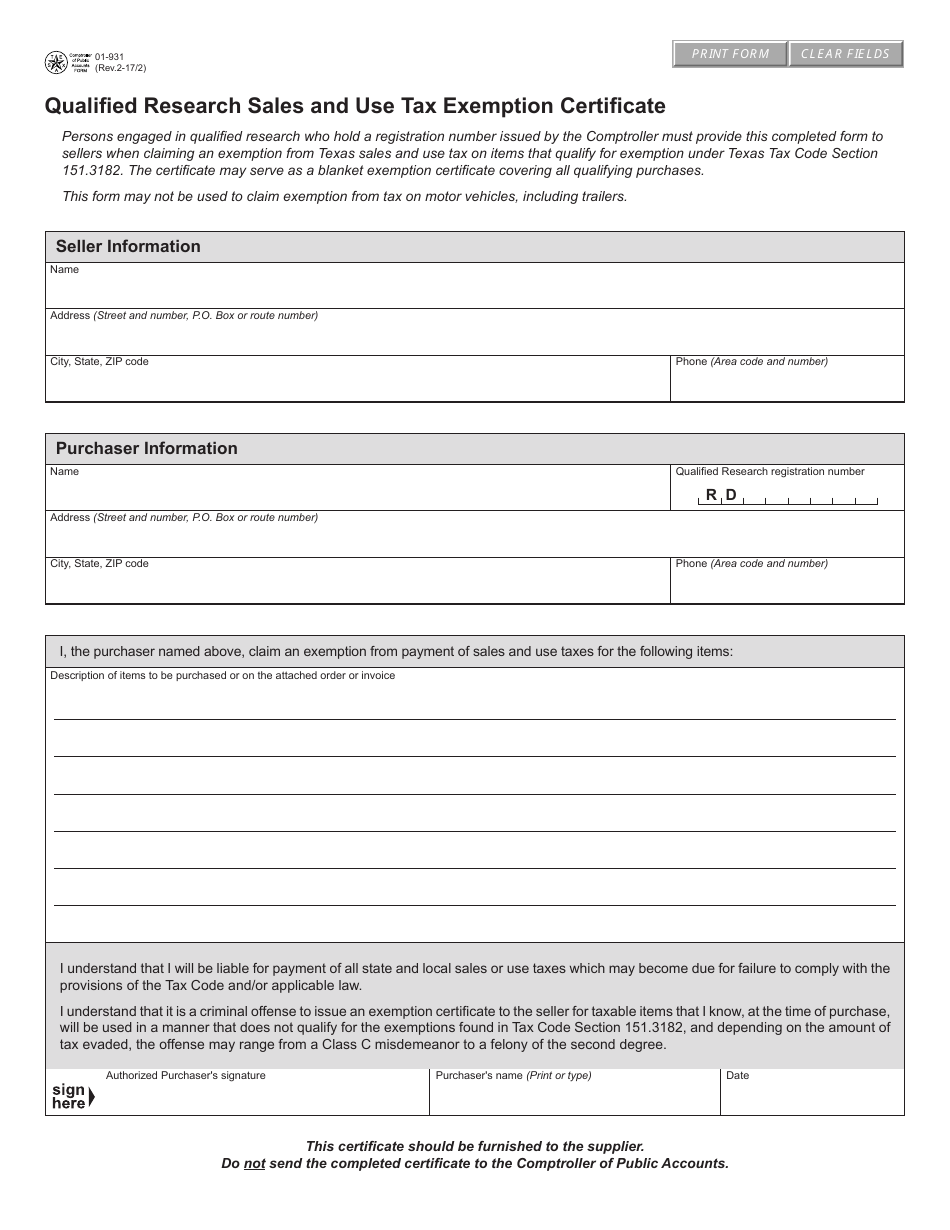

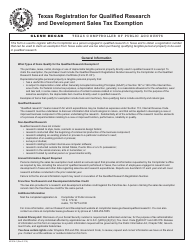

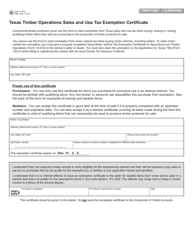

Form 01-931 Qualified Research Sales and Use Tax Exemption Certificate - Texas

What Is Form 01-931?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 01-931?

A: Form 01-931 is the Qualified Research Sales and Use Tax Exemption Certificate in Texas.

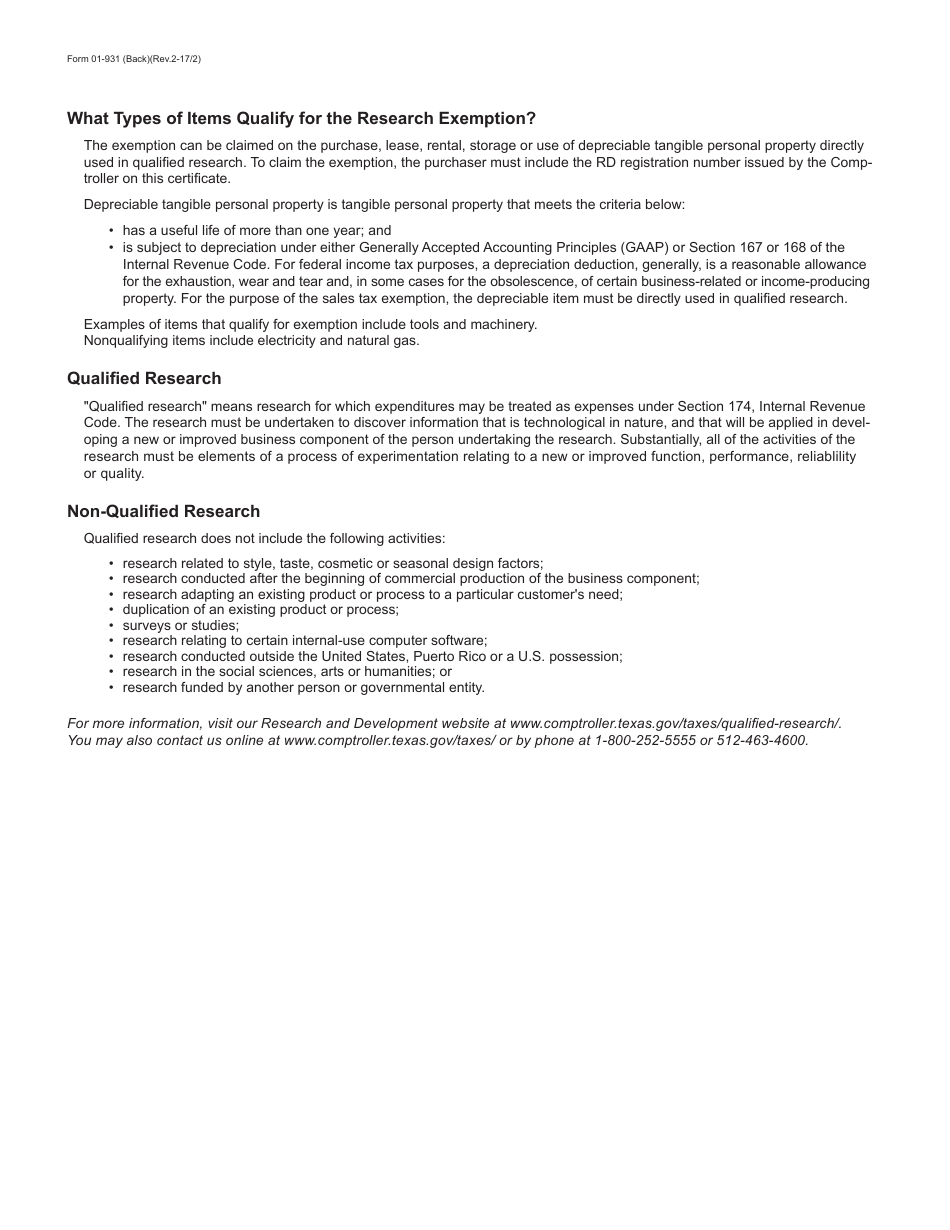

Q: What is the purpose of Form 01-931?

A: The purpose of Form 01-931 is to claim a sales and use tax exemption for qualified research activities in Texas.

Q: Who can use Form 01-931?

A: The form can be used by individuals, businesses, and organizations engaged in qualified research activities in Texas.

Q: What information is required on Form 01-931?

A: Form 01-931 requires information such as the taxpayer's name, address, taxpayer identification number, and a description of the qualified research activities being conducted.

Q: When should Form 01-931 be filed?

A: Form 01-931 should be filed with the Texas Comptroller's office before or at the time of a taxable purchase related to qualified research activities.

Q: Are there any fees associated with filing Form 01-931?

A: There are no fees associated with filing Form 01-931.

Q: Can Form 01-931 be used for multiple purchases?

A: Yes, Form 01-931 can be used for multiple purchases related to qualified research activities within the exemption period.

Q: How long is the exemption period for Form 01-931?

A: The exemption period for Form 01-931 is for a maximum of 4 years.

Q: Is Form 01-931 valid for all Texas sales and use tax?

A: No, Form 01-931 is only valid for qualified research activities and does not exempt the taxpayer from other Texas sales and use tax obligations.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-931 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.