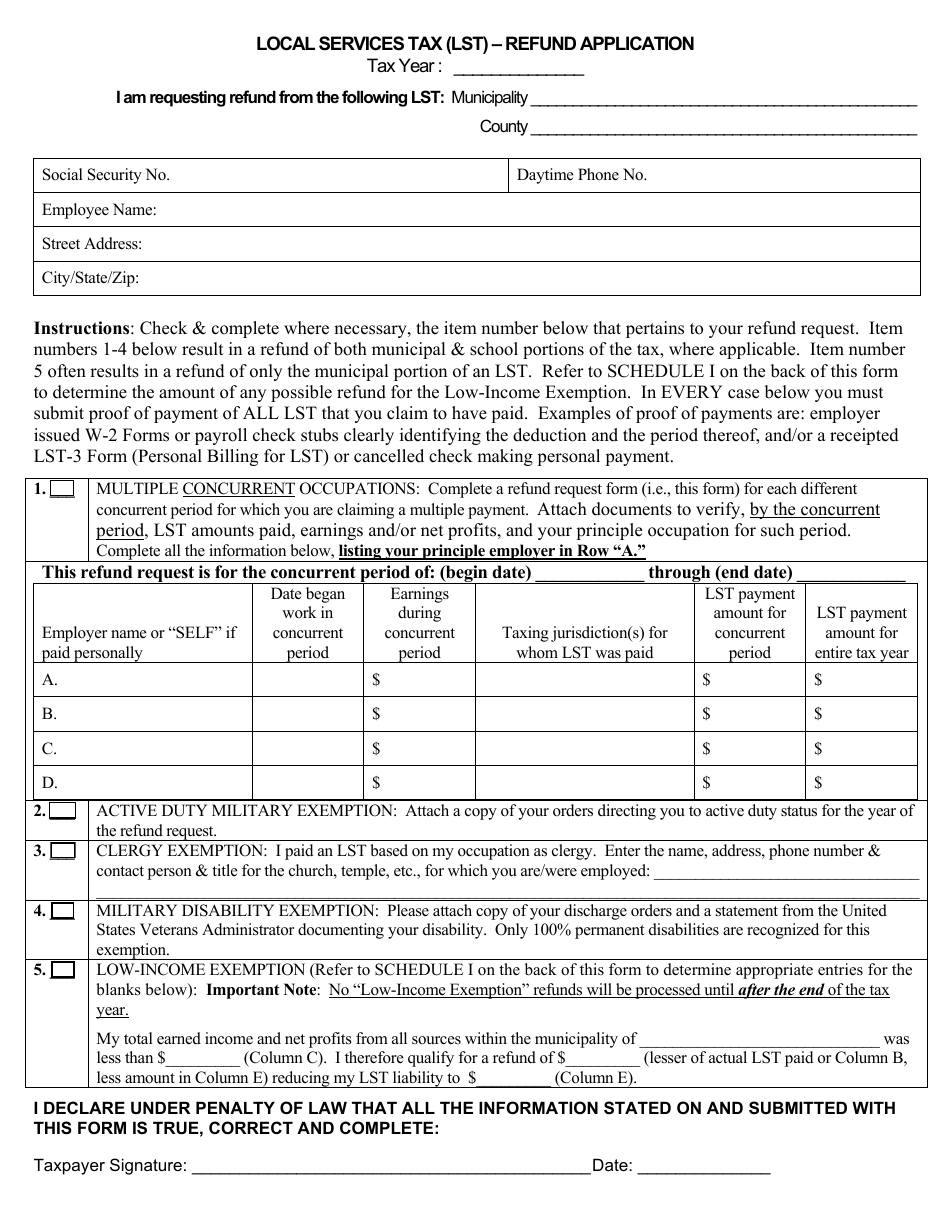

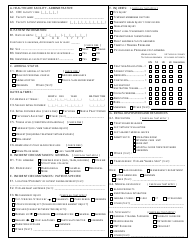

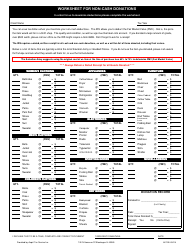

Local Services Tax (Lst) - Refund Application Form

The Local Services Tax (LST) - Refund Application Form is used to request a refund of the LST that was mistakenly withheld from your paycheck or paid by mistake.

The answer may vary depending on the specific local jurisdiction. In some cases, the employer may file the Local Services Tax (LST) refund application form on behalf of the employee. In other cases, the individual employee may need to file the form themselves. It is recommended to check with the local tax authorities or consult the specific guidelines for the jurisdiction in question to determine who is responsible for filing the LST refund application form.

FAQ

Q: What is the Local Services Tax (LST)?

A: The Local Services Tax (LST) is a tax imposed by certain local governments on individuals who work within their jurisdiction.

Q: Who is eligible for a refund of the Local Services Tax?

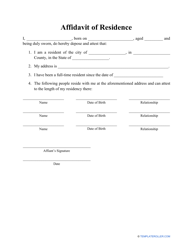

A: Individuals who had multiple employers or only worked part of the year in a local jurisdiction that imposes the LST may be eligible for a refund.

Q: How can I apply for a refund of the Local Services Tax?

A: To apply for a refund of the Local Services Tax, you will need to complete and submit a Refund Application Form to the appropriate local tax office.

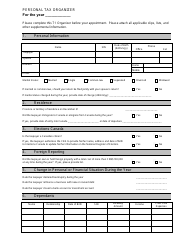

Q: What information do I need to provide on the Refund Application Form?

A: The Refund Application Form will typically require you to provide details about your employment, income, and residency status.

Q: When is the deadline to submit the Refund Application Form for the Local Services Tax?

A: The deadline to submit the Refund Application Form for the Local Services Tax varies depending on the jurisdiction, so it is important to check with the relevant local tax office.

Q: How long does it take to receive a refund of the Local Services Tax?

A: The processing time for a refund of the Local Services Tax can vary, but it is typically a few weeks to a few months.