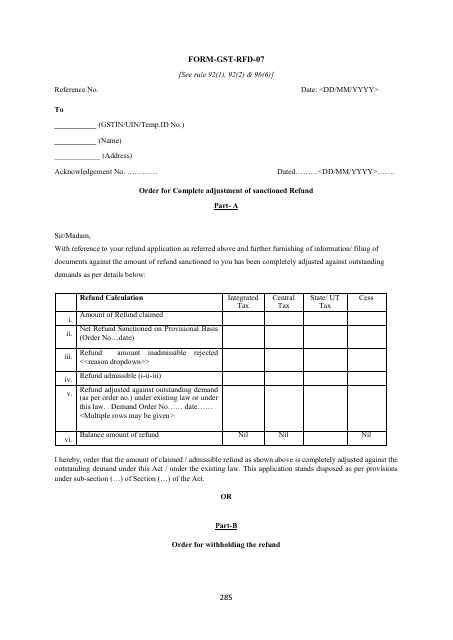

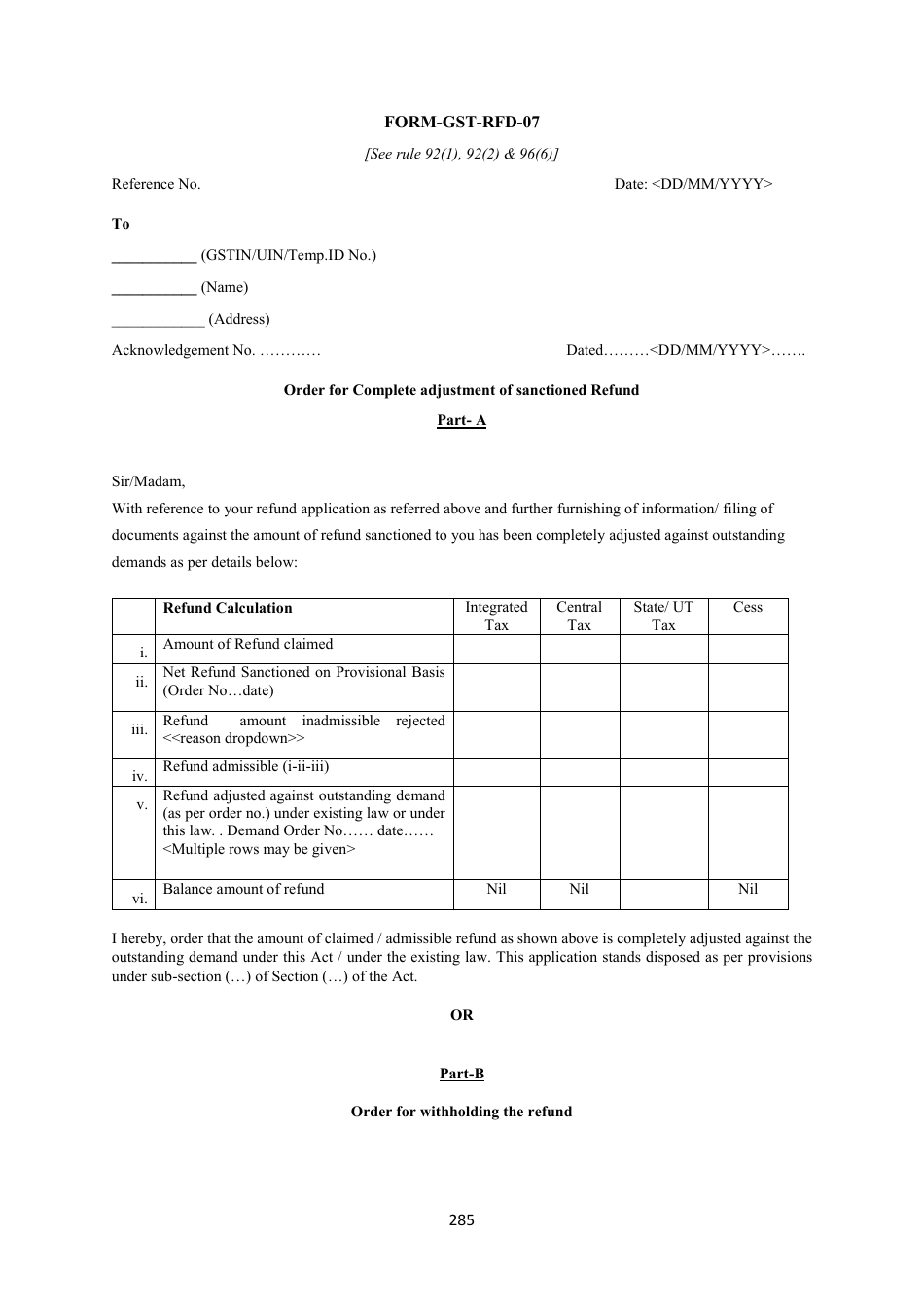

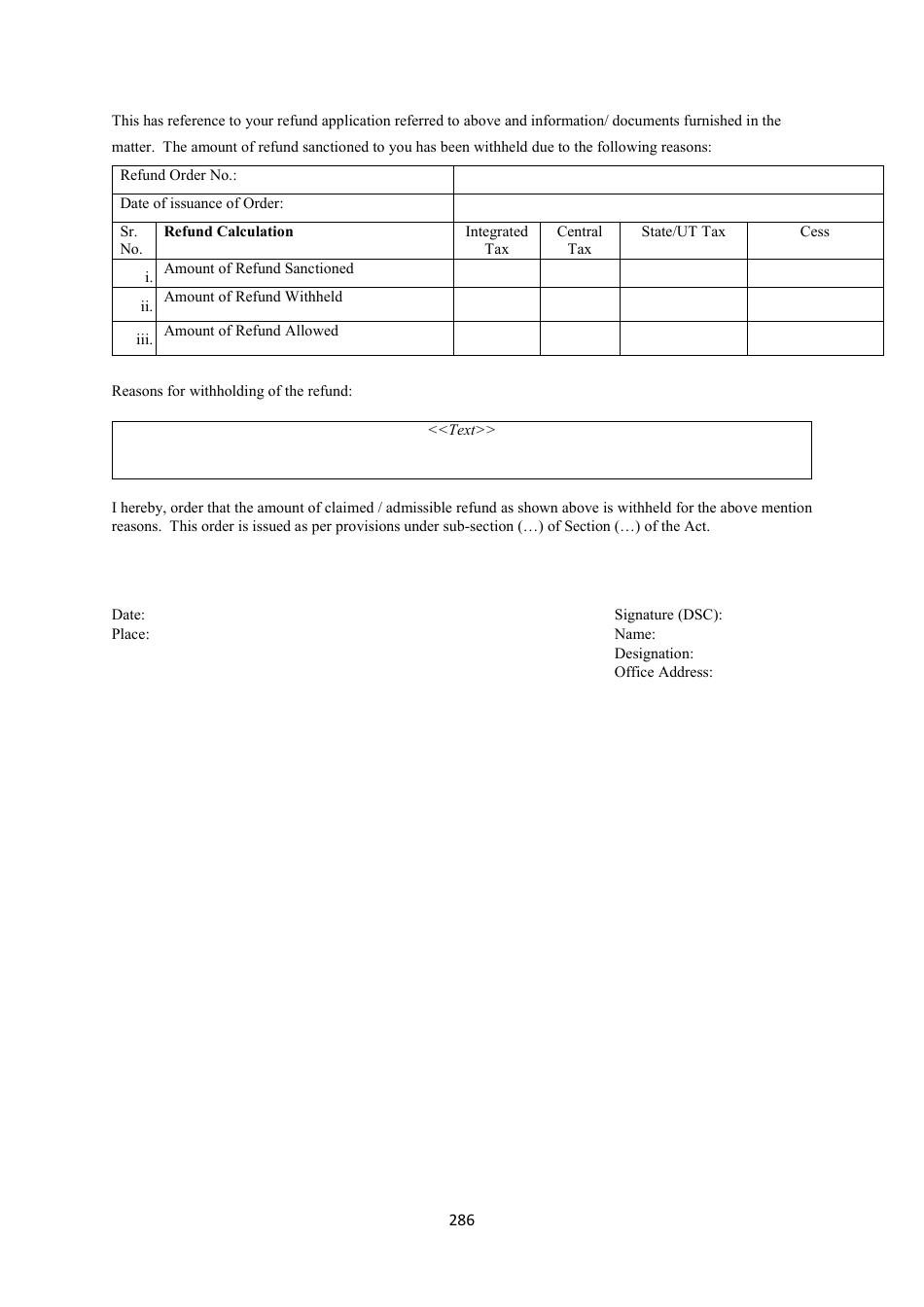

Form GST-RFD-07 Order for Complete Adjustment of Sanctioned Refund - Karnataka, India

Form GST-RFD-07 is used in the state of Karnataka, India for the purpose of making a complete adjustment of the sanctioned refund. This form is utilized in cases where the refund amount sanctioned to a taxpayer needs to be adjusted against any outstanding dues or liabilities of the taxpayer. It allows for the proper adjustment and reconciliation of the refund amount with the taxpayer's outstanding obligations.

The Form GST-RFD-07 Order for Complete Adjustment of Sanctioned Refund in Karnataka, India is typically filed by the registered taxpayer who is entitled to the refund.

FAQ

Q: What is Form GST-RFD-07?

A: Form GST-RFD-07 is a document used in the state of Karnataka, India for the complete adjustment of a sanctioned refund under the Goods and Services Tax (GST) system.

Q: What is the purpose of Form GST-RFD-07?

A: The purpose of Form GST-RFD-07 is to request the complete adjustment of a sanctioned refund, which means utilizing the refund amount for the payment of any existing tax liabilities or other dues.

Q: Who needs to fill out Form GST-RFD-07?

A: Form GST-RFD-07 should be filled out by a registered taxpayer in Karnataka, India, who has received a sanctioned refund and wishes to utilize the refund amount for the adjustment of tax liabilities or dues.

Q: What information is required to fill out Form GST-RFD-07?

A: To fill out Form GST-RFD-07, you will need to provide details such as your GSTIN (Goods and Services Tax Identification Number), legal name, trade name (if any), the amount of sanctioned refund, and the amount to be adjusted towards tax liabilities or dues.

Q: Is there a deadline for submitting Form GST-RFD-07?

A: Yes, there is a deadline for submitting Form GST-RFD-07. The specific deadline may be mentioned in the sanction order for refund, and it is important to submit the form within the given timeframe to ensure timely adjustment of the refund.

Q: Can I make partial adjustment of a sanctioned refund using Form GST-RFD-07?

A: No, Form GST-RFD-07 is specifically used for the complete adjustment of a sanctioned refund. If you wish to make a partial adjustment, you need to explore other options or consult with the appropriate tax authorities.