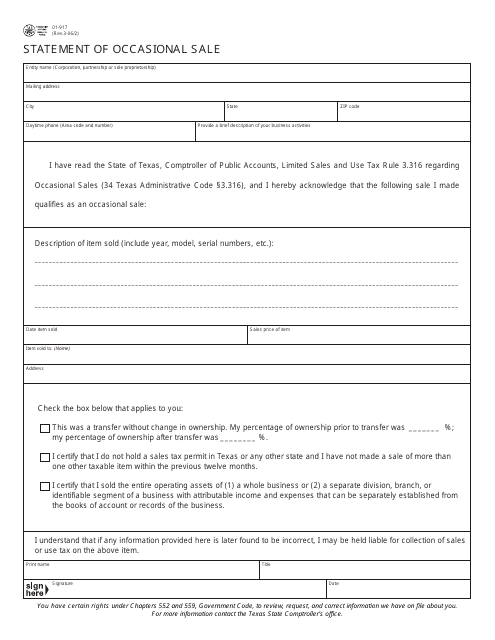

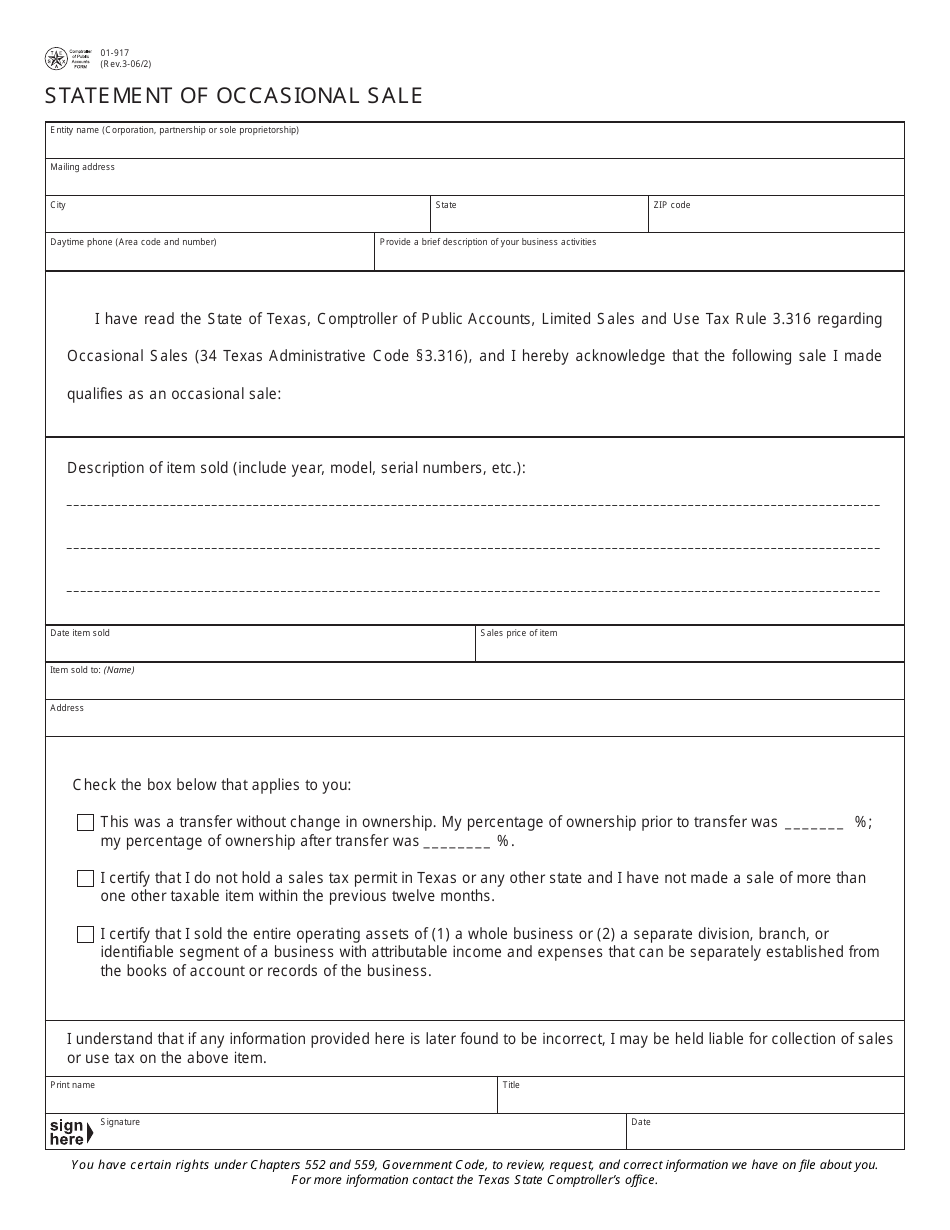

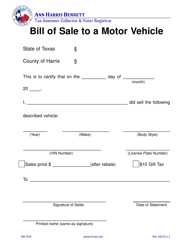

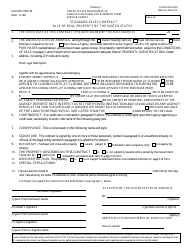

Form 01-917 Statement of Occasional Sale - Texas

What Is Form 01-917?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 01-917?

A: Form 01-917 is the Statement of Occasional Sale form used in Texas.

Q: When is Form 01-917 used?

A: Form 01-917 is used to report occasional sales of tangible personal property in Texas.

Q: What is considered an occasional sale?

A: An occasional sale is a one-time or infrequent sale of tangible personal property by a person who is not engaged in the business of selling that type of property.

Q: Who needs to file Form 01-917?

A: Anyone who is not regularly engaged in the business of selling tangible personal property but makes an occasional sale in Texas needs to file this form.

Q: What information is required on Form 01-917?

A: The form requires information about the seller, buyer, and details of the sale, including the date, description of the property, and sale amount.

Q: Is there a deadline for filing Form 01-917?

A: Yes, Form 01-917 must be filed within 30 days of the date of the occasional sale.

Form Details:

- Released on March 1, 2006;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-917 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.