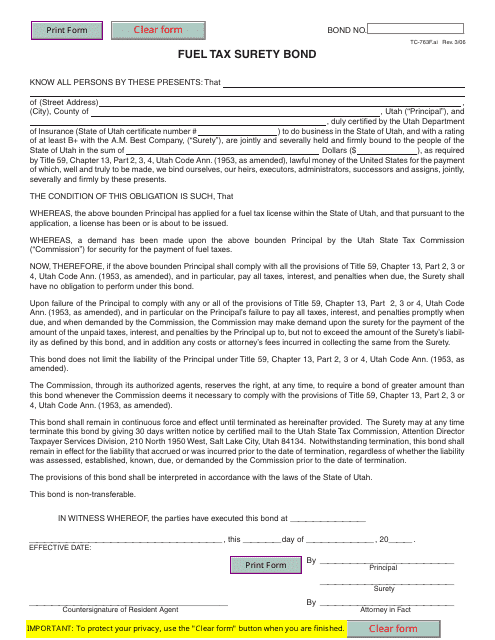

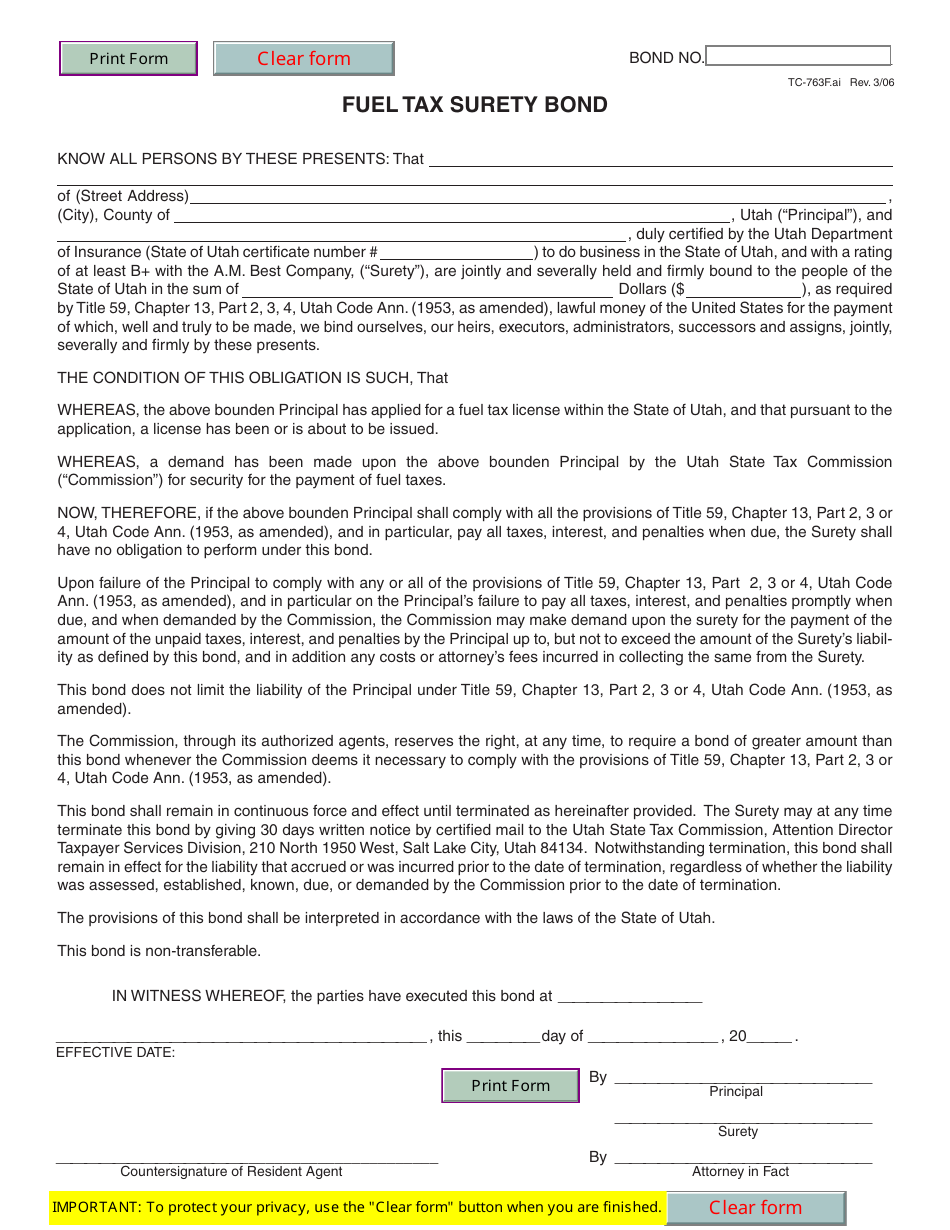

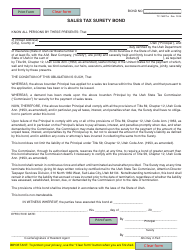

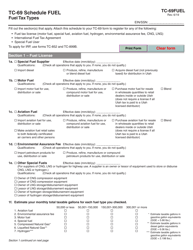

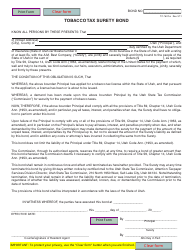

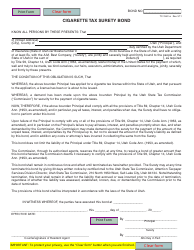

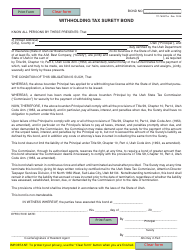

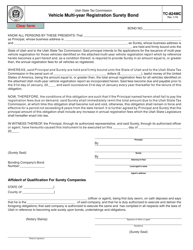

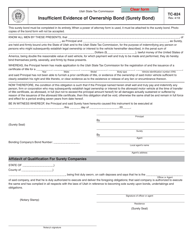

Form TC-763F Fuel Tax Surety Bond - Utah

What Is Form TC-763F?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a TC-763F Fuel Tax Surety Bond?

A: A TC-763F Fuel Tax Surety Bond is a type of bond required by the state of Utah for businesses that sell or distribute fuel.

Q: Why is a TC-763F Fuel Tax Surety Bond required?

A: The TC-763F Fuel Tax Surety Bond is required to ensure that businesses comply with the state's fuel tax laws and regulations.

Q: How does a TC-763F Fuel Tax Surety Bond work?

A: When a business obtains a TC-763F Fuel Tax Surety Bond, the bonding company guarantees to the state of Utah that the business will pay all fuel taxes owed.

Q: How much does a TC-763F Fuel Tax Surety Bond cost?

A: The cost of a TC-763F Fuel Tax Surety Bond varies depending on factors such as the business's credit history and the desired bond amount.

Q: How long is a TC-763F Fuel Tax Surety Bond valid?

A: A TC-763F Fuel Tax Surety Bond is typically valid for one year, but the specific duration may vary depending on the bonding company's terms.

Q: What happens if a business fails to pay fuel taxes?

A: If a business fails to pay the required fuel taxes, the state of Utah may make a claim against the TC-763F Fuel Tax Surety Bond to recover the unpaid taxes.

Q: Can a business cancel a TC-763F Fuel Tax Surety Bond?

A: Yes, a business can typically cancel a TC-763F Fuel Tax Surety Bond by providing written notice to the bonding company.

Q: Are there alternatives to a TC-763F Fuel Tax Surety Bond?

A: In some cases, businesses may be able to use cash deposits or irrevocable letters of credit as an alternative to a TC-763F Fuel Tax Surety Bond.

Q: Who should I contact for more information about a TC-763F Fuel Tax Surety Bond?

A: For more information about the TC-763F Fuel Tax Surety Bond, you should contact the Utah State Tax Commission or a licensed surety bond company.

Form Details:

- Released on March 1, 2006;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-763F by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.