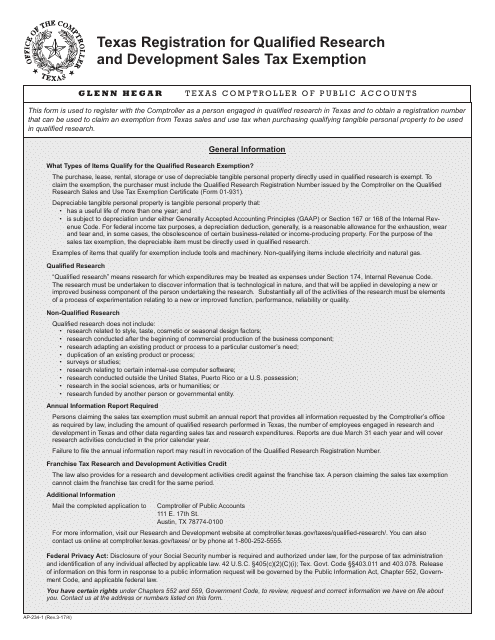

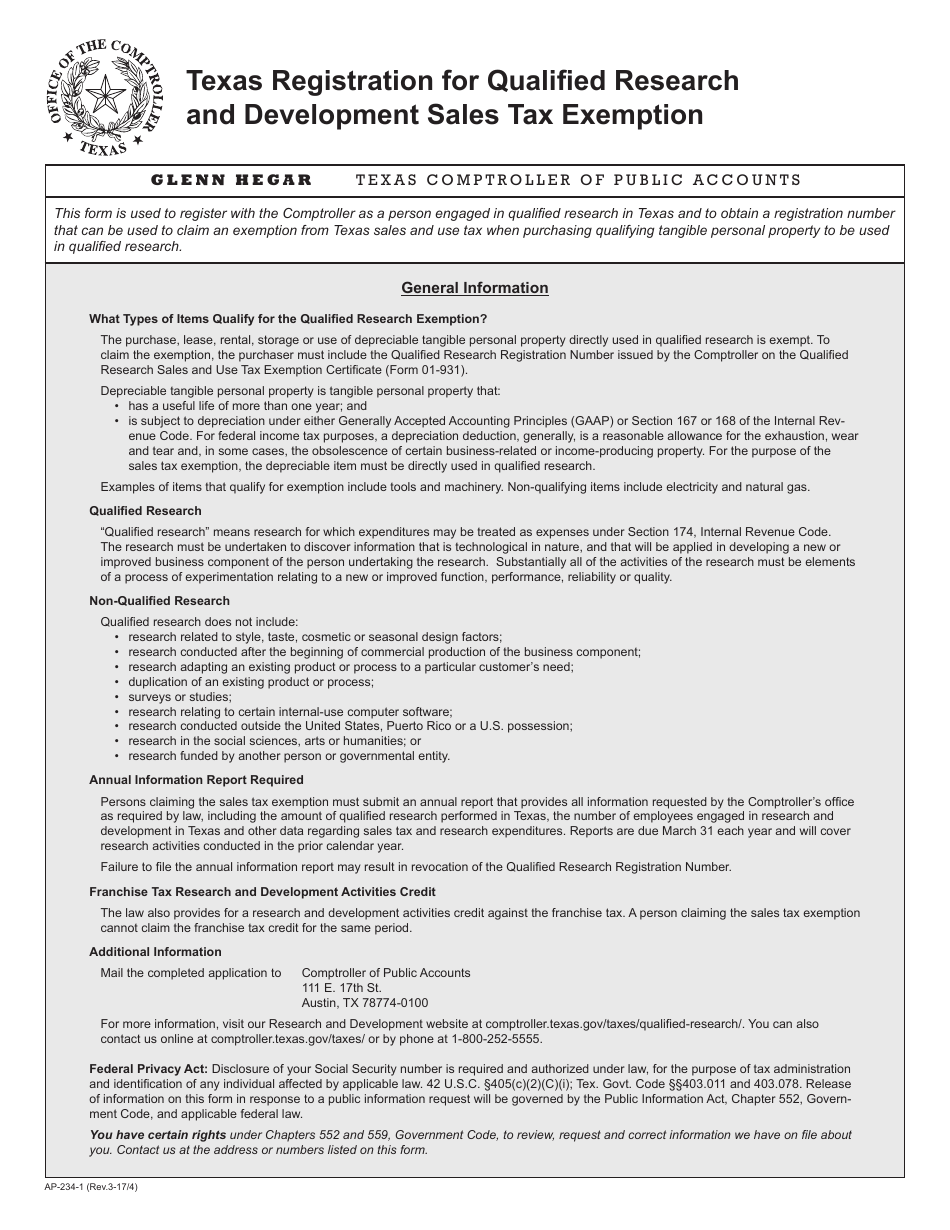

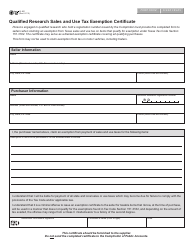

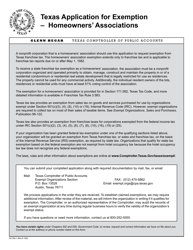

Form AP-234 Texas Registration for Qualified Research and Development Sales Tax Exemption - Texas

What Is Form AP-234?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AP-234?

A: Form AP-234 is the Texas Registration for Qualified Research and Development Sales Tax Exemption.

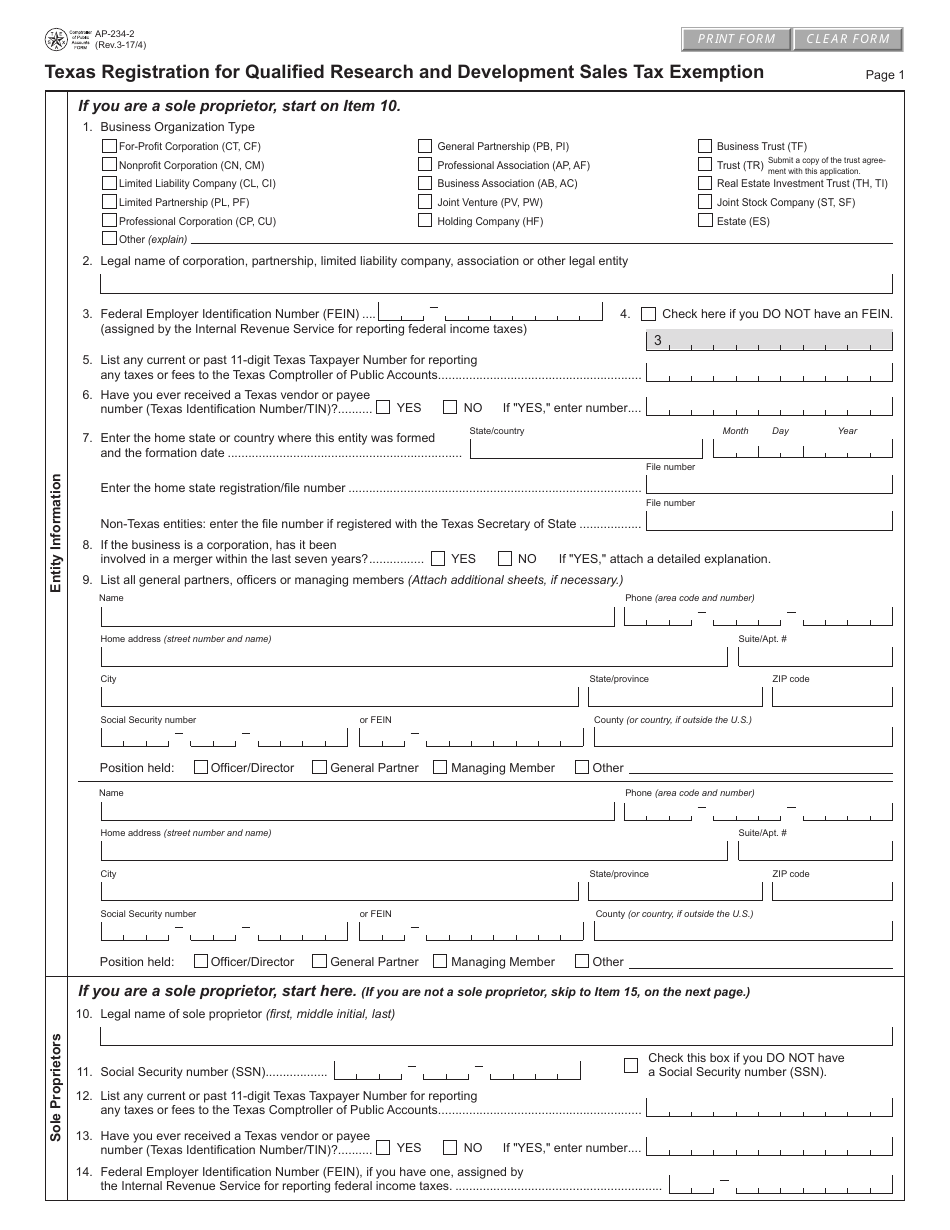

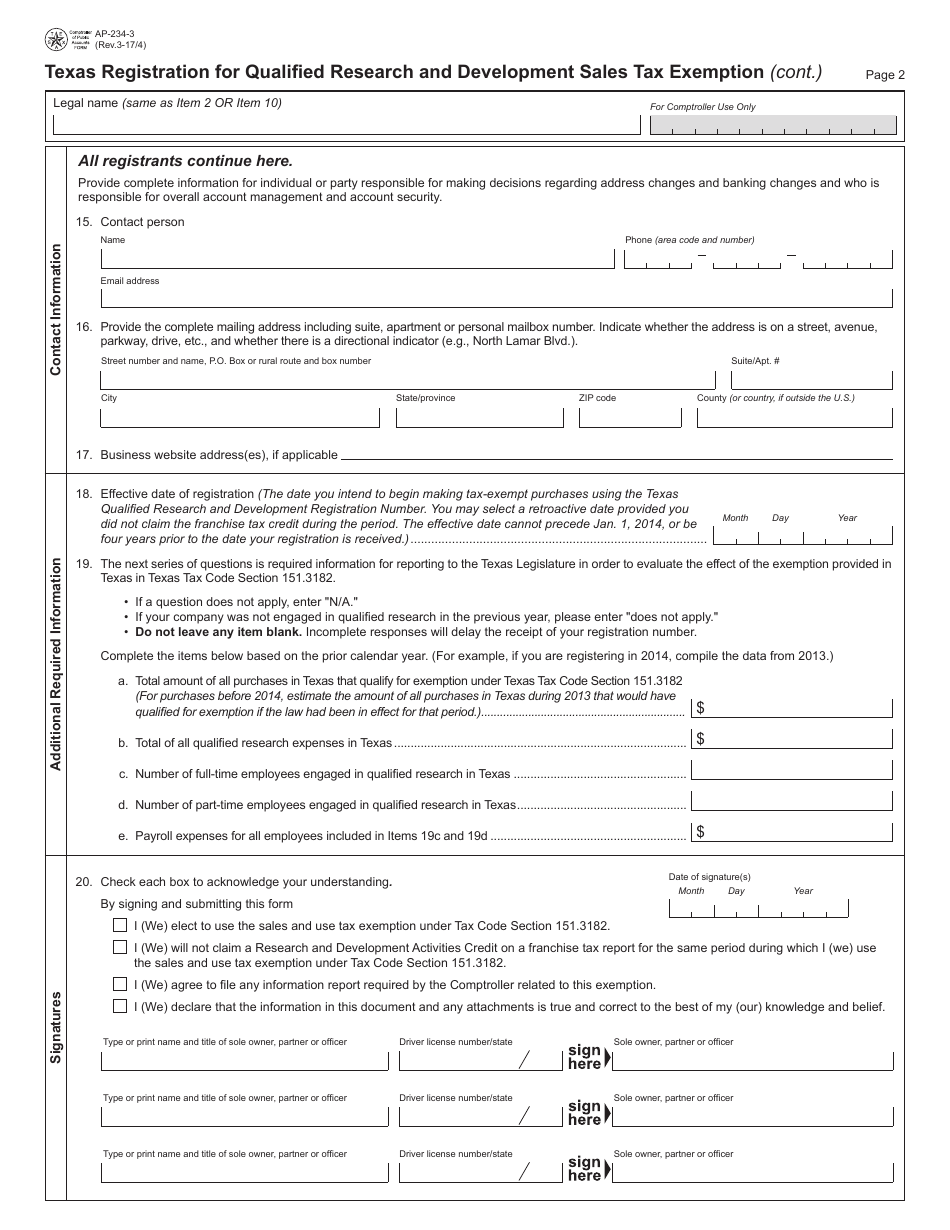

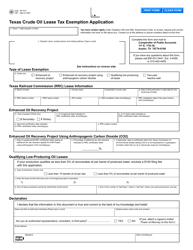

Q: Who is eligible to use Form AP-234?

A: Entities engaged in qualified research and development activities in Texas are eligible to use Form AP-234.

Q: What is the purpose of Form AP-234?

A: The purpose of Form AP-234 is to register for the qualified research and development sales tax exemption in Texas.

Q: What is the qualified research and development sales tax exemption?

A: The qualified research and development sales tax exemption allows eligible entities to exempt sales or use tax on qualified research and development equipment.

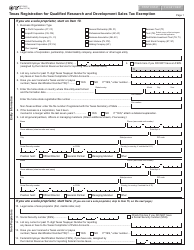

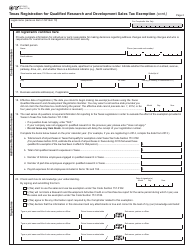

Q: How do I complete Form AP-234?

A: You need to provide your entity information, description of your qualified research and development activities, and details of the equipment to be exempted.

Q: Are there any deadlines for filing Form AP-234?

A: There are no specific deadlines mentioned for filing Form AP-234. However, it is recommended to file it as soon as possible to ensure timely processing.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-234 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.